Investor lending cools: Pete Wargent

Anyone who implies you that they have any genuine clarity around what is happening with Housing Finance data at the moment is telling you porkies, but since the September data was released today, let's at least see what we can deduce!

At the margin there are evidently blurred lines between loans that are being classified as investor lending, and those which are determined to be owner-occupier approvals.

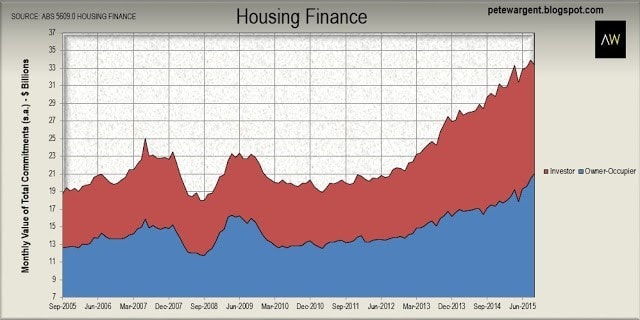

The figures reported for new investor lending dropped sharply in September to $12.3 billion on a seasonally adjusted basis, having pulled back from a record peak of above $14 billion in April.

As sure as night follows day, however, with Australia's major lenders continuing to target high returns on equity (ROE) there will certainly be a strong push to promote owner-occupier lending (ask for a mortgage discount!), and this was once again in evidence with another 3 per cent seasonally adjusted surge in the value of commitments in September to more than $21 billion.

Thus while the monthly value of investor lending is now broadly flat year-on-year, the total value of owner-occupier commitments has leapt more than 23% higher.

Blurred lines

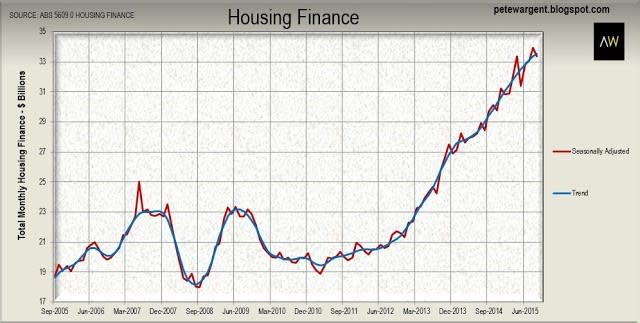

Given the blurred lines in relation to loan classifications and refinancing right now, the most straightforward measure of housing market activity is simply to look at the aggregate value of housing finance.

There was more than a slight suspicion that the rocketing value of owner-occupier commitments in the preceding month was partly a result of the mis-classification of refinancing as new lending.

While this story remains somewhat unclear for now, the housing finance data showed another very strong month of lending in aggregate at a seasonally adjusted $33.4 billion, taking the trend estimate up to a fresh high.

Classification issues or no, given that total seasonally adjusted monthly housing finance breached $25 billion for the first time only two years previously in September 2013, a total result of $33.4 billion is a phenomenally high level of activity by any reckoning.

Ultimately, as pointed out by Reserve Bank Governor Stevens recently, borrowers can still source mortgage rates of close to 4 per cent despite the recent tightening on some investor loans, and there is still a good deal of appetite for borrowing where finance can be successfully sought.

Unintended consequences

Macroprudential measures taken to cool housing markets will inevitably have some unintended consequences, one of which may be that lenders demanding a high ROE target potential borrowers with existing equity, which in a curiously reflexive manner might skew lending towards markets which have already outperformed through the cycle.

That is, cooling measures could accidentally spill fuel onto raging fires, since banks still have a desire to lend even in the face of stricter loan-to-value ratio (LVR) controls.

Certainly in London we saw the Pommie equivalent Mortgage Market Review (MMR) gum up UK market activity in aggregate, yet by the end of Q2 2014 the London housing market was blowing off in a spectacular starburst of bubbliness, recording its fastest annual rate of price growth in nearly three decades at +26 per cent.

Nor has the underlying problem remotely gone away since, with record low mortgage rates helping to thrust the average London house price considerably higher still to £500,000, and the latest forecasts projecting another kamikaze 31 per cent boom in London house prices by 2019.

Commentary suggesting that Auckland house prices would be curbed by macroprudential measures also proved to be misguided, at least in the near term, with house prices thereafter bubbling up in rampant fashion towards the million dollar mark, although a reversal may at last now be falling due.

Another of the unintended consequences of macroprudential measures may be a premature end to Australia's residential building boom, with loans for the construction of new homes sinking almost right across the board over the past year, and investor loans for the construction of new residential properties having tanked by nearly a quarter.

Thirdly, tighter lending measures will almost certainly knock more budding first time buyers out of the market, with market share tumbling from 15.8 per cent to 15.4 per cent in the month, and first time investors or "rent-vestors" doubtless befalling a similar fate due to their lack of existing equity.

Thirdly, tighter lending measures will almost certainly knock more budding first time buyers out of the market, with market share tumbling from 15.8 per cent to 15.4 per cent in the month, and first time investors or "rent-vestors" doubtless befalling a similar fate due to their lack of existing equity.

Granularity of markets

In this context it will be interesting to see what happens to lending in Sydney and Melbourne over the year ahead, since there exists tentative evidence of similar patterns unfolding.

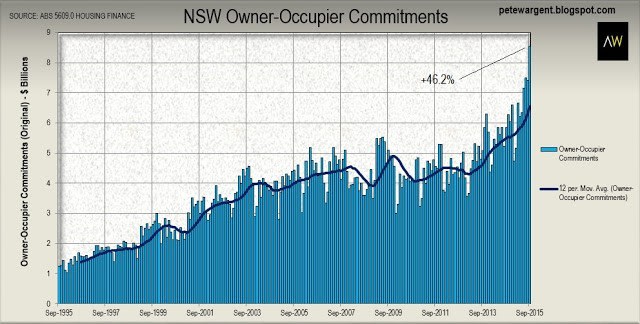

Of the 23 per cent boom in the value of monthly owner-occupier commitments over the past year, New South Wales has accounted for nearly two thirds of that increase, and Victoria one third.

The two most populous states - and home to the two capital cities which have overwhelmingly played host to the housing value growth through this cycle to date - have accounted for almost all of the increase in the value of lending.

The two most populous states - and home to the two capital cities which have overwhelmingly played host to the housing value growth through this cycle to date - have accounted for almost all of the increase in the value of lending.

Queensland is home to any number of regional markets which have floundered in contrast to their supposed hotspot status of 2012 - Moranbah, Dysart, Emerald, Bowen, Chinchilla, Roma, and Gladstone, to name but a few - so in this context the relatively moderate uptick in lending commitments at the state level can be no surprise.

Indeed the figures conversely augur well for housing market activity across the Greater Brisbane area given that the original data for Queensland in September showed solid total owner-occupier lending of $3.44 billion, taking lending volumes up to a 67 month high on a 12mMA basis.

As for the New South Wales figures in September, there has never been a month of home lending like it in Australia, with the original data busting out a +46.2% year-on-year increase in the value of lending to an astonishing $8.55 billion.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.