Population growth and infrastructure crucial for property price growth: Pete Wargent

Sadly an inevitable consequence of the internet age for investors has been a focus on shorter and shorter timeframes.

While extra frequency of analysis can be interesting and fun, for most investors the best results will be secured by seeing the big picture and building a long term plan around it, particularly so in property investment which is ideally suited to a longer time horizon.

When it comes to population and demographic projections, there are certainly plenty of cranks making forecasts, but if you're going to pay attention to any of them, then bugrudgingly it's got to be the cranks that determine policy.

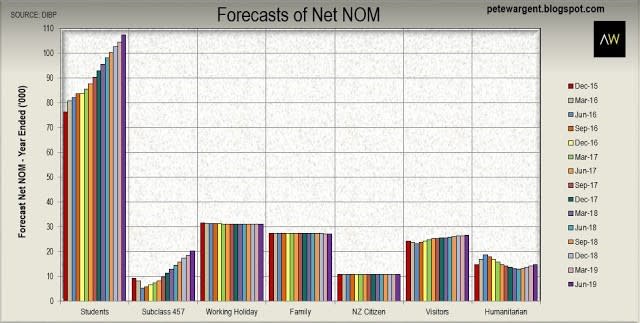

Over the short term to June 2019, the drivers of a rebound population growth from net overseas migration are clear enough, at least according to the latest available figures from the Department of Immmigration and Border Protection (DIBP).

But what about for the longer term?

It is often said that infrastructure investment is a key driver of property price growth, and this can certainly be the case whereby the multiplier effect of new projects generate economic activity, while infrastructure can also make certain suburbs a more appealing prospect.

Of course, we have just been through a once-in-a-century resources investment boom, which temporarily caused a spike in dwelling prices in some towns, before they crashed again as supply responded and contractors skipped town.

Infrastructure investment is evidently only one part of the puzzle, and it needs to be coupled with a strong and sustainable growth in population, economic activity, and household wealth. I'd further add land supply constraints to that.

In this context I took another read of Infrastructure Australia's latest estimates and projections, so let's take a 60-second look at what they say.

"Population a key driver of economic growth"

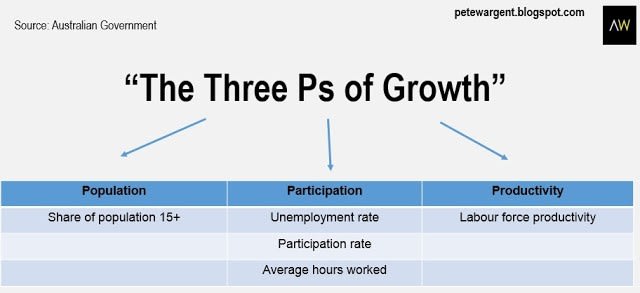

The "three Ps" model of economic growth applied by the Australian Treasury has population growth at its very core:

In the 2015 Intergenerational Report population growth was assumed to drive for almost half of the projected economic growth, measured in real Gross Domestic Product (GDP), over the next four decades.

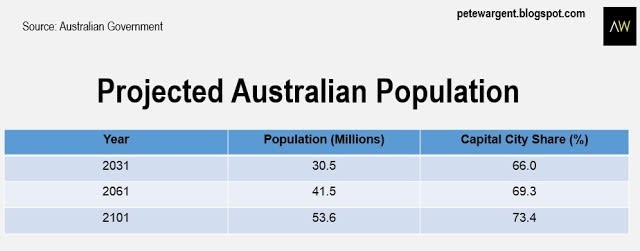

Projected population figures quoted in April 2015 by the Infrastructure Australia audit background paper were somewhat higher than the equivalent figures released in 2008, and tend to mirror previous projections by the Australian Bureau of Statistics reasonably closely.

Notably, it is clearly articulated that state governments are planning for their capital cities to continue taking on a continually greater share of the state's population, particularly in the most populous states.

As such, going forward an ever greater share of the actual population growth must correspondingly take place in the capital cities, as confirmed by the projections.

These are telling numbers indeed, but for mine it's the texture provided by the Government that is the really interesting bit:

"Population growth is likely to have its greatest impact in Australia’s cities. Around the globe, cities are increasing their share of national population. Australia is already one of the most urbanised countries in the world. It would be unusual – if not remarkable – if Australia were to chart a materially different path from its past (or where the world is heading), at least over the next 15 years or so."

Looking forward

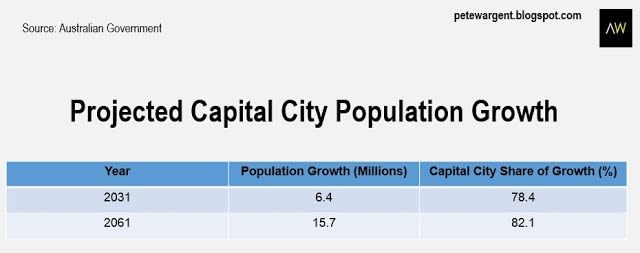

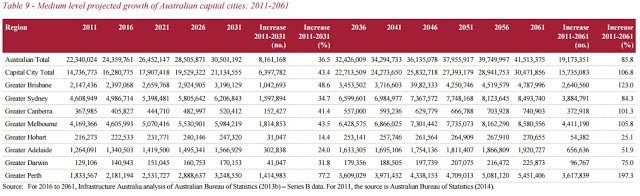

On the medium level projections, by 2031 Australia’s capital cities will be home to 6.4 million extra people (around 43.4 per cent more than 2011). The growth to 2061 (15.7 million persons) is around 1 million persons more than the current combined population of all of Australia’s capital cities.

