Pete WargentDecember 17, 2020

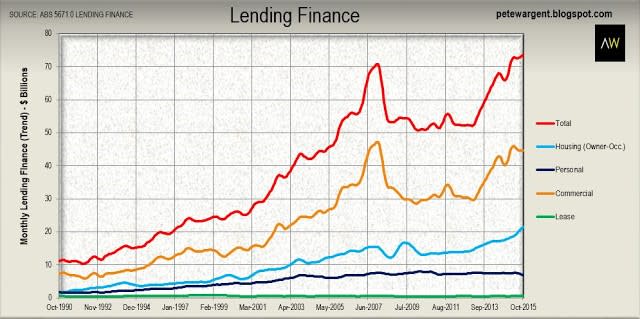

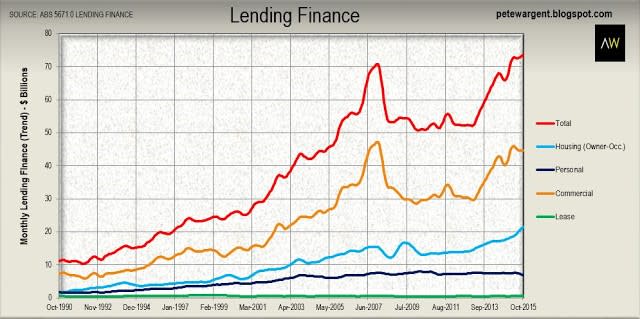

A reasonably solid set of Lending Finance numbers were reported for October 2015, with commercial finance fairly flat, down 1% at a seasonally adjusted $45.6 billion (following a 9% jump in September), and total lending tentatively inching up to a new trend high of $73.7 billion.

Both commercial lending and total lending finance have recently breached 7 year highs.

Click to enlarge

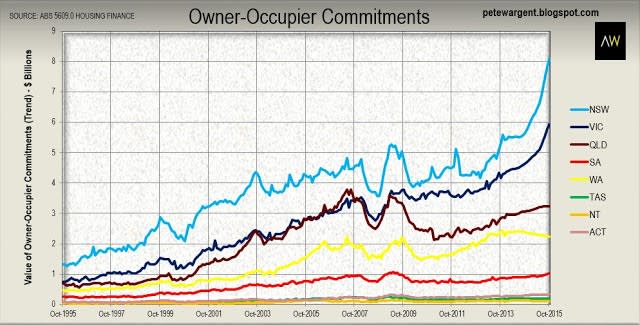

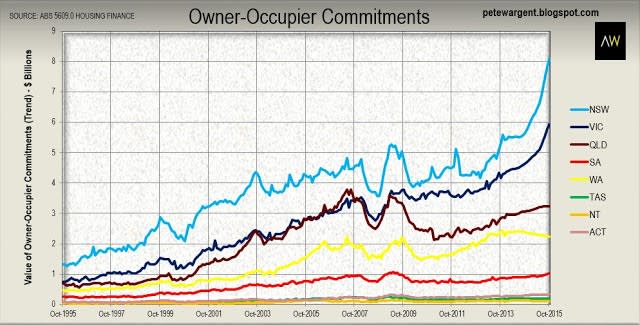

As we saw earlier in the week, owner-occupier lending has increased very sharply, with commitments for the purchase or construction of dwellings up by 23% over the past year on a seasonally adjusted basis.

Click to enlarge

Lease finance increased by 17 per cent over the year, but loans for the purchase of blocks of residential land are down by some 25 per cent since one year ago.

