Three positives for property in 2016: Pete Wargent

Golly. My word there's some crappy economic data doing the rounds globally at the moment - the commodity markets smash-up continuing to take front and centre stage, while China's manufacturing activity gauge slumping to a 77 month low for good measure.

The commodity price exuberance was in part an echo of China's own property market largesse. Or if bubbles are your thing - and they seem to be all the rage these days - an echo-bubble of China's property bubble.

With stock markets in the business of tanking anywhere and everywhere from the US to the UK, Australia, China, Japan and...well, pretty much all over the show to be honest...perhaps it's no surprise that real estate is sifting back in favour togiven record low borrowing rates around the developed world.

Aussie stocks are well on track for their worst month since the global financial crisis having wiped close to 9 per cent off their value already in the month of August alone, while UK stocks have already meandered into correction territory.

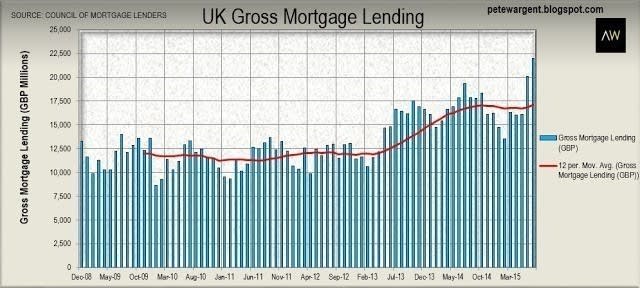

On the flip side for British investment markets, the UK Council of Mortgage Lenders reported that UK mortgage lending has bolted to its highest level in seven years - since before the financial crisis fallout - at an estimated £22 billion for the month (where is the pound symbol on keyboards these days, by the way?).

The key point here being that while macro-prudential markets may be designed to effectively slow the market, they don't take away the demand for property completely or permanently.

Australia - 3 positives for property in 2016?

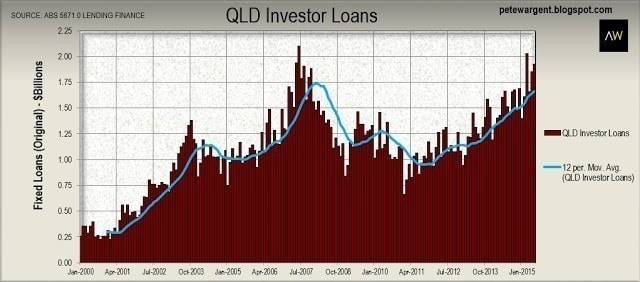

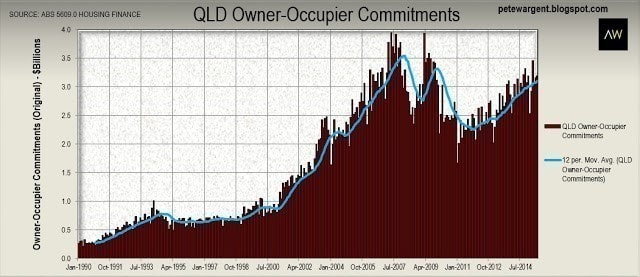

The cash rate futures implied yield curve suggests that markets area already looking for another interest rate cut to 1.75 per cent by the second half of 2016.

"Dr. Copper" is testing 6 year lows and toying with financial crisis depths while lurking below US$2.30/lb. Precious metals are miles below their peaks...and on the list goes.

Ordinarily one might say that this will be bad news for property markets and investor sentiment, yet realistically with mortgage rates falling towards record lows and cash in the bank paying essentially nothing worthwhile after inflation, where else are Aussies going to invest their money?

Into our tanking and resources-heavy stock market? Hmm, not so sure about that.

HSBC are already now offering variable rate mortgages from 3.99 per cent, with is just unbelievably cheap. We might expect to see other banks to follow suit.

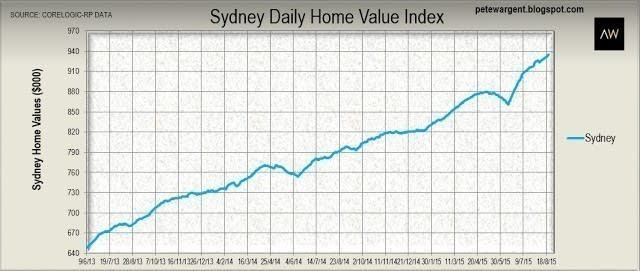

Brisbane could be the one to watch in 2016.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.