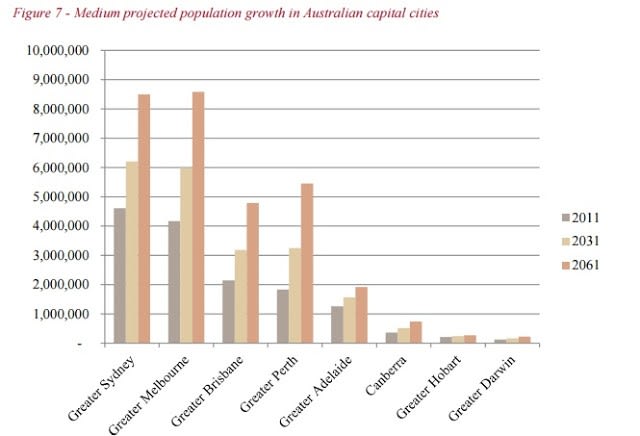

Note in particular the enormous projected growth in Greater Sydney, Melbourne, Brisbane, and Perth respectively (click to enlarge).

Or looked at graphically.

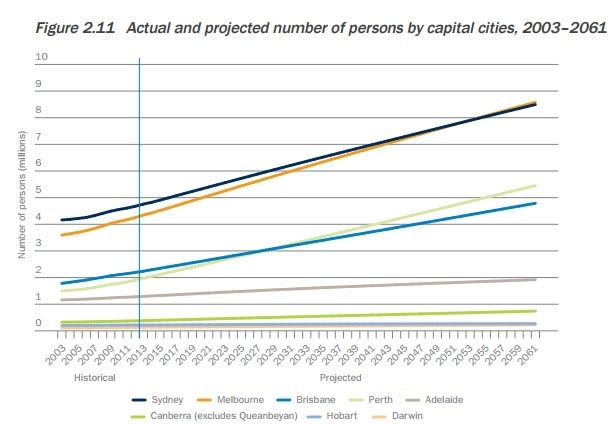

Looked at another way, the gradients of capital city projections show how the four largest cities are expected to garner the great bulk of the projected growth in population.

Infrastructure plans and peri-urbanisation

Projected population growth between 2011 and 2031 is evidently huge - the equivalent of an entirely new Melbourne and Brisbane combined! - while the projected growth to 2061 is more than all of the existing population of the capital cities cobbled together.

However, according to the Australian Government, regional development and decentralisation policies tend to have a short life span, and thus regional population growth is forecast to decline as a share of the pie:

"It is unclear whether governments and the Australian community would support material ongoing interventions over the long term to encourage decentralised growth. Proposals for investment in regional areas need to be supported by rigorous and transparent analysis."

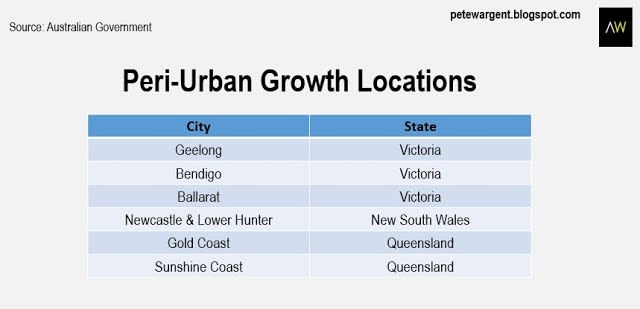

A handful of areas which are close to the capital cities might be expected to grow appreciably, being "peri-urban" locations with social and economic linkages to the capital cities. These are cited as follows:

Notes the Government: "In the absence of employment growth in these locations, ‘journey to work’ trips to and from the capital city may increase appreciably."

Infrastructure investment: cities are critical

The infrastructure audit background paper could hardly have been more explicit in its conclusions, so to wrap up I will simply quote it directly:

"Within the capital cities, the location of new development and population growth will be critical. While the cost of providing new infrastructure in ‘greenfield areas’ is substantial, the cost of retrofitting or augmenting some infrastructure (for example transport links in tunnels) in established areas can also be high.

With a few exceptions, the population case for expanding infrastructure networks in regional areas is less obvious. Arguments for investment in infrastructure in those areas will be driven more by social considerations."

While I don't agree with the intended policy - I don't originally hail from a capital city myself after all - it is abundantly clear that infrastructure investment will be focussed very heavily on the capital cities.

While I don't agree with the intended policy - I don't originally hail from a capital city myself after all - it is abundantly clear that infrastructure investment will be focussed very heavily on the capital cities.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.