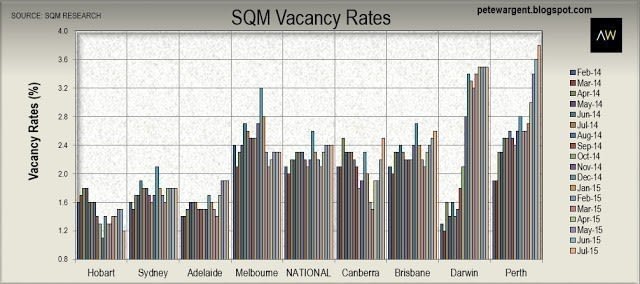

Vacancies rising in resources capitals

On a related note SQM Research released its latest July 2015 Vacancy Rates and asking rents data yesterday.

Hobart's vacancy rates have tightened over the past year from 1.5 per cent to 1.2 per cent despite a near total dearth of population growth - if you think carefully about it, you may come to your own conclusions as to why - while Sydney's vacancy rate of 1.8 per cent is unchanged from one year ago.

Brisbane city-wide vacancy rate is now recorded as being 2.6 per cent, and in fact in a number of Apartment Construction hubs vacancy rates are already considerably higher than that.

Meanwhile vacancy rates in Perth have blown all the way out from 2.5 per cent in July 2014 to 3.8 per cent.

Also reported in the SQM media release was a massive 20.5 per cent fall in asking rents for houses in Darwin, as well as 15.2 per cent decline in asking rents for Darwin units.

Over the past year asking rents have also declined in Perth for both houses (-7.4 per cent) and units (-6.3 per cent), according to SQM's index.

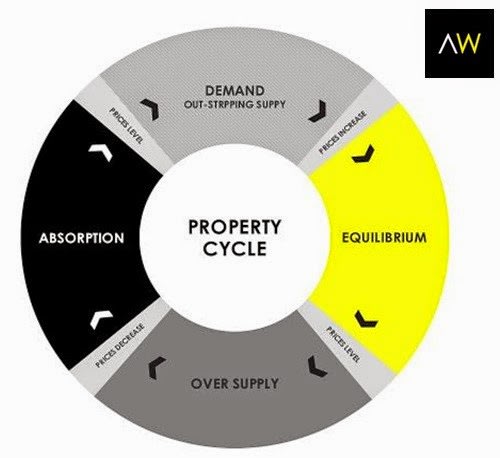

Of course, vacancy rates are expected to rise at this stage in the construction cycle, but it may take Perth and Darwin quite some time to absorb the excess stock.

This capital city market action is of course small fry compared to what is playing out in resources regions.

Following on in sympathy from an epic property crash in the Pilbara, the Australian Financial Review reported that investors in the Bowen Basin heartland are being sent broke with dwelling prices continuing to collapse dramatically.

Property prices in Moranbah have reportedly crashed by up to 70 per cent over the past three years, while prices in Dysart prices have crashed by closer to 50 per cent over the same period.

Instead of linking back to articles which promised untold riches from investing in mining towns, it is worth considering the two golden rules which nearly all of the most successful investors follow religiously:

Rule 1 - Don't lose money.

Rule 2 - See Rule 1.

When it comes to property investment, there is no easy way back from a 50 per cent drawdown, particularly if leverage is used.

Remember that the promise of higher returns often comes with correspondingly higher risks.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.