Will lower mortgage rates reinvigorate the taper in dwelling turnover? Cameron Kusher

Over the second half of 2014 capital city home sales fell, with the decline in-line with a softening in growth in home values. Interest rate cuts in 2015 may result in a rebound in sales activity this year.

Based on CoreLogic RP Data’s estimates of residential sales transactions to December 2014, there were 471,932 dwelling sales nationally. Despite the growing trend to more units being constructed, house sales still account for the overwhelming majority of sales.

Over the year there were 339,902 house sales (72% of all sales) and 132,030 unit sales. Based on these figures, house sales were 0.2% higher over the year unit sales were -6.4% lower. Keep in mind that although we attempt to estimate for off the plan unit sales, they are likely to be revised higher as they settle. The settlement period for off the plan unit sales can take more than 12 months as the project is constructed. Off the plan sales ultimately get recognised at their contract date upon settlement.

Rolling annual dwelling sales, Nationally

If we take a look at the capital city housing markets we see similar trends. Over the 12 months to December 2014, there were 218,479 house sales and 99,707 unit sales.

Compared to annual sales in 2013, combined capital city house sales were 2.8% higher while units were -7.0% lower resulting in a -0.5% overall fall in capital city sales.While at a national level house sales accounted for 72% of all sales, across the capital cities they accounted for a lower 68.7%. Again, we may see the number of unit sales revise higher as off the plan settlements take place.

Rolling annual dwelling sales, Combined capitals

The trend both at a national and combined capital city level was that the number of sales fell away over the second half of 2014. The same trend was noted in terms of home value growth. After the annual rate of capital city home value growth peaked at 11.5% in April 2014, the rate of growth slowed to 7.9% annual growth by the end of 2014. Value growth has re-inflated over the first two months of 2015 and the recent interest rate cut may also contribute to faster growth, this is also likely to result in a rebound in sales transactions.

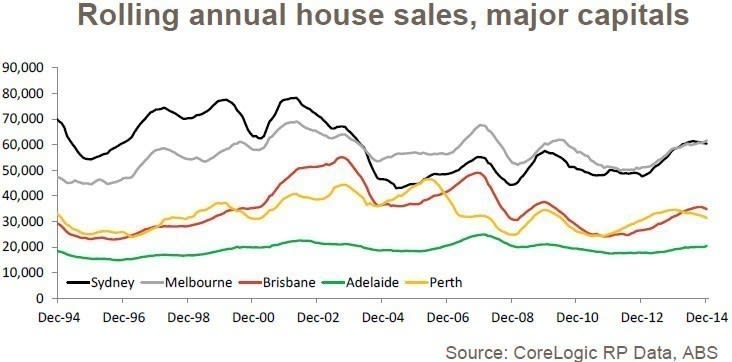

Across the individual capital cities, the number of house sales was higher in 2014 than in 2013 across most cities. The exceptions were the markets where value growth has slowed most markedly in 2014; Perth (-9.4%), Darwin (-4.8%) and Canberra (-2.7%).

Elsewhere, house sales have increased by 3.4% in Sydney, 5.1% in Melbourne, 8.9% in Brisbane, 6.9% in Adelaide and 8.0% in Hobart. Although house sales were generally higher in 2014 than in 2013, most cities have seen an easing in transactions over the second half of 2014 with Melbourne and Hobart the only cities where sales volumes have continued to trend higher.

Rolling annual house sales, major capitals

Turning to the unit market where across the combined capital cities the number of sales has actually fallen over the past year. Across the individual cities, only Melbourne (1.0%), Adelaide (5.7%) and Darwin (24.2%) recorded an increase in transactions over the year. Elsewhere, unit sales fell -13.8% in Sydney, -2.6% in Brisbane, -16.1% in Perth, -1.0% in Hobart and -14.5% in Canberra.

Rolling annual unit sales, major capitals

It is also interesting to look at the proportion of house sales across each city. It shows that units are much more prevalent across the east coast capital cities as well as Darwin and Canberra. Over the year, the proportion of total sales that were houses across the capitals were recorded at: 60.8% in Sydney, 68.9% in Melbourne, 70.3% in Brisbane, 75.9% in Adelaide, 82.6% in Perth, 77.1% in Hobart, 62.1% in Darwin and 59.9% in Canberra.

The sales volume data also reveals that despite ongoing strong rates of population growth and buoyant housing market conditions over recent years, the number of dwelling sales has not risen by a commensurate amount, with the number of sales well below what was recorded over previous growth periods.

Across the individual capital cities, the peak in annual sales were recorded at: April 2002 in Sydney (136,925), December 2007 in Melbourne (105,264), September 2003 in Brisbane (74,941), January 2008 in Adelaide, May 2006 in Perth (56,850), October 2003 in Hobart (7,425), July 2006 in Darwin (4,469) and June 1992 in Canberra (13,655).

Across all cities, the number of home sales over the past year has been significantly lower than these peaks. This suggests that for one reason or another, despite a higher population, a smaller proportion of people are buying and selling homes.

The high entry and exit costs of homes in Australia are likely the major reason, the two biggest costs are stamp duty and agent commissions both of which are higher as home values increase as they are levied off the purchase (stamp duty) and sales (commission) prices. Other factors might include less participation from first home buyers and the high rate of savings where more households are focussing on debt reduction.

Annual house and unit sales, year to December 2014

Sales volumes eased over the second half of 2014 in-line with a slowing of home value growth. With mortgage rates moving lower in February 2015 and expected to reduce further during 2015, there may also be a rebound in sales activity. Despite a potential rebound, transaction volumes are likely to remain below historic peaks.