Construction trends (off-the-plan mess) Pete Wargent

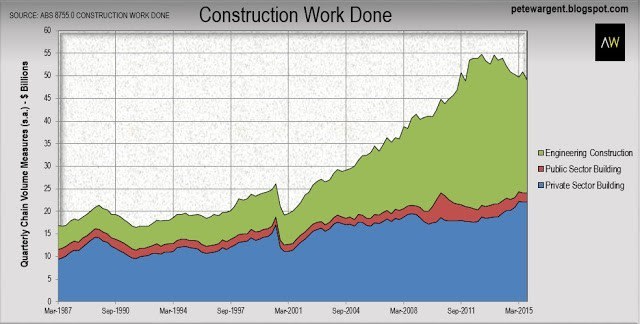

Total construction work done in Australia has declined by 3.7% over the past year in seasonally adjusted terms. Let's take a look in two short parts at what this actually means.

Part 1 - Total construction

Total construction work done in the third quarter of 2015 declined by 3.7% to $49 billion on a seasonally adjusted basis.

Despite a lift in residential building work done (+2.0%), there was a decline in non-residential building (-1.9%), and as widely expected engineering construction fell sharply (-7.3%) to be -11.7% lower over the year.

The green shaded area which records construction work done in chain volume measures terms shows that the unwinding of the resources construction boom has a way to run yet.

The green shaded area which records construction work done in chain volume measures terms shows that the unwinding of the resources construction boom has a way to run yet.

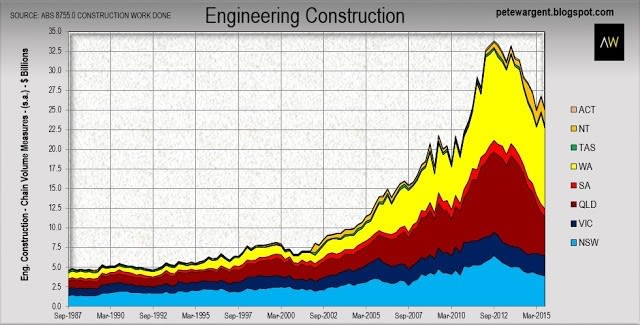

Quarterly engineering construction work done has declined from a peak of $34 billion to around $25 billion, but given the weakness in commodity prices - and given that in the same quarter a decade ago activity was just $13 billion - the decline surely has a long way to go.

The decline in engineering construction this quarter was driven by an overdue reversal in Western Australia, and to a lesser extent a decline in Queensland, as mega-projects begin to wind down.

Activity in the Northern Territory continues to track at a historically exceptionally high level of $2 billion, accounted for primarily by the massive Ichthys LNG project.

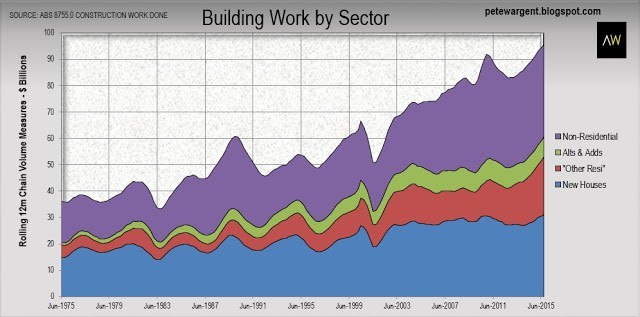

While non-residential building and major renovations have contributed little of significance to the rebalancing of the economy, new house building and "other residential" building (apartments, units, townhouses) have effectively done everything that could have been expected of them in response to low interest rates.

Total building work done of $24 billion represents a solid 6.4 per cent increase over the year, with no thanks to the non-residential sector.

These high level numbers should present an idea of some of the challenges facing the economy given that housing starts are projected to decline from pretty much now, while the decline in engineering construction may only be half way done.

Even now I'm still not sure anyone really has a satisfactory answer for what is going to fill this gaping hole while commodity exports ramp up. Given the expansion of Australia's population the obvious answers should come under the heading of "infrastructure" but if there's a coherent plan for that being discussed anywhere I haven't heard of it.

