APRA's traps and investor loans: Pete Wargent

As promised, a quick look around the traps at where APRA's cooling measures have slowed investor lending the hardest, and where some or all of the hot air is coming out of the investor market.

New South Wales saw $5.6 billion of investor loans in September 2015, taking activity back down to the breached for the first time in December 2014 - though as I analysed here previously, owner-occupier lending has (apparently) soared to unprecedented heights in recent months, more than compensating for the decline.

Macroprudential measures undertaken to cool housing markets will inevitably have some unintended consequences, one of which may be that lenders demanding high returns on target potential borrowers with existing equity, which in a curiously reflexive manner might temporarily skew lending towards markets which have already outperformed through the cycle (i.e. Sydney).

That's one to watch for next year, but for now total lending for NSW housing of more than $14 billion in September was the biggest month on record, even if the numbers were somewhat fishy.

Macroprudential measures undertaken to cool housing markets will inevitably have some unintended consequences, one of which may be that lenders demanding high returns on target potential borrowers with existing equity, which in a curiously reflexive manner might temporarily skew lending towards markets which have already outperformed through the cycle (i.e. Sydney).

That's one to watch for next year, but for now total lending for NSW housing of more than $14 billion in September was the biggest month on record, even if the numbers were somewhat fishy.

It's a near-identical story in Victoria, with a notable decline in investor lending, but a corresponding leap in owner-occupier lending.

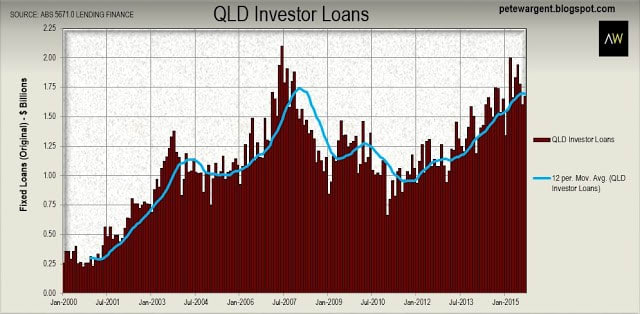

In Queensland the decline in investor lending has been relatively marked from $2.0 billion in March, although there was a slight rebound in September to $1.67 billion. A spirited increase in owner-occupier lending means that total lending has increased moderately over the past year.

Queensland's property markets are something of a multi-speed affair, with certain areas of SEQ - such as some sub sub-regions within Brisbane and the Gold Coast - faring relatively well, but many regional markets decidedly in the doldrums.

Queensland's property markets are something of a multi-speed affair, with certain areas of SEQ - such as some sub sub-regions within Brisbane and the Gold Coast - faring relatively well, but many regional markets decidedly in the doldrums.

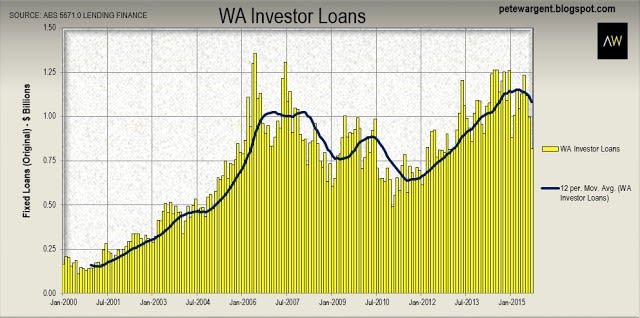

Not much in the way of good news to report for Western Australia, with investor lending tailing off sharply in recent months from $1.26 billion in December 2014 to just $0.82 billion in September 2015.

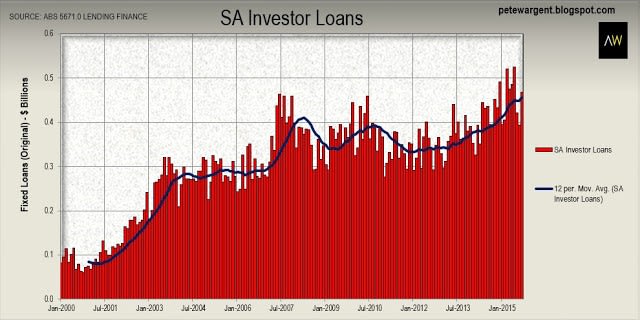

It hasn't been a great time for the South Australian economy in recent years, with the trend unemployment rate of 7.7% way above the national average of 6.1%, while employment growth has been non-existent for years now.