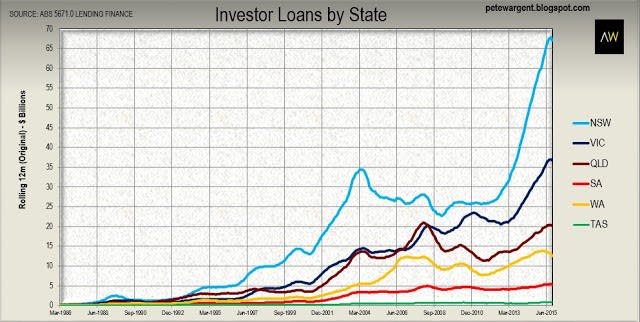

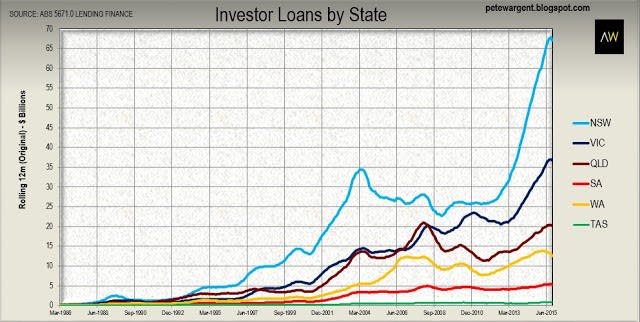

Investor finance derailed

The flip side to the strong home loans data is that the cooling macroprudential measures implemented by APRA have derailed the runaway investor boom, with investor commitments crashing off their respective tracks across every state and territory.

Demand was fading in Western Australia and the Northern Territory in any case, and now after lending curbs even those who want to source investor finance are struggling to do so.

Prices will almost certainly thus follow rents down in 2016 in

Perth and

Darwin. The Top End in particular is looking set for a sharp correction, with median detached house rents having declined by around 20% and investor loans now tanking, down by more than 40 per cent over the past year.

Borrowers flipping the scriptThe crimping of investor lending has clearly been enough to bring many property markets back to stall speed, as evidenced by stumbling auction clearance rates. However, there is a bit more to this than meets the eye, and it does not necessarily follow that APRA's measures will lead to declining house prices across the board (it seems unlikely that this was the intention in any case).

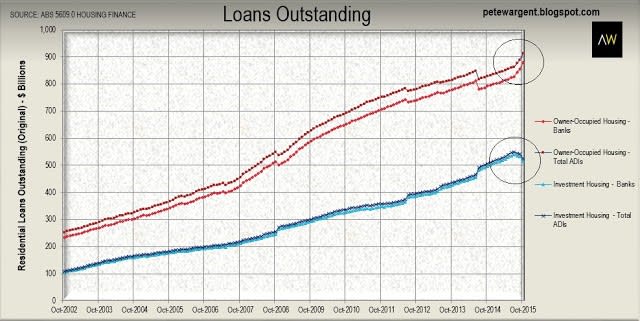

For "Exhibit A" the Reserve Bank's Financial Aggregrates data has already implied that some loans are being switched to or reclassified as owner-occupier products, as borrowers aim to obtain the cheaper mortgage rates now associated with that sector of the market (see

here for more).

And now for "Exhibit B", refer to the Housing Finance data for October released this week, which implies exactly the same thing, that borrowers and lenders are flipping the script in order to counter APRA's regulatory intervention.

To date most of the increase in owner-occupier commitments has been focussed upon New South Wales and Victoria, although a fair proportion of that has related to refinancing rather than genuinely new lending.

The Reserve Bank's Financial Aggregates data for October mirrored these trends closely, the net result being that housing credit growth rose to a fresh cyclical high of 7.5%, although it does seem that the pace of increase is steadying.

The wrap

There is evidently quite a bit going on in the housing finance space at the moment and not a great deal of clarity surrounding the numbers. In truth some lenders themselves probably have little clarity around the classification of loans beyond their initiation.

To date it has become clear that the APRA measures have scrambled the market and have stopped the

Sydney boom from rolling unchecked into another calendar year, with investor commitments having pulled back sharply right across the board.

In time, this will be seen to be a worthy step, since many markets had become far too top-heavy with investors. At the peak of the investor market, excluding refinancing, in New South Wales and Victoria investor loans had breached 60 and 50 per cent of the mortgage market respectively. Today the equivalent numbers are down to 50 and 40 percent and falling.

My experience in the UK suggests to me that caution should be exercised before declaring the unpredictable outcomes of macroprudential measures prematurely. Britain's Mortgage Market Review (MMR), which had the stated goal of curbing irresponsible lending, radically changing mortgage rules with effect from April 2014 and for six months the housing market was gummed up by the paperwork and pen-pushing.

Yet as of today UK housing prices are once again rising at a reomping annualised pace of 9 per cent, with the popular markets of the south east tracking in double digit territory to record highs. Unlike the global real estate experts out there I don't pretend to know a great deal about the experiences related to macroprudential measures in New Zealand, but assume similar tales could be told, at least in Auckland.

It will be an interesting start to 2016, which I think will be a more unpredictable year than most, and not only in the housing market space.