Owner-occupiers pick up housing market baton: Pete Wargent

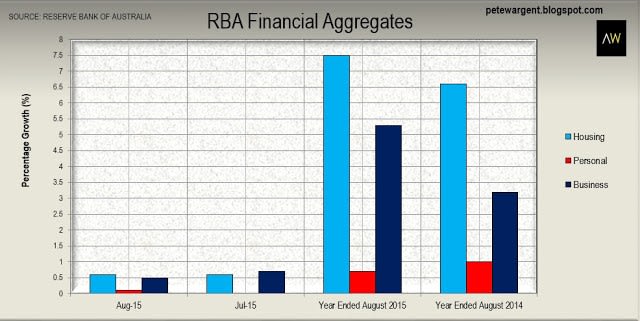

On the last day of the month the Reserve Bank released its Financial Aggregates data for the month of August 2015, which showed another solid month for both housing credit growth (+0.6%) and business credit growth (+0.5%).

Over the year housing (+7.5 per cent) and business (+5.3 per cent) credit has helped to take total private sector credit growth to its highest level since 2008 at +6.3 per cent.

Business credit grows

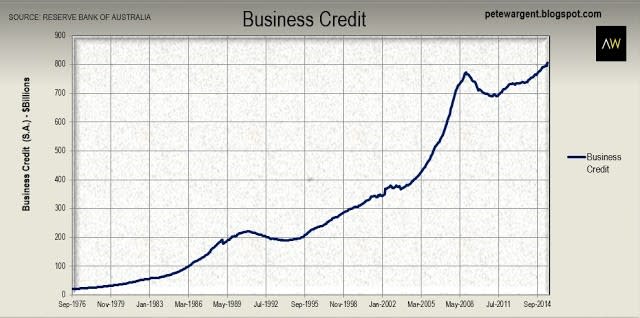

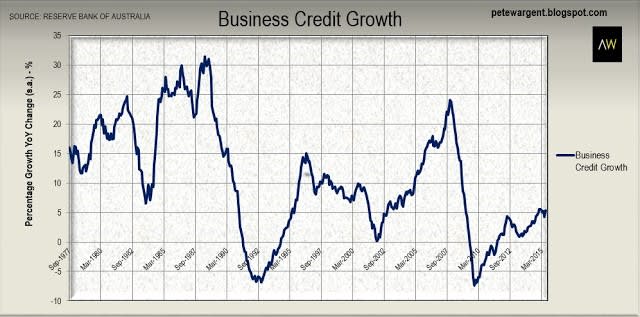

Total business credit outstanding ticked up to above $800 billion, having recovered steadily since the financial crisis.

Annual credit growth for the business sector increased at its strongest annual pace since February 2009, with Westpac forecasting further moderate gains in the months ahead.

Investor loans slowed

In turn this has helped total home lending credit growth rise to +7.5 per cent, which is now a 59 month high.

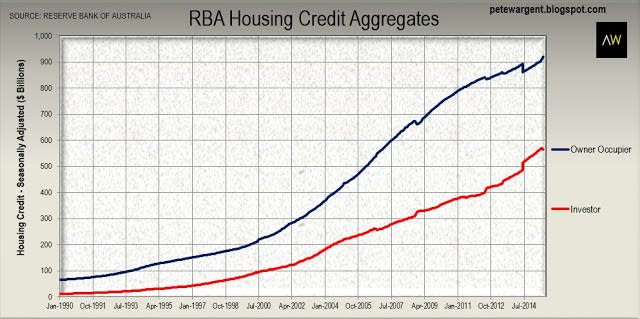

There has evidently been a little innocent jiggery-pokery by Australia's major lenders when it comes to the splitting of investor and owner-occupier credit.

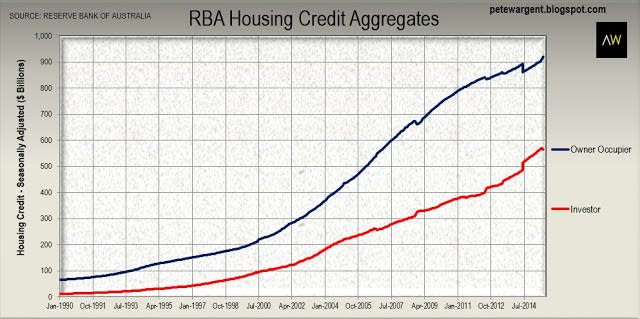

As you can see in the chart below, last month it transpired that tens of billions of dollars of credit had been misreported as owner-occupier credit, when in fact in related to investment housing.

The direction of the misstatement can hardly come as a shock.

The direction of the misstatement can hardly come as a shock.

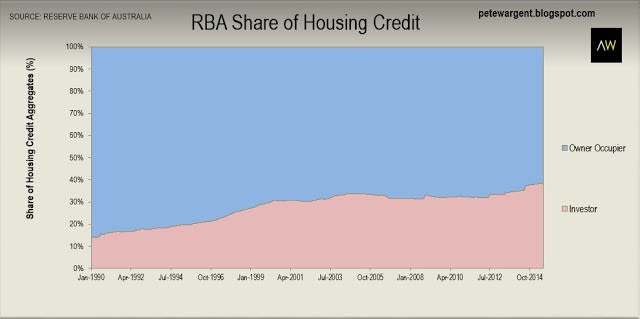

As a result the share of outstanding credit for investment housing is materially higher than previously had been thought (or at least, reported - I expect few market participants would be surprised).

That said, the slow drip of measures taken to douse investor credit first became a trickle and now it is a flow, and it appears that APRA's intervention has now taken the sting right out of the investment lending sector, with some lenders having put the kibosh on new investment loans altogether.

You can see the impact of the restatement and then APRA's macroprudential measures in the red line below, with the total stock of outstanding credit not rising on a seasonally adjusted basis this month for the first time since 2011.

You can see the impact of the restatement and then APRA's macroprudential measures in the red line below, with the total stock of outstanding credit not rising on a seasonally adjusted basis this month for the first time since 2011.

Overall this is a healthy move for the market, which was at risk of becoming too "top heavy" with investors.

Although there is no oversupply of dwellings in aggregate, there clearly were too many investors piling into the market which had helped to slow rental growth to a 20 year low.

The return of owner-occupiers

Although there is no oversupply of dwellings in aggregate, there clearly were too many investors piling into the market which had helped to slow rental growth to a 20 year low.

The return of owner-occupiers

However, it is too simplistic to say that the slowdown in investor lending will automatically put dwelling price growth into reverse gear.

If there is one thing we know about banks in this country it is that they will look to lend against housing where possible, and as such we can expect lenders to push owner-occupier loans ever harder, using enticing mortgage rates of around 4 per cent to in order to expand home loan books.

The Reserve Bank Governor himself has predicted that more folk will opt to place themselves as "owner-occupiers" in due course.

The Reserve Bank Governor himself has predicted that more folk will opt to place themselves as "owner-occupiers" in due course.

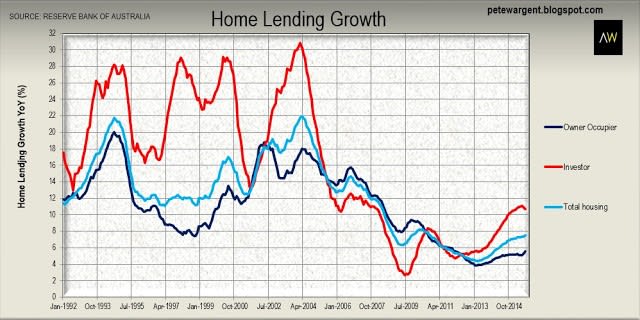

Indeed, while investor credit is now almost certain to fall below APRA's advisory +10 per cent growth threshold over the next few months, owner-occupier credit has already been picking up the slack in rising by rising by +0.6 per cent in August.

There has been a clear pick-up in the pace of owner-occupier credit growth over the past three months, and annualised home lending growth to owner-occupiers has increased to 43 month high at +5.6 per cent.

In turn this has helped total home lending credit growth rise to +7.5 per cent, which is now a 59 month high.

Investor share of credit falls

The restatement of the categorisation of investor loans saw the total share of investor credit blow out to an unprecedented 38.6 per cent last month.

However, with APRA's cooling measures now taking effect the investor share ticked downwards in August for the first time in 30 months, more evidence that the regulatory intervention will have a material impact on the investor sector.

The wrap

Overall it was another month of strengthening housing credit, with owner-occupiers increasingly willing to take advantage of record low borrowing rates.

Investor credit growth looks set to fall back to an annual growth rate of below 10 per cent, but in total housing credit is still picking up its pace to multi-year highs.

---

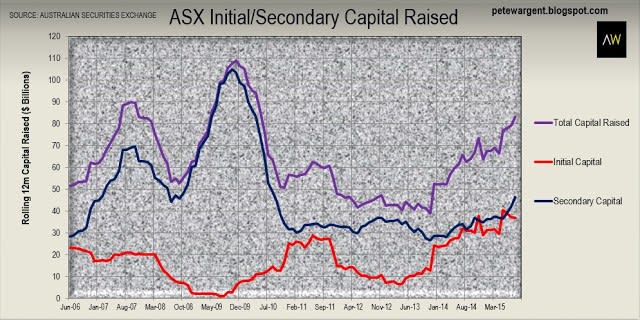

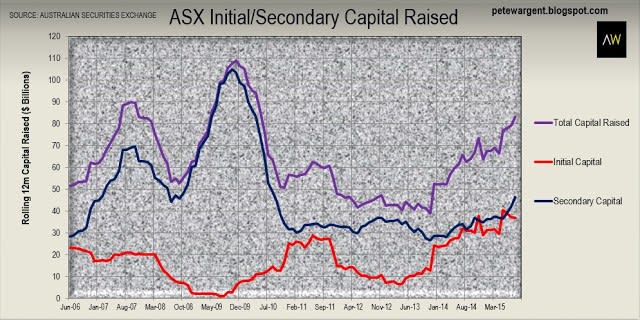

August was a quieter month for initial capital raised on the Australian Securities Exchange, although there was a strong volume of secondary cap raisings.

Total capital raised on a rolling annual basis has increased to its highest level since the great flood of recapitalisation over the year to May 2010.

Total capital raised on a rolling annual basis has increased to its highest level since the great flood of recapitalisation over the year to May 2010.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.