If you are thinking of fixing your mortgage, now could be the time: Xavier Perronnet

Earlier this month, the big four banks gave their predictions on the official cash rate’s likely movements over the next year. Although none of them predicted an increase, the figures were startlingly different.

NAB: No change

Commonwealth: -0.25 percentage points

ANZ: -0.5 percentage points

Westpac: -0.75 percentage points

The big four’s predictions varied by three quarters of a percentage point – demonstrating that even chief economists, who are highly knowledgeable about and attuned to interest rate cycles, are really only making an educated guess.

Small wonder that most home buyers and investors are confused about interest rate movements. It doesn’t help, of course, that most people decide to choose or switch to a fixed rate based on commentary about likely variable rate movements.

The fixed-rate interest cycle always runs about six months ahead of variable-rate interest cycle. That’s why, even though the big four’s recent variable rate predictions differed wildly, their fixed rates are almost identical. Their current three-year fixed rates range from 5.59% to 5.64% – hardly a piece of paper between them.

Fear and greed: the sure routes to poor decision-making

History tells us that when the variable rate is rising, a fear of further rate rises drives people to lock in their interest rates. By contrast, when the variable rate is falling, greed drives them to avoid locking in their interest rate. In both cases, they are motivated by a desire to get the timing exactly right.

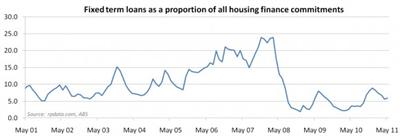

The following graph from RP Data shows the percentage of fixed term loans as a proportion of all home loans over the last 10 years.

The graph shows that in 2007, when the share market was booming and interest rates were at 7%, around a quarter of all new loans were fixed. Because a fixed interest rate is essentially a hedge against future variable interest rate rises, most people would have fixed their home loan at this time based on a fear that variable rates would keep rising.

By contrast, in 2009, when the cash rate was down at 3%, less than 5% of new loans were fixed. Based on a desire to obtain the lowest possible variable rate, the other 95% would have waited until they believed variable rates had hit bottom before making a decision about fixing their loans.

Fixed rate cycle set to bottom out

Home buyers and investors who wait to fix their loan until the variable rate bottoms out will always be around six months behind the fixed interest rate cycle – meaning they will never fix at the most advantageous time.

The current standard variable rate home loan for all the major banks is around 6.9%, and most home loans include a 0.7 percentage point discount off the standard variable rate. This means most people are on a variable rate of 6.2%.

Even if the Reserve Bank cuts the cash rate by the most bullish prediction of 0.75 percentage points over the next year, and even if all the banks pass on the rate cut in full (which, on recent form, isn’t likely), this will only bring retail variable rates down to a similar level as the current three-year fixed rate.

What's more, the best fixed rate of any major lender in the downwards phase of the last fixed rate cycle was around 4.99%; and that offer only lasted a couple of weeks. There is no doubt that we are very close to the bottom of the current fixed rate cycle. Historically speaking, this means the current three-year fixed rates are extremely good value.

The bottom line?

Any decision about whether or not to fix your interest rate should always be guided by your individual circumstances. However no one, not even the big four’s chief economists, ever knows for sure what will happen to the variable interest rate. If it is right for you and you lock in now, you can be sure you are not making a big mistake.

Yes, lenders may put slightly better offers on the table over the next six months, but that won't mean you've made a blunder. You might not have gotten it 100% right, but you might have gotten 90% right — and as Warren Buffett says, I'd rather be vaguely right than precisely wrong!

Xavier Perronnet is a director of iProperty Plan, which provides independent analysis and tailored advice to investors and home buyers.