Fortunes for the state waned further this week when it was finally confirmed that Arrium will cut 250 jobs from its Whyalla steelworks, with further cuts expected from Alinta.

Fortunes for the state waned further this week when it was finally confirmed that Arrium will cut 250 jobs from its Whyalla steelworks, with further cuts expected from Alinta.

Despite the ongoing labour market shock, South Australia is home to a number of relatively affordable property markets after so many years of lacklustre growth.

As such South Australia is also the one state where investor lending is actually in an uptrend on a 12mMA basis, with the $469 million in investor lending in September representing a solid increase on the prior year equivalent figure of $390 million.

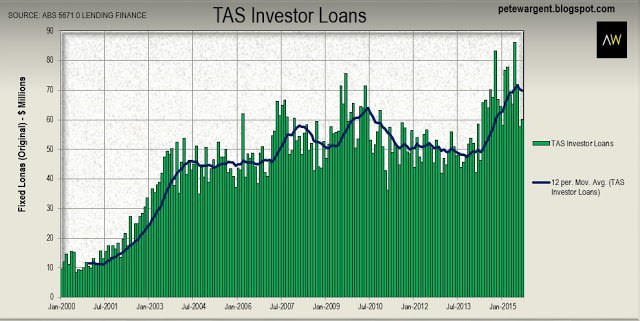

The outlook has been looking up for the economy and labour market of Tasmania lately, but a lack of existing equity in the market following no real dwelling price growth for close to a decade appears to have knocked the investor market for six, with volumes declining from a record high $86 million in June to only $60 million in September.

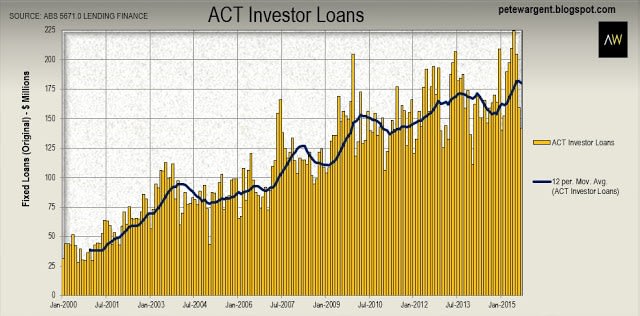

The Australian Capital Territory (ACT) continues to meander along, with investor lending pulling back since June here too, declining from a record spike of $224 million to $142 billion.

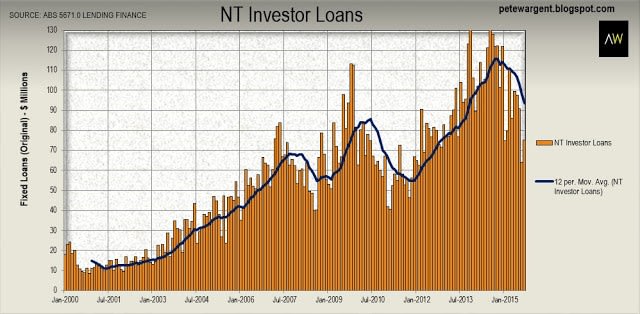

Finally, there are no positives at all to draw from this data series for the Northern Territory, where investor lending has all but collapsed over the past year from $122 million to $75 million.

With elevated vacancy rates and nose-diving rents, Darwin and other parts of the Top End are heading for a potentially sharp and long overdue property market correction.

With elevated vacancy rates and nose-diving rents, Darwin and other parts of the Top End are heading for a potentially sharp and long overdue property market correction.

Overall, it has become clear that APRA's cooling measures have worked quickly and effectively, knocking out a good deal of riskier investor lending right across the board.

The property markets story for 2016 will largely be of to what extent lenders can push up the market share of owner-occupier loans in order to compensate for the evident decline in investor volumes.

The property markets story for 2016 will largely be of to what extent lenders can push up the market share of owner-occupier loans in order to compensate for the evident decline in investor volumes.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.