High rise approvals drop after July surge: Matthew Hassan

GUEST OBSERVER

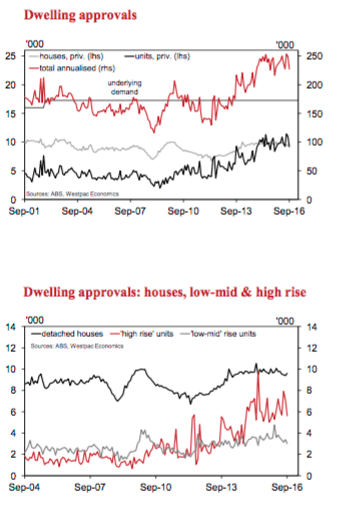

Dwelling approvals dropped 8.7 percent in Sep, larger than the market expectation of a 3 percent fall but within the range of ‘normal’ volatility for month to month reads.

The detail shows a sharp 16.3 percent drop in units was the main driver in the month – with-in this segment the ‘usual culprit’ when there is volatility - high rise approvals – was down just over 20 percent in the month but down only slightly on a year ago, reflecting the high starting point following a big surge in July. Even with a dip last month, August was the fourth highest reading on record.

Outside of ‘high rise’ the monthly moves were mixed but mostly hint at an underlying trend softening. Private sector house approvals were up 2.3% but ‘mid-rise’ were down over 10 percent. The combined picture from ‘non high rise’ approvals now show a trend decline for six consecutive months tracking at a 10-15 percent annual pace. The state detail shows this coming through across all the main states – a more convincing though still tentative sign of a broad underlying slowdown.

The signal from ‘high rise’ remains much less conclusive – despite the latest monthly drop it is unclear whether the segment is levelling out or turning down with approvals uneven across the major states as well (up strongly on a year ago for NSW but lacking a clear direction in Vic and Qld).

The value of renovation approvals declined 2.2 percent to be down 10.6 percent/yr, pointing to a clear softening heading into year end after strong gains in the first half of 2016.

The value of non res building approvals spiked sharply in Sep (+119 percent!). The gain came from a mix of retail, office, hotels and entertainment & recreation buildings – the breadth of the gain a promising sign that it may not be just a 'one-off'. State-wise, all of the gain is coming from NSW and Vic.

Overall, the update provides more tentative evidence of an underlying slowdown in non high rise dwelling approvals but the picture on high rise remains very uncertain. The mix still looks relatively constructive for new dwelling construction in 2017 – when the continued ramp up in apartment work looks set to more than offset the slowdown in other segments. The near term path of high rise approvals is more critical for activity in 2018.

The September pull back in this segments falls well short of a decisive signal – it would take similar-sized moves in the next few months to signal the sort of 'break out' weakening that would indicate a sharp wind down in high rise activity is on the way.

Matthew Hassan is senior economist with Westpac.

Jonathan Chancellor

Jonathan Chancellor is one of Australia's most respected property journalists, having been at the top of the game since the early 1980s. Jonathan co-founded the property industry website Property Observer and has written for national and international publications.