How wages are affecting the property market

A fairly soft wage price index release this week, while the share markets got a bit of nudge cropping by 1.4%. Not much to get excited about with the wage prices, in truth. Wages in Australia increased by 0.5% quarter on quarter leading to year on year wages growth of 2.7%, with the usual volatility across industries.

Source: ABS

Wages growth at that kind of level appears unlikely to fuel much in the way of consumer price inflation, yet go some of the way towards explaining how hard it is to time property markets. In Sydney, for example, we have had three property downturns in the last ten years (2004, 2008, 2011), yet as each cycle passes wages and household incomes have trended higher over time.

This soft wages print adds something to the argument that interest rates could be staying right where they are with an official cash rate (OCR) of 2.50%, potentially for the next six months, until such time as there is clear evidence that the unemployment rate has peaked.

The inflation picture is a little mixed at present. The key inflation readings - the trimmed mean and weighted mean - are comfortably within the target range, yet note the gulf between tradables inflation and non-tradables (apologies, I have to go with the RBA's spelling, though I don't like it).

Note that: "Tradable items are things whose prices are largely determined on the world market like oil, motor vehicles and clothing. As such, the prices of tradable items are heavily influenced by exchange rate movements. By comparison, non-tradables refers to things that are not readily exported or imported, like medical services, housing and haircuts. As such, their prices are largely determined domestically."

Following on from its worse-than-expected business survey, National Australia Bank (NAB) still believes that the next move in interest rates will be down, although it has pushed out its cut estimate until the middle of 2014. Others remain more positive on the economic outlook and see the next move as being up.

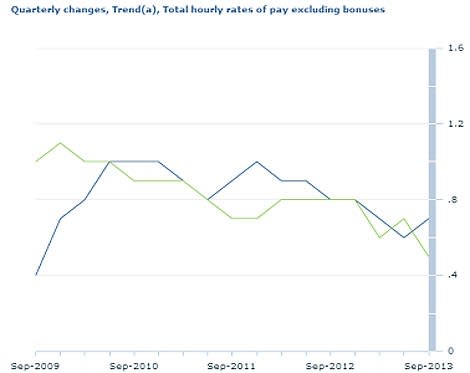

The respective trends for public and private sector wages are detailed below. The downtrend over the last three years is fairly clear, although perhaps there are signs of hope in private sector wages. The trend for public sector wages doesn't look inspiring. On a related point, the outlook for Canberra's property markets also does not appear great with jobs likely to be cut in the ACT.

Source: ABS

Elsewhere, however, Westpac reported that consumer confidence picked up (no doubt in part due to stronger dwelling prices) and perhaps unemployment expectations may have topped out...for now.

Overall, the data on Wednesday seems to fit with the Reserve Bank of Australia's base case, which is for below-trend GDP growth through 2014 before the economy starting to pick up momentum again in 2015. The impact of slowing mining capital investment will be key, and certainly one of the most significant issues to watch with interest.

Pete Wargent is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His new book 'Four Green Houses and a Red Hotel' is out now.