Dr Andrew Wilson:

"The double-whammy of the lowest interest rates since the 1960s and an investor frenzy has seen Sydney's median house price smash through the magic $1 million mark for the first time.

Domain's senior economist, Dr Andrew Wilson, says house prices leapt an extraordinary 8.4% over the June quarter to $1,000,616.

"It's the highest rate of growth since the late 1980s," Dr Wilson said.

"And it's because of low interest rates and they're going lower, lower and lower."

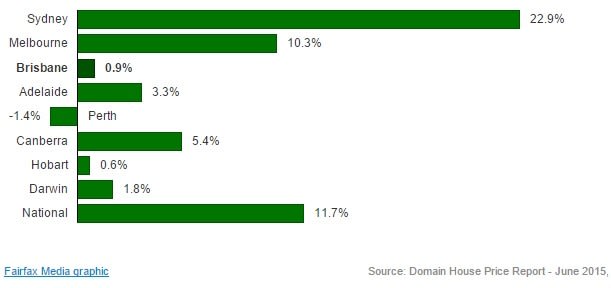

The median house price has increased by almost $200,000 in a year or 22.9%, which is one of the highest annual growth rates ever recorded by the city.

Dr Wilson said it exceeded the boom time results of 2001 and 2002.

Dr Wilson said it exceeded the boom time results of 2001 and 2002.

He attributed the huge growth to the high level of investor activity, with the $6.4 billion in loans approved over May – a record.

"Sixty-two per cent of the housing market loan share is now investors – another record – and an increase of 27 per cent over the first five months of this year compared with the first five months of last year."

"Sixty-two per cent of the housing market loan share is now investors – another record – and an increase of 27 per cent over the first five months of this year compared with the first five months of last year."

Will Hampson:

"Auctioneer Will Hampson has presided at auctions going $200,000, $300,000 and even $500,000 over reserve this year with suburb records often being smashed."

But even he described the $1 million median house price and the rate of growth as "incredible".

"Each year for the past three years the auction market has been so strong," Mr Hampson said.

He says auction listings are up 50 per cent up on last year for August and he's also tipping a strong spring.

"Conditions are perfect because interest rates are at record lows and there's a shortage of supply in many pockets," Mr Hampson said.

"A lot of buyers want to buy in a particular suburb – so perhaps Balmain, Mosman or Double Bay ... if they want to buy in those suburbs they are going to have to pay the price."

The rate of growth is sure to spark fresh suggestions that the market is overheating but Mr Hampson hosed down such talk. "The market is not going to collapse ... even if it does adjust slightly, there's a massive amount of both local and foreign investment."

...& McGrath:

"McGrath chief executive John McGrath said Sydney had proven itself to be one of the most resilient property markets in the world, with long-term fundamentals underpinning the market.

"The boom will end at some point, but that doesn't mean price growth will end, but rather continue in a more moderate fashion," Mr McGrath said."