After a somewhat downcast speech from Reserve Bank Governor Stevens yesterday, analysts will be awaiting these latest figures with bated breath.

Before we move on to look at the employment figures in detail, a quick look at why the residential construction boom has plenty of gas left in its tank yet.

New home finance up

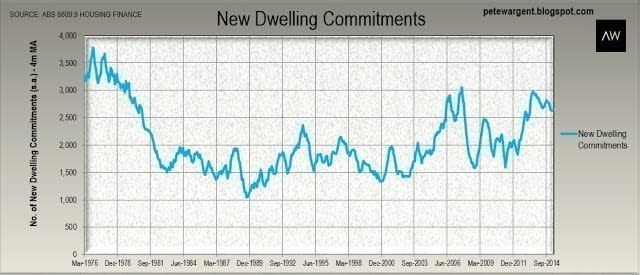

The Housing Finance figures for April showed a moderate increase in the seasonally adjusted number of new dwelling commitments to 2,766 in the month.

While this was an improvement on the March figure, smoothing the data on a 4mMA basis, shows that the trend looks to have passed its peak.

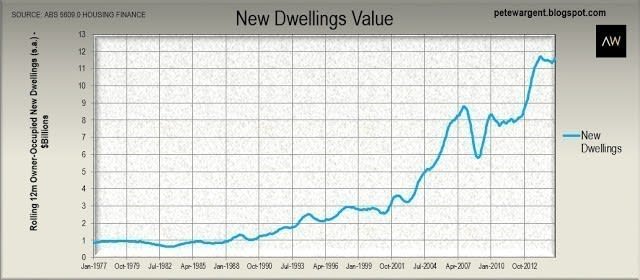

In terms of the value of loans written for new dwellings, the data recorded a record high of $1.03 billion in April, reflective of the expensive nature of new housing stock in Australia.

Investors both domestically and from offshore pay a hefty premium to buy new, and this has taken rolling annual new dwellings finance its highest ever level at $11.6 billion.

Despite the trend in new dwelling commitments looking decidedly toppy, this overlooks that a sizeable percentage of new dwelling sales are made to foreign investors, particularly in Sydney, Melbourne, Brisbane, and elsewhere.

Naturally enough, these offshore sales are not picked up in our domestic housing finance figures.

Most other indicators, including record high building approvals and forecast dwelling starts, point towards an industry which is now at or approaching its full capacity.

Typically skills and materials shortages at this stage in the construction cycle will lead to rapid inflation in the build cost of new dwellings, and there are already some indicators of this dynamic.

In particular, the Reserve Bank's liaison work has noted a shortage of bricklayers and project managers in the residential space, despite the widespread availability of construction workers as the mining investment boom dies its long, slow death.

Construction loans

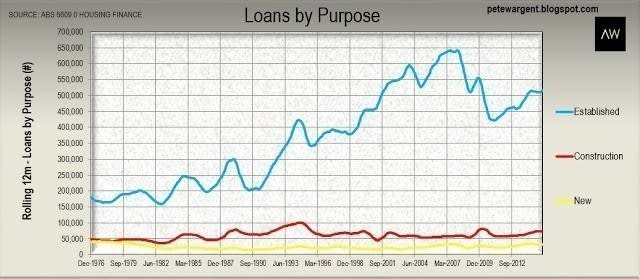

Unsurprisingly most buyers continue to seek finance to buy established property, although if you look closely, construction finance is rising steadily.

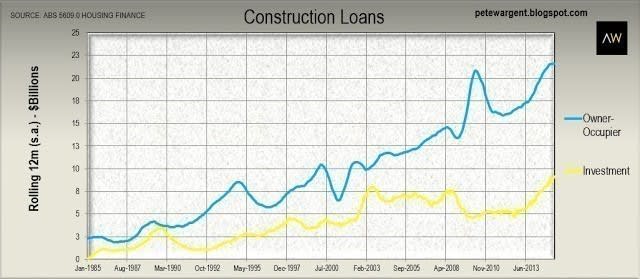

Drilling into this a little further, the rolling annual value of construction loans to owner occupiers appears to have peaked out at a record $22 billion.

However, rolling 12 monthly construction finance commitments to investors continue to rise, now up to $9.1 billion of loans written, which is also a record high.

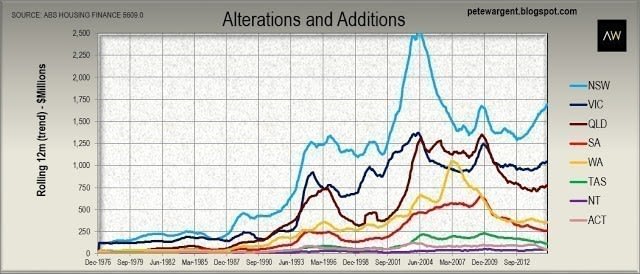

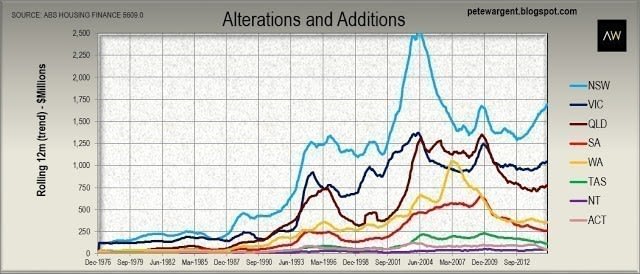

Renovations

If there is one genuine bubble in the Australian economy, it is surely in the irrationally exuberant number of renovation TV shows advertised on the television (I've never actually watched one, I should disclose...not my thing).

Alas, outside Sydney, where renovations activity is both robust and rising, nobody seems to be undertaking any renovation projects themselves!

Sure this was only the first month of the quarter, but the contribution to GDP growth from major alterations and additions in the second quarter of the year already looks likely like to be nil.

Meh.

The wrap

Some survey indices have lately pointed to a contraction in apartment and attached dwelling construction.

These indices are surely broken!

Just a few days wandering around the capital cities and major regional centres would tell you as much.

The residential construction boom continues, fuelled largely by sales to offshore buyers, and for this reason, the data on new dwelling commitments domestically doesn't give us the full picture.

The construction loans data charted above - combined with record high building approvals and a strapping number of dwelling starts - imply that the next two years will see a sustained high level of activity in home building.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His book 'Four Green Houses and a Red Hotel' is out now.