Savers stung by falling rates, despite no likely RBA cut: RateCity

Saving rates have continued to plunge even though the Reserve Bank isn’t expected to cut the cash rate today, says Australian financial comparison website RateCity.

RateCity analysis shows that more than 40 banks cut saving account rates, including CBA, NAB, Macquarie Bank and AMP.

Average ongoing saving rates now sit at 0.59 per cent.

Research director Sally Tindall says complacent savers are earning next to nothing in this low rate environment.

“Seventy-six per cent of all household deposits are held by the big four banks, yet they’re the ones offering some of the lowest ongoing savings rates on the market.”

Westpac is the only big bank bucking the trend, offering an impressive 3 per cent rate for customers aged 18 to 29.

At the same time interest rates have continued to fall, deposits have hit an all-time high, according to the latest APRA statistics.

This means banks don’t need to attract new savers, Tindall says.

“They can’t even afford to offer respectable returns to the customers they’ve got.”

Just last week, Macquarie Bank slashed its introductory rate by 0.50 per cent to 1.50 per cent while AMP terminated its welcome rate altogether.

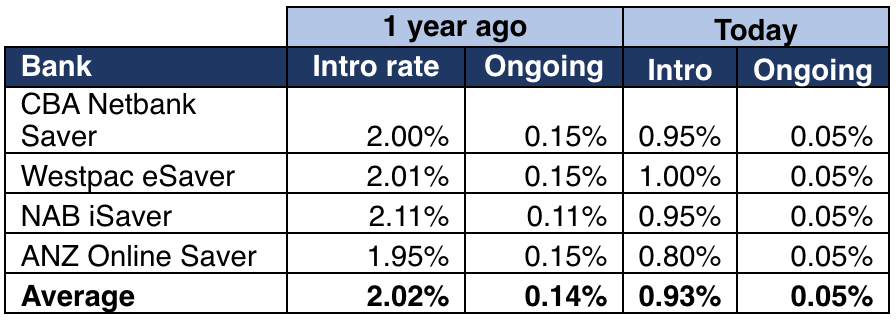

Introductory rates across the big four banks have dropped by an average of 1.12 per cent while the ongoing savings rate has dropped by 0.09 per cent.

The average cash rate has dropped by 0.75 per cent in the last year for the big four, while the conditional savings rate has dropped to 0.92 per cent.