Residential construction peak: Pete Wargent

In the past week the ABS released its Construction Activity figures for the June 2015 quarter, which pull together data on building and engineering construction.

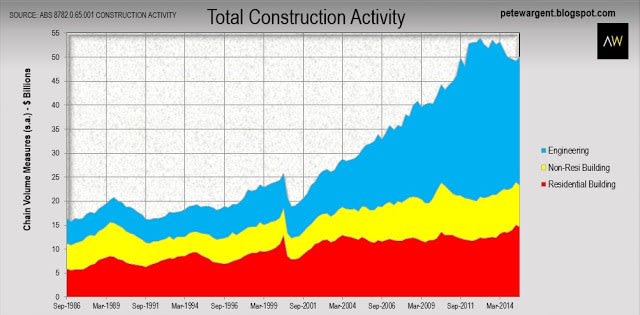

As you can see below total construction surprised in jumping back up by a seasonally adjusted +1.8% in Q2 to sit above $50 billion in chain volume measures terms.

The rebound was driven by a surge in engineering construction (see the blue shaded area in the graphic below), which rose by +5.7% in the quarter, although with fewer large projects in the pipeline this sector will soon enough resume its inevitable decline over the next couple of years.

Given the sheer size of the engineering construction sector at $26.7 billion of work done in the June quarter, the downturn is will continue to act as a material drag on economic growth for quite some time.

The red shaded area below shows that residential building work declined in the June quarter by -2.9% to $14.7 billion, despite still being up by +7.6% over the year.

Non-residential building, denoted by the yellow shaded area below, has not really contributed a great deal to growth, having actually declined by -1.2% over the past year.

Apartment approvals to decline

While there is still a high volume of residential building approvals in the pipeline - which is expected to see housing starts remain strong across the next financial year - it appears that the peak in construction activity may be in for the cycle.

Although defaults relating to apartment pre-sales have been low to date and indicators of household financial stress benign, developers will be increasingly reticent to lend against high density projects in certain inner city areas, particularly in Melbourne and Brisbane.

If you take a walk around Fortitude Valley/Newstead (see my photos here for an idea of what I'm referring to), or West End/South Brisbane (see my photos here for more of the same) it is not hard to see why, with building approvals as a percentage of existing dwelling stock already tracking at an elevated level.

Brisbane CBD faces similar challenges as I looked at with some photos here, as does Melbourne in certain inner city locations.

Brisbane CBD faces similar challenges as I looked at with some photos here, as does Melbourne in certain inner city locations.

The is a glut of apartment building coming online in these areas which will see vacancy rates rise and rents fall, and it follows there is no requirement for further apartment approvals.

Indeed, we already know that DA lodgements in Brisbane began to fall quite sharply earlier in the year.

This is one of the risks identified by the Reserve Bank of a property cycle which is driven largely by investors - speculative demand can lead to a sharp supply response.

In this case it comes in the guise of rapid increase in construction activity in the apartment sector, and in turn a future supply overhang.

Implications

While work in the pipeline should keep residential building activity humming along at a historically high level - and a boom in major renovations work could even see total residential activity rise a little from here - there appears to be little hope that the sector can contribute a great deal more to economic growth than it already has.

Since engineering construction is also set to decline over the next couple of years, it is perhaps little wonder that future markets are beginning to look for further interest rate cuts (plural) towards a cash rate of just 1.50%.

While forecasters are expecting the economy to grow at a moderate pace in Q3, on the evidence of the above numbers there could potentially be some downside risk, particularly if resources construction resumes its contraction.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.