Will new housing approvals continue to ease through 2016? Cameron Kusher

The November 2015 building approvals data show a sharp fall in dwelling approvals led by the volatile unit segment. Seasonally adjusted total dwelling approvals were -12.7 percent lower over the month, their largest monthly fall since July 2012.

Year-on-year dwelling approvals are -8.4 percent lower and approvals have retracted to be -16.8 percent lower than their recent record highs. The data indicates a slowing in developer appetite for approvals and, given the slowing demand for mortgages from investors and slowing home value growth, it is a trend which is likely to continue over the coming months.

The decline in approvals in November was led by units however, house approvals, which haven’t seen the same level of acceleration as units, also recorded a fall over the month. House approvals were -0.6 percent lower over the month and -2.2 percent lower year-on-year. Meanwhile, unit approvals declined by -24.0 percent in November and were -15.0 percent lower year-on-year. Although the unit approvals series is much more volatile series than houses, it has now started trending lower with approvals -30.3 percent lower than their recent record high of 11,084 approvals in July 2015.

House approvals are also trending lower, albeit at a more moderate pace, down -9.4 percent from their recent peak of 10,376 approvals in April 2015. The most recent Census in 2011 shows that 21.2 percent of detached houses are rented compared to 56.0 percent of units. The recent sharp fall in investor housing finance commitments is much more likely to impact on demand for new units than new houses and we may be seeing developers starting to react to this market shift.

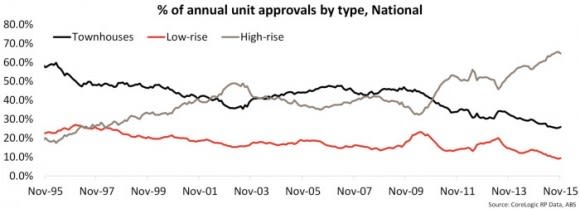

The data on unit approvals by type further highlights the recent boom in high-rise (4 storeys and greater) unit approvals. Historically townhouses have been the product of choice for medium and high density developers however, over the past four years we have seen record high levels of high rise construction. Both monthly and annual data points to demand for high-rise approvals starting to fall although it should be noted that high-rise approvals still account for a majority of unit approvals.

High-rise approvals could be considered a bit of a double-edged sword for developers, in one instance they are considered the highest and best use of land in areas of strategic significance (eg along transport spines and in areas closed to major working nodes like the CBD) however, they are heavily reliant on achieving a particular level of presales.

From an economic sense they take longer to build so the economic benefit of the construction is stretched over a longer period of time however, they are ultimately less likely to end up constructed because much more financing is required and they are so dependent on adequate levels of presales.

It is likely that given units are much more likely to be purchased by investors and investor demand is now falling that a larger than normal proportion of these units will not end up constructed in this new phase of the housing cycle. Historically around 98% of units approved are constructed compared to around 85% of units.

Much like home sales, values and investment related mortgage demand, we are now also seeing early signs of a slowing in dwelling approvals. Although approvals are slowing there is still a large number of unit projects under construction which should continue to provide a high level of economic benefit as the recent record high number of dwelling approvals continues for a few years. Of course the huge surge in housing construction at a time when population growth is slowing means that there is a better balance between housing supply and demand. In fact in certain areas there are now concerns about oversupply, particularly in inner city unit markets.

This is going to be a key theme to watch during 2016 particularly considering that we are already seeing investor demand falling and record low levels of rental growth. The next challenge will be when these units come to settlement will their initial valuation hold up and will the changed lending landscape mean that some purchasers will have to find larger deposits in order to settle. Furthermore, if they purchased for investment purposes the next challenge may just be finding someone to rent the property.

Cameron Kusher is research analyst for CoreLogic RP Data. You can contact him here.