Housing market in good health: Pete Wargent

There are always plenty of angles put forward for why the housing market must be struggling, or will be set to struggle in due course, true enough.

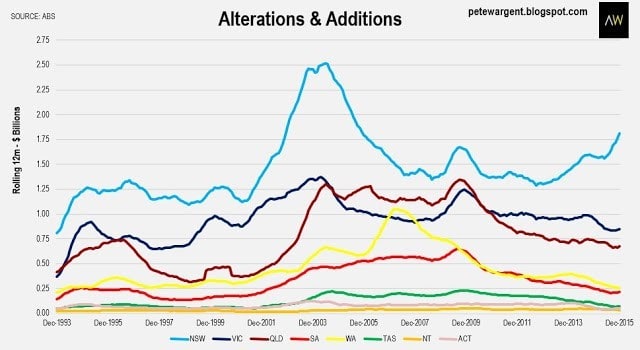

And indeed, some locations are struggling, no question about that - mainly comprising mining towns, or regions being heavily impacted by the ongoing collapse in mining investment.

Anecodotally, mortgage lending has also perhaps been a little bit slower in January.

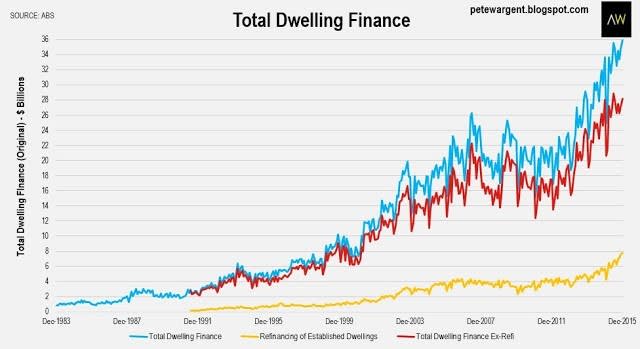

Refinancing is evidently a complicating factor, as you can see in the chart above, but the value of loans actually advanced in December was up by +24.6 percent to its highest ever level at $23.8 billion.

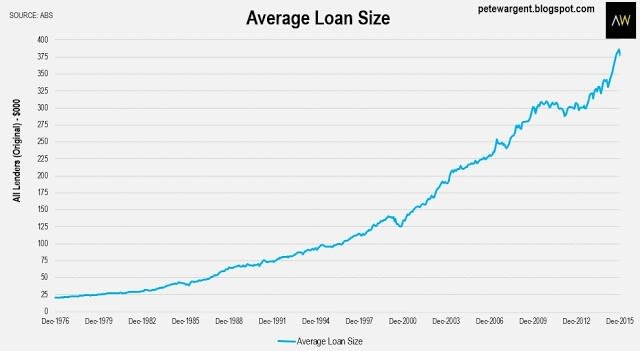

I noted on Twitter last week that the average loan size figures seemed to have gotten a little ahead of themselves, and sure enough there was a pullback in December to a somewhat more believable $377,600, althought this is still +11.2 per cent higher than one year ago, and the figure still looks rather overstated.

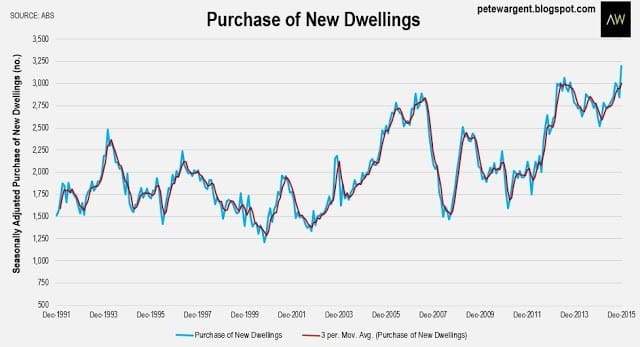

Construction continues

The wrap

Overall, it is clear that there has been a behavioural shift between lenders and borrowers towards favouring owner-occupier mortgages over investment loans, the lines between which have become hopelessly blurred.

The headline figures show that in aggregate housing finance remained relentlessly strong through 2015, even if some mining regions are feeling the burn.

According to CoreLogic-RP Data Sydney posted Very solid preliminary auction clearance rate of 78.6 per cent from 469 auctions, well ahead of the preliminary clearance rate for Melbourne at 72.6 per cent.

Vendors seem a bit more realistic, and these are still relatively low volumes. Most signs point to a steady Sydney market in 2016.

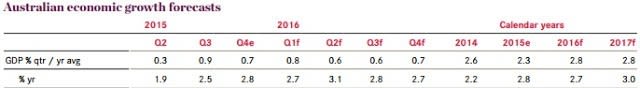

Westpac's forecasts for economic growth from 2015 to 2017:

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.