The good (and the not-so-good) investments since the GFC

Not much to report on the share markets: the Fed taper keeps getting deferred and US stocks remain in a significant uptrend.

There has been a lot of talk about shorting the market over the last few years due to the world ending - and it still might yet. There are a lot of debt-related issues in the world (both public and private) where the full pain of a long-term resolution has never fully been taken.

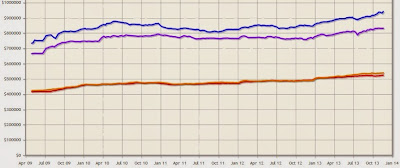

But you'd have done very well indeed just to hold the index - the Dow Jones Industrial Average is +27% year on year...and the returns since the middle of 2009 have been staggering.

The share market recovery has been less dramatic in Australia, in part due to a historically strong Aussie dollar which may have made our stock market less appealing to foreign investors.

Nevertheless, excellent returns for holder over the past half decade, particularly for those holding strong dividend-paying stocks.

You could have done well from shorting the market if you timed your entry and exit well, but that's a tough gig to get right for most average traders/investors. As a general rule, for most people, there is a far greater chance of long-term success through owning quality income-producing assets.

Source: ASX

I keep reading articles about how, for various reasons, property in Sydney is not a good investment. Well, you can keep telling yourself that if you like and if it makes you feel better, but unfortunately, that's nowhere near being the case.

SQM produces an excellent 'vendor sentiment index' based upon asking prices by property type and by capital city. It's one of my favourite reporting tools. Here is their key:And here has what has happened to Sydney dwelling prices since the financial crisis, which is to say, sentiment has been very, very strong across all property types. And sentiment is continuing to get stronger, with SQM forecasting a boom in prices of 15-20% in 2014.

Vendor expectations are getting higher, and as anyone who has actually bought in the established Sydney market of late will know, there are stacks of buyers out there ready to meet them.

Source: SQM

If you think back to my posts on population growth, here and here, combined with an inherent under-supply in the harbour city and low interest rates, it's not hard to see why.Sure, population growth in itself does not cause property prices to move higher, but in the supply-constrained desirable suburbs that is precisely the impact it is having.

Wondering whether Adelaide will start to pick up a bit now? You'd think it would have to sooner or later after a very uninspiring and under-performing five years, but at this stage, according to SQM's vendor sentiment index...no dice.

Source: SQM

Pete Wargent is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His new book 'Four Green Houses and a Red Hotel' is out now.