Migration away from Sydney falls to record low

A huge shift in net interstate migration has taken place since the financial crisis, a major demographic trend which is a game-changer for this property market cycle, particularly in Sydney. Let's take a look in four short parts.

Part 1 - Mining states slowing...but Sydney booming

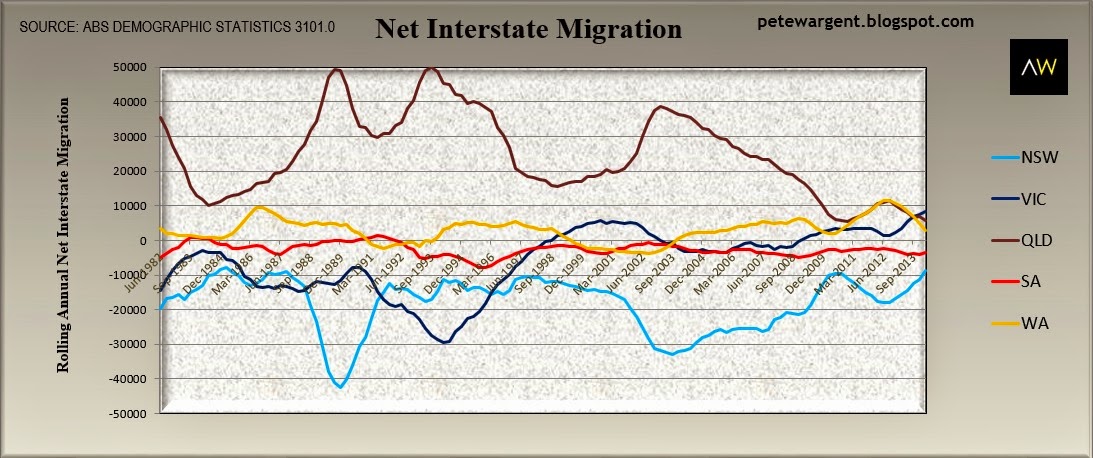

Drilling into the most recent round of demographic data from the Australian Bureau of Statistics confirmed an interesting fact: net interstate migration from New South Wales has declined to its lowest level on record at just 1,036 in the March 2014 quarter.

Typically there has been a very significant population flow away from NSW, especially expensive Greater Sydney, which is comfortably more than replaced by immigrants from overseas and natural population increase. But as the mining construction boom fades so too does the tide of interstate population shift away from Sydney.

The mining states which have benefited most from net interstate migration historically are now no longer doing so - predominantly the maroon line of Queensland (and how!), the gold line of Western Australia (we use state cricket colours, see?) and the red of South Australia (Redbacks? Ah, you have the hang of it now), in that order.

Instead an expected rebound in services and construction jobs in Sydney and to a lesser extent Melbourne is seeing a massive boom in the population of those two cities.

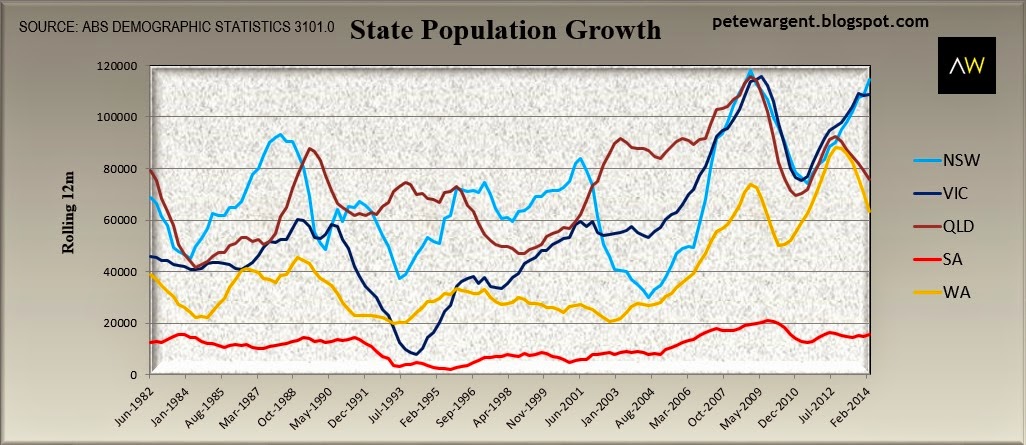

Charted below is the annualised rate of population growth by state, which shows New South Wales (+115,000) now threatening to spiral off the top of the chart, with Victoria (+109,000) not too far behind.

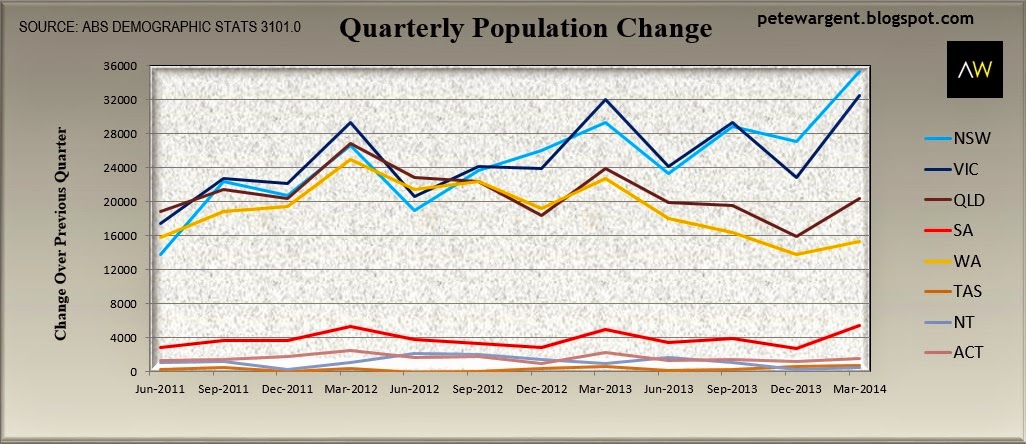

It never pays to get too aroused by one quarter of data - particularly from ABS releases at the present time! But the population change in the March 2014 quarter showed NSW recording an extraordinary increase of 35,285, potentially implying an unheard of annualised pace of well over 140,000.

In the event, we will not see the state's annual population growth figure scaling such dizzying heights due to the now slowing pace of net overseas migration, with fewer Kiwis and Poms in particular choosing to take the path Down Under at this stage in the cycle. Indeed, most immigrants to Australia now hail from Asia.

Nevertheless, despite the slowing pace of net overseas migration, by the time the June 2014 data rolls around we will probably see New South Wales annual population growth approaching 120,000, which is a huge figure.

Part 2 - Dwelling supply: too hot, too cold...or just right?

There is some some conflicting and some zany market commentary when it comes to the adequacy of dwelling supply in Australia, often involving a preconceived notion ("massive overbuilding" or "chronic undersupply") and the producing of data to support the position.

Sometimes we see analysis of building completions in Australia compared to the existing population, which is an interesting point of comparison, but a clear confusion of stock versus flow.

Much more unusually we see offbeat comparisons of Australian construction versus that seen in certain US states which previously had a cahuna oversupply and now aren't constructing much (relevance?), or on particularly obscure days, comparisons with Japanese construction.

The slightly boring answer is that there is no chronic undersupply of dwellings in Australia and nor is there massive overbuilding in aggregate, although it is possible to highlights regions and suburbs which represent examples of each.

Property markets are complex and imperfect beasts. If you can analyse and understand data flows it becomes possible to identify specific areas where undersupply will begin to bite, and thus you can comfortably outperform market capital growth averages over time by buying investment property with an element of scarcity value in these locations.

The data to analyse

A better starting point is to scrutinise Australian building approvals, dwelling commencements and completions data against the changes in demand in Australia, drawing inferences based upon average household sizes (a little over 2.5 depending on your preferred source) for the regions analysed.

There have been warnings about a potential oversupply of dwellings in Sydney, for example. Travelling around certain parts of town I can see why you might reach that conclusion, but from a macro perspective, you'd be wrong.

There is something of an oversupply of units looming in a few pockets - in the CBD and inner city, around the airport and inner south, and in a few of the new Urban Activation Precincts (UAPs) around transport hubs, where there will now be fewer height restriction on the building of apartment tower blocks.

Largely bought by offshore investors, these off-the-plan apartments will generally be poor performers and are likely to suffer from falling rents, vacancies, and possibly both.

(As an aside it's often highlighted how most property investor loans written are for established dwellings, but since there are now 9,366,800 dwellings and counting in Australia, and since a high proportion of the new stock is sold offshore, the percentage of domestic investment in established stock will continue to rise.

Moreover, established properties usually represent better value than most expensive new units and therefore a majority of domestic investors will rationally steer clear of the newly constructed stock in the absence of incentives to do otherwise. In short, we probably do need foreign investors to create supply).

Sure, there are some areas where there are more new flats than willing renters. But ask anyone in the market and they'll tell you that in the lifestyle suburban areas where most people actually want to live, precisely the opposite problem exists - there is a dearth of quality stock and the decent stuff is selling in a matter of days.

Article continues on the next page. Please click below.

Part 3 - New stock has come online

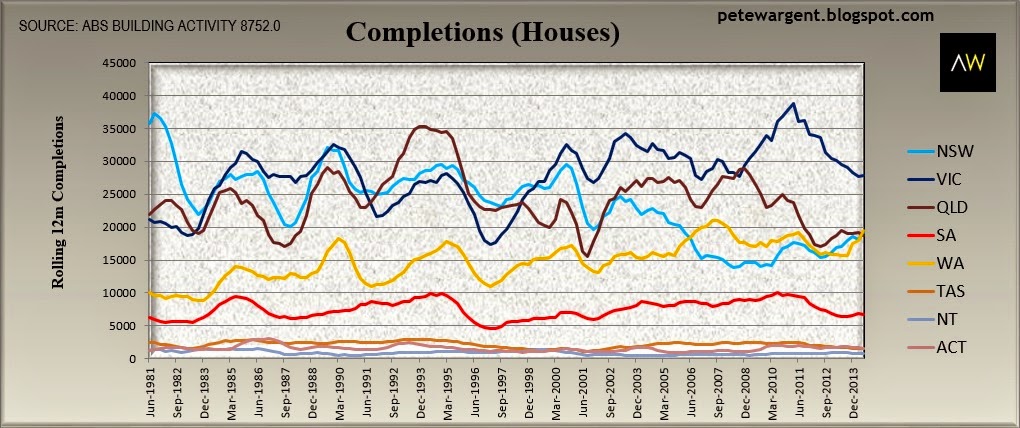

Think back to the annualised population growth figures discussed previously for New South Wales, which are tracking at about 115,000 over the year to March 2014. In the 12 months to June 2014, the state saw the completion of 19,134 houses...

...and only 17,510 completions for unit and apartments.

That's a grand total of 36,644 completions. Given that the state population in the year to March 2014 increased by 114,509, I don't think we need to panic about massive overbuilding just yet.

Completions have not even been high enough to match the demand from the state population growth let alone address previously inherent supply imbalances in Sydney...and that's before we even begin to account for brownfield site demolitions and stock obsolescence.

In fact, if you drill in more closely to the population and demographics data you will find that population growth in New South Wales regional centres has been far below the national averages in all but a tiny handful of localities. Meanwhile Greater Sydney is set to record population growth somewhere in the vicinity of 90,000 in this calendar year.

Part 4 - Decent approvals & supply in the pipeline

In terms of forthcoming supply, it is true that there is more to come in the pipeline. In the 12 months to June 2014, New South Wales commenced 20,000 houses and 25,000 units. And Greater Sydney apartment approvals are now tracking at a little over 26,000 on a rolling annual basis.

That's a decent enough supply response to rising prices, assuming all approvals make it to completion, which they won't.

However the level of monthly apartment approvals peaked way back in March 2014 and is now rolling over. The major developers, who are nobody's dummies, are aiming to have their Greater Sydney new apartment stock completed and sold by December 2015.

Oversupply theory? Doesn't pass the "sniff test".

With the exception of the aforementioned locations, there is no city-wide oversupply of dwellings in Sydney, and nor is there going to be any time soon.

Inner Melbourne and inner Brisbane are two other areas we can talk about with an apartment oversupply. And, for example, some coal mining towns and regions are likely to experience oversupply too, albeit as result of a collapse in demand rather than overbuilding.

As a Chartered Accountant and sometime auditor, too many years ago now I was trained at accounting college to consider that when people make sweeping yet unsubstantiated claims such as "there is an obscene amount of construction going on in Sydney" then that claim should be weighed up against or made to pass a common sense or "sniff test".

Even if you choose to dismiss vacancy rates as an unreliable indicator, which in Sydney are hovering way below the notional equilibrium position of 3% at just 1.7%, the best "sniff test" for oversupply to my mind is to look for signs of negative rental growth.

Today apartment rental growth is tracking somewhere between at 3% and 5.3% in Sydney, depending on your data provider of choice.

Over the past 10 years the growth in median rental for detached houses in Sydney has been 80%, and for attached dwellings the equivalent growth in median rental is 77%.

'Nuff said.

You can visit AllenWargent property buyers (London, Sydney) or Pete's blog.

His latest book is 'Four Green Houses and a Red Hotel' .