The housing market switcheroo: Pete Wargent

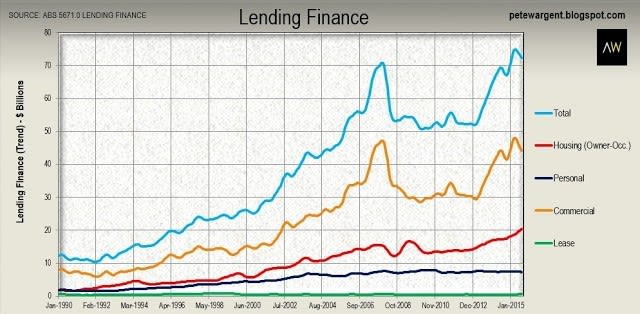

The ABS released its Lending Finance figures for August 2015 this morning.

August was a weaker month for commercial lending, with the trend estimate declining by -2.1% in the month to $44.1 billion, having peaked at more than $48 billion back in April.

The trend certainly appears to be softening in sympathy with weak capex intentions surveys and macroprudential measures to trim back property investment loans - but then, that's been said before through this cycle, so time will tell.

The trend certainly appears to be softening in sympathy with weak capex intentions surveys and macroprudential measures to trim back property investment loans - but then, that's been said before through this cycle, so time will tell.

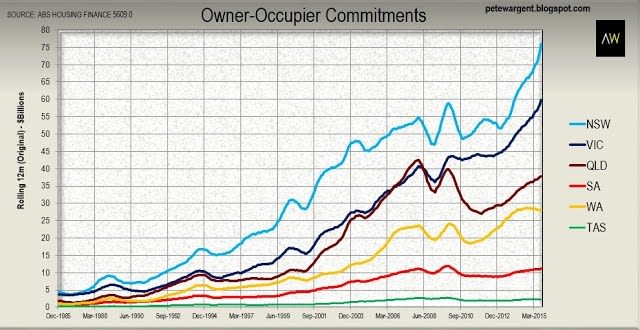

On the other hand, home lending to owner-occupiers is now trendng up sharply, with the seasonally adjusted result showing a +6.1% leap in August, and the trend estimate bolting +18% higher over the year.

Significantly, AMP announced today that it would chop a variable rate home loan package available to owner-occupiers to a highly competitive rate of just 3.99%.

It seems likely that the major banks will be targeting this sector hard in the months ahead.

Total lending finance has also trended down a little from an April peak.

Total lending finance has also trended down a little from an April peak.

Charted below is what at face value is happening to owner-occupier home loans at the state level, which is to say now apparently burning up in the most populous states.

In obliquely related news, the latest credit card figures from the Reserve Bank showed that Aussies are clearing credit balances more comfortably than before, with balances down over the year and more of us opting to pay off balances by the due date.

Switcheroo

For the remainder of 2015, the housing market story will largely be a tale of whether banks and borrowers can find a way to shoehorn owner-occupier lending higher in order to offset any pending declines in investor loans.

In August the answer was seemingly at an emphatic "yes" with investor loans essentially flat at $13.6 billion but owner-occupier commitments ripping more than +6 per cent higher to $20.8 billion.

In this regard, the AMP decision to cut its variable rate to below 4 per cent effective from today appears to be a clear statement of intent.

That said, the August figures may yet prove be bogus to some extent, and another month or two of data will shed more light.

In the words of one eminent Chief Economist "we can conclude that the figures have suddenly become a lot murkier", while Westpac instead opted for a more canine theme in describing the latest data as "a dog's breakfast".

Overall it seems that the macroprudential story has some way to run yet before the waters are de-murkified (or the dog's morning meal is digested).

I looked at this in more detail in relation to last week's Housing Finance release here.

Investor loans cooling...

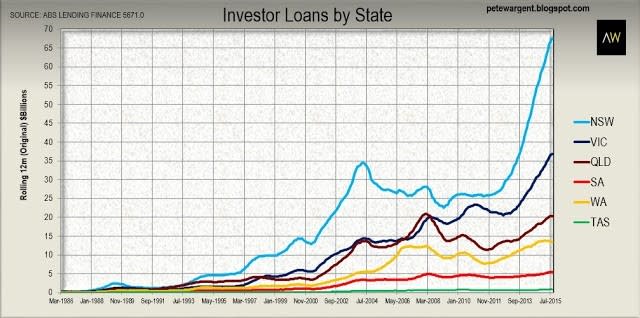

Of course the flip side to the new-found strength in the homebuyer space is that property investment loans should now be cooling in response to APRA's calming macroprudential measures.

On a rolling annual basis New South Wales originated investor loans climbed to a new high of $67.6 billion, but there have now been two consective months of declines in original terms from the May 2015 monthly peak of $6.6 billion.

Although investment loans remained at a high level in Victoria and Queensland, there has been a general cooling of this sector across recent months.

Since the investment loans data is not seasonally adjusted I also look at it on a 12mMA basis, and we can see that while the trend in Queensland has risen to its highest level since April 2008, the trend is now falling in Western Australia, South Australia and Tasmania.

In the Northern Territory the trend in investment loans seems to be dropping off a cliff so there is likely to be some fallout for Darwin.

More on all of these figures and trends to follow tomorrow.

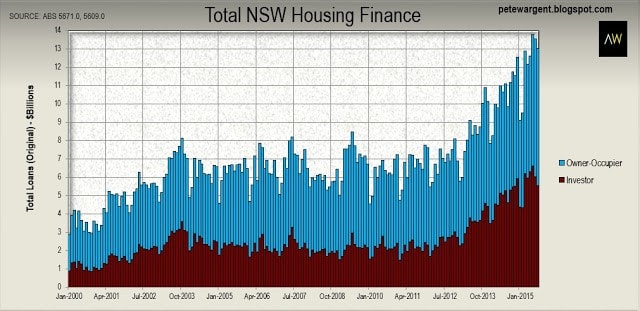

The detailed monthly investor loans figures for New South Wales show loans tracking at $5.53 billion in August, down from the all-time record high of $6.62 billion in June.

In the Northern Territory the trend in investment loans seems to be dropping off a cliff so there is likely to be some fallout for Darwin.

More on all of these figures and trends to follow tomorrow.

The detailed monthly investor loans figures for New South Wales show loans tracking at $5.53 billion in August, down from the all-time record high of $6.62 billion in June.

Looking at total lending for housing in New South Wales, the total housing market finance for August surpassed $13 billion for the third time, however it could not quite match the record levels seen in June.

The most important release of the week will be the Labour Force data for September on Thursday morning.

Expecting to see a flat result for the month, both for total employment and the unemployment rate.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.