Part 2 - Building work by state

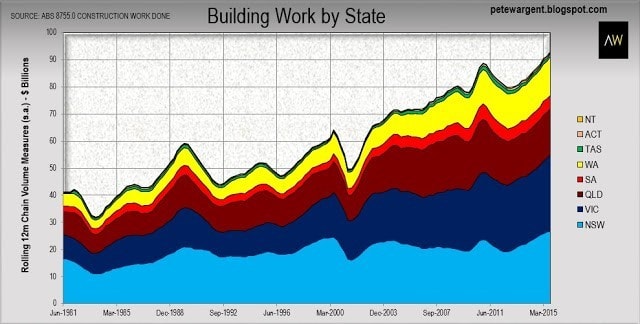

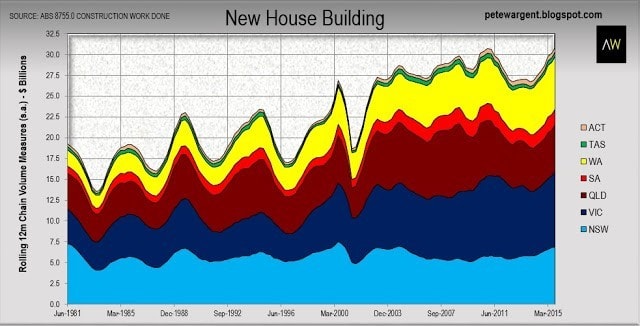

Victoria has been the king of building work through this cycle, with New South Wales following in second place, these states being home to the two capital cities with the strongest dwelling price gains.

Indeed, Melbourne is a fine illustration of why it is important for market analysts to pay close heed to both demand and supply factors when forming their views. The Victorian capital has been building both houses and units like billy-o since 2010 - the source of a thousand crash predictions - yet vacancies and stock on market are both falling, and the market seems to be gathering momentum again.

Indeed, Melbourne is a fine illustration of why it is important for market analysts to pay close heed to both demand and supply factors when forming their views. The Victorian capital has been building both houses and units like billy-o since 2010 - the source of a thousand crash predictions - yet vacancies and stock on market are both falling, and the market seems to be gathering momentum again.

While there has been a reasonable response from the house building sector since 2012, approvals data shows that this market is running out of puff for the cycle, and has probably all but peaked already.

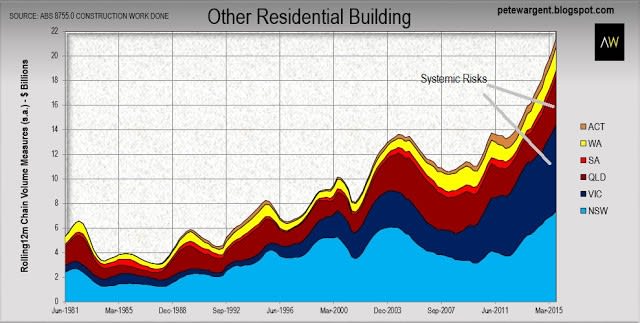

On the other hand the "other residential" sector continues to surge to record heights (this has been visible in the largest cities to anyone with a working pair of eyes...always knew those gauges were dodgy!), the new high rise building boom being the defining dynamic of this market cycle.

Building work in this sector is at historical highs in Victoria, New South Wales, Queensland, and Western Australia, with over-building of high rise apartments evident in parts of Brisbane and Melbourne.

Building work in this sector is at historical highs in Victoria, New South Wales, Queensland, and Western Australia, with over-building of high rise apartments evident in parts of Brisbane and Melbourne.

If you've been following this blog for the last couple of years, you will appreciate that the systemic risks in the housing market are obviously apparent and buried within this final chart. Would-be market shorters should dig deeper here.

There have long been indicators of overbuilding in the high rise markets of inner city Melbourne and Brisbane, with a high proportion of new build sales being made offshore, especially to China.

The storm clouds were gathering for off-the-plan buyers well before APRA's intervention, but recent tightening measures to lending procedures could well be the factor which nails on the correction for this sector.

How many buyers who put down trifling holding deposits will fail to settle if lenders demand a 20 per cent deposit prior to completion? Perhaps up to a third could be in trouble, and will be juggling personal finances as we speak.

Could get messy.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.