Consumers upbeat, Reserve Bank watchful: CommSec's Craig James

GUEST OBSERVER

