Headline CPI surprised in Q1: Westpac's Justin Smirk

GUEST OBSERVER

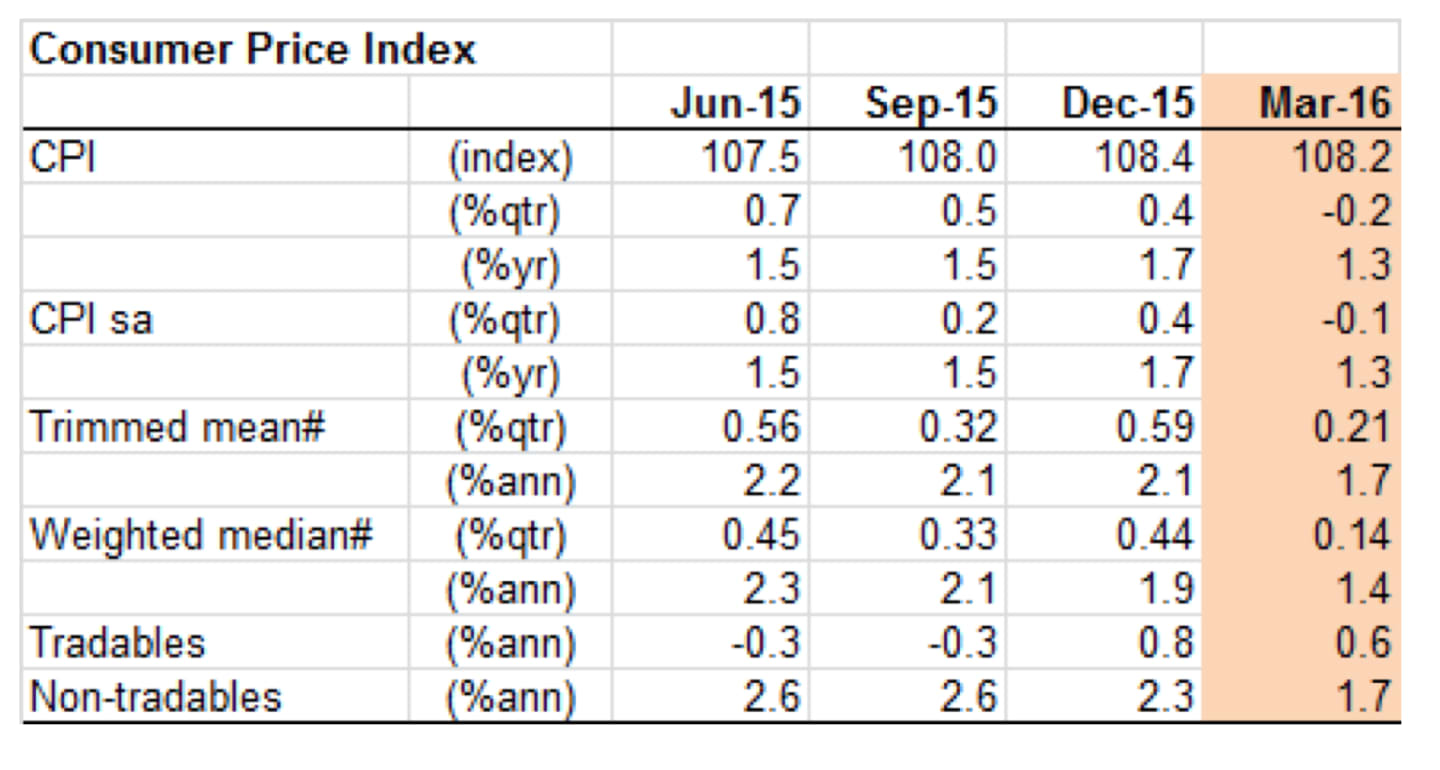

The headline CPI surprised in Q1, falling 0.2 percent compared to Westpac’s forecast for +0.4 percent.

The market median was +0.2 percent. The annual rate is now just 1.3 percentyr compared to 1.7 percent/yr in Q4.

The core measures, which are seasonally adjusted and exclude extreme moves, rose 0.2 percent compared to the market’s expectation of 0.5 percent rise, Westpac was slightly higher at 0.6 percent. In the quarter, the trimmed mean gained 0.21 percent while the weighted median lifted 0.14 percent. The annual pace of the average of the core inflation measures is now 1.5 percent from 2.0 percent in Q4 (Q4 was unrevised).

The six month annualised pace of core inflation came in well below the band at a very modest 1.4 percentyr pace, this is the third quarter in a row it has been below the band and the lowest six month annualised pace since the 1.3 percenty print in March 1999 (a seventeen year low).

Traded goods prices fell 1.4 percentqtr following a stronger 0.5 percent in Q4. It is true that the significant fall in auto fuels and, if to a lesser extent, falling fruit prices had a big role to play. But even excluding fuel, food and tobacco traded goods fell 1.3 percentqtr. This is much weaker than we had anticipated.

Non-traded prices rose just 0.4 percentqtr which matched the softer print in Q4. This was due to the softer than expected annual price resetting for health and education. However, more critical to the outlook was the very soft 0.3 percent rise for housing owing to the continue moderation in rents inflation (0.1 percentqtr vs 0.2 percent in Q4) and a very modest update in dwelling prices (just 0.2 percentqtr when we had been looking for a modest bounce from the 0.1 percent print in Q1.

The key observation in the March quarter is the across the board weakness in Australia retail prices highlighted by the first disinflationary CPI headline print in seven years and the lowest six month annualised pace of core inflation in seventeen years.

The key observation in the March quarter is the across the board weakness in Australia retail prices highlighted by the first disinflationary CPI headline print in seven years and the lowest six month annualised pace of core inflation in seventeen years.

All together this highlights downside risks for our medium term inflation forecasts.

But low inflation, on its own, is not a trigger for a rate cut.

Sure, it unlocks the interest rate door for the RBA should it decide it needs to walk through that door as the Bank would not have to wait for another CPI update before doing so. However, it does not mean that the RBA will cut rates! A rate cut is dependent on local economic conditions demanding a rate cut.

With unemployment on a new downtrend this is not so at the moment and we suggest that the RBA is waiting to see a new weaker trend in domestic activity and employment before it would embark on such a strategy.

Justin Smirk is senior economist, Westpac Group and can be contacted here.