Some parts of the country looks set for a long, slow decline, but not Sydney: Pete Wargent

It's interesting to note that RP Data has Sydney dwelling prices up by more than 4% in fewer than 6 weeks.

Hmm. So much for those "falling house prices" and "more properties being sold into a falling market" being reported in May (in the face of 80% auction clearance rates and 85%+ in the inner western suburbs).

Nationally, RP Data has prices up by more than 1% in July, but much of that is really only offsetting falls reported in May.

If inflation prints low next week (say, 0.6% for the quarter or less) then interest rates will likely be cut again in August and there now appears to be a genuine risk that Sydney's property markets will be sent into overdrive.

Sydney's real estate problems are multi-faceted and well documented: a booming population of 60,000 extra persons per annum, construction too slow, planning restrictions, not-in-my-back-yard-ism, a disproportionate level of investor activity and appreciating land prices, to name but a few of the issues.

Sydney stands to be a likely beneficiary of the weak response to interest rate cuts elsewhere. In cities such as Adelaide, prices have stalled over the past half decade despite the recommendations to buy property there from yield-seeking property commentators, while Brisbane, Canberra and most regional markets have not been much cop either, and show few signs of really picking up to date.

It very much looks like a long, slow, bleeding decline for many parts of the country.

Dropping interest rates fired up activity once through 2009-2010, but it doesn't look as though there will be much response a second time.

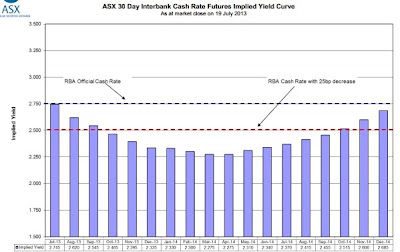

Futures markets are already pricing an August interest rate cut to 2.50% as more likely than not (a 64% chance of a cut on August 6), and indeed, they are all but pricing in two further cuts by March 2014.

It's overwhelmingly investors who are pumping up the Sydney property market, with prices soaring to new heights.

Nationally, however, prices still remain 2% below their previous 2010 peak and don't seem inclined to be heading a whole lot higher at this juncture.

Dwelling prices from the RBA chart pack (a bit of a time-lag in the data here: it will be updated again soon):

And copied below is the futures implied yield curve, showing the cash rate as likely to be headed towards 2.25% by March next year.

Record low levels as the Reserve attempts to rebalance the economy away from mining construction and towards dwelling construction.

Interesting times...

Source: ASX