First home buyer figures are still understated

First home buyer data continues to be understated.

A point which has been much discussed over the past year: the non-sensical figures being reported as "fact" for levels of first home buyer activity.

Even until relatively recently the Reserve Bank (RBA) was producing stats for first homebuyers which suggested that numbers were abnormally low after a spike caused by home buyer grants.

Some time ago, however, the Reserve gave up on reporting those figures since it was quite clear to impartial observers that with the withdrawal of first home buyer grants, a significant proportion of first time buyers were not being recorded as such.

For example in this month's Chart Pack, the RBA only reports the following, which is a strong and rising market. With no credible first home buyer data available, it is no longer reported:

What gives?

Unfortunately, despite this all being well known about for yonks, this has not stopped commentators from continuing to post the Australian Bureau of Statistics (ABS) figures uncritically, as though to imply that all first home buyers have been frozen out of the housing market by greedy investors.

While there has no doubt been a fair element of this happening, and particularly so at the margin and in inner city locations in Sydney and Melbourne, it never really made sense to suggest that first home buyers were casually sitting out of a rising market with disinterest. History suggests that is unlikely.

Had banks been requiring 20% deposits, thenyes, clearly this would have happened. But, unlike in the UK, lenders have generally not been requiring large deposits at all and high Loan to Value Ratio (LVR) loans have remained widely available (and in any case, outside Sydney, property price growth just hasn't been that strong over recent years), and thus unsurprisingly, first home buyers are still buying.

Look at the reported data for Western Australia, for example! A huge segment of the market has been first timers, between a quarter and a fifth of all buyers.

Listening to the data critically and understanding its message - generally, there have robust property markets, particularly in cities like Sydney - would surely lead you to the right conclusion.

Another point, which I touched on here back in March, is that a significant number of first time buyers in Sydney, have been buying investment properties as their first step on the ladder, thereby never being recorded as first-timers at all. Indeed, I have known from my own client base that it's a cast iron fact that the number of first homebuyers is understated... the real question is only "by how much?"

The problem is that we now have no true way of knowing the quantum of the issue, if indeed there is much of an issue on a national basis. Of course, there are always anecdotes about first homebuyers being outbid by "the Chinese" (i.e. anyone of Asian appearance), and investors do compete with first home buyers for properties (it's a market - that's life) but anecdotes also frequently lead to poor conclusions.

This article continues on the next page. Please click below.

ABS confirms under-reporting

Not at all surprisingly, here is what the ABS reported in its Housing Finance release on Friday:

"A preliminary investigation has been conducted to evaluate the robustness of estimates of loans to first home buyers. In collecting this information, lenders are asked to report all loans to first home buyers. Concerns have been raised that under-reporting could occur if some lenders were only able to accurately report on those buyers receiving a first home buyer grant.

"Most data on first home buyers are collected by the Australian Prudential Regulation Authority (APRA). The investigation indicates that some lenders experience difficulty reporting on loans where the buyer is not receiving a first home buyers grant. Estimates of loans to first home buyers are therefore under review and users are advised to exercise caution in referencing this data.

"The ABS is working with APRA to explore options to make it easier for lenders to report correctly in future. In the meantime, the ABS is further investigating the potential for under reporting first home buyer data and the feasibility, if necessary, of estimating the extent of under reporting and adjusting the first home buyers estimates accordingly. The outcomes from the investigation will be published on the ABS website."

No shocks there.

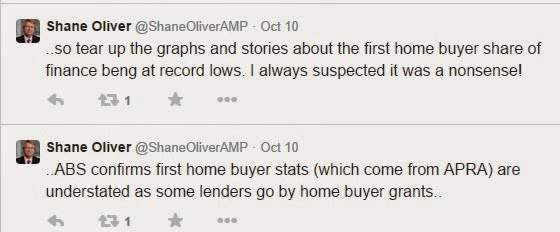

From Shane Oliver, Chief Economist and Head of Financial Strategy at AMP:

Indeed. As a sometime "first-time investor" (and thus, never being recorded as a "first time buyer") himself many years ago, to his credit Shane was always well aware of this issue.

Hot sectors of the market

Over the past year we have bought a lot of properties for clients in Wollstonecraft, Waverton and other Sydney lower north shore suburbs such as Neutral Bay.

The Sydney north shore market has been absolutely flying in 2014, with some properties recording huge gains.

A run-down wreck at 47a King Street, Wollstonecraft sold yesterday for an astonishing $2,230,000, a monster $830,000 over the reserve price. Meanwhile, 2 bedroom unit 14/4 Gillies Street in Wollstonecraft sold for $780,000, implying an uplift in the market of well over 10 percent in a matter of fewer than 6 months. John Howard will be pleased.

People have tried to torture the Sydney data a little lately to show that the market has been relatively soft (generally, it hasn't), but if you look at what has happened to individual properties, particularly in suburbs such as these, price action has been very hot.

Indeed, gains over the past year have been exceptional on the north shore in suburbs such as Milsons Point, Crows Nest and even Hunters Hill and a number if others, as well as in our old favourite inner west suburb, Erskineville, which notched a yet further 25% of capital growth in the past year. Huge returns.