Mortgage approvals jumped to pre-COVID levels in July

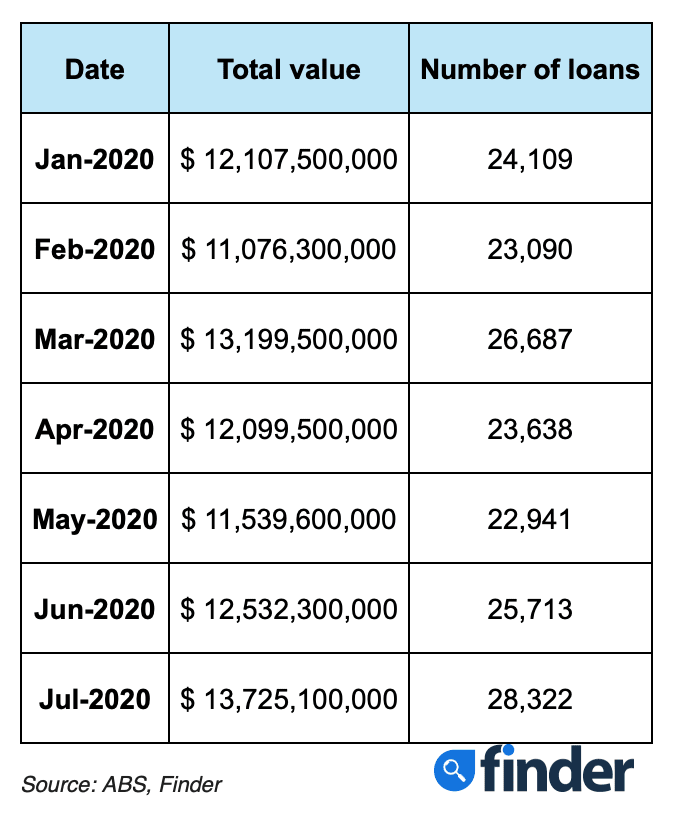

Mortgage approvals jumped over 10 per cent over July to bounce back to pre-pandemic levels, recent statistics from the ABS found.

The number of mortgages approved rose from 25,713 in June to 28,322 in July, the largest monthly increase since COVID started to impact Australia.

There was a $1.2 billion spike between June and July for owner occupier property purchases, with 59 per cent of Australia believing now is a good time to buy property, finder.com.au research suggests.

Finder's insights manager Graham Cooke said the figures signal fresh energy in the housing market.

“Judging by the surge in activity, plenty of Aussies are fired up about property again", Cooke said.

“The housing market is also benefiting from the pent-up demand released with the restarting of auctions and inspections in several places.

“The full economic impact of COVID-19 has yet to be realised, but Aussies are unshakable in their love of housing,” he said.

Finder's research shows 11,018 first home buyers have got a foot in the property market in July, 20 per cent more than May.