Shifting sands (record NSW lending?) Pete Wargent

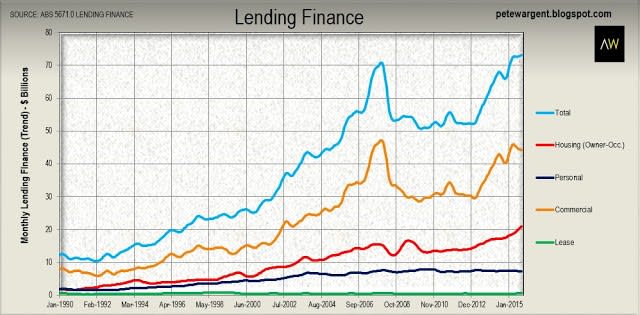

The ABS released its lending finance figures for the month of September 2015 which showed a seasonally adjusted 9.5% jump in commercial finance, though in trend terms commercial finance has looked somewhat peaky.

Total lending finance increased from a seasonally adjusted $70.7 billion in August to a new cyclical high of $75.3 billion, another signal that low interest rates are gradually biting and having a positive impact on credit flows.

Shifting composition

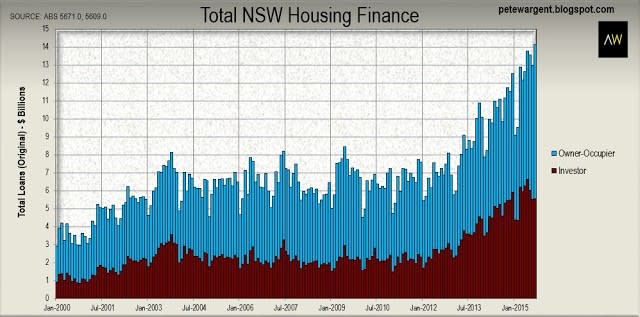

In trend terms owner-occupier lending has surged more than 20% higher over the past year, while major renovations activity ("alterations and additions") trended up to its best result in four years.

Mirroring figures previously reported by the Reserve Bank, September was a healthy result for commercial finance with a 9.5 per seasonally adjusted jump in the month to $46.1 billion.

While the trend result looks peaky, this can be a rather unpredictable series, and in rolling annual terms commercial lending has surged 50 per cent higher over the past half decade to sit at its highest level in some 7.5 years.

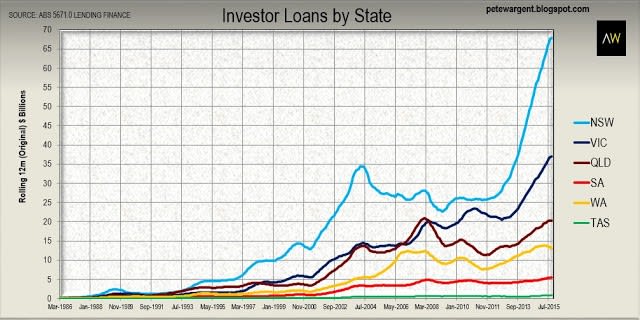

On a rolling annual basis NSW investment loans tore out a new record of $67.9 billion, but this particular peak is now close to being in following three months of softer results.

In June the Premier State had seen an unprecedented $6.6 billion of investor loans written in a single month, but over the last two months of available data the total dollar value of NSW property investment loans has come in at around $5.6 billion (which is nevertheless still a huge volume in historical terms).

At the sub-regional level it would be no surprise on this evidence to see surprisingly strong auction and property market results in some of Sydney's inner ring, particularly in the eastern suburbs.

However it's clear that the heat has already come right out of the western and outer south-western suburbs, leaving some recent buyers wondering what they've let themselves in for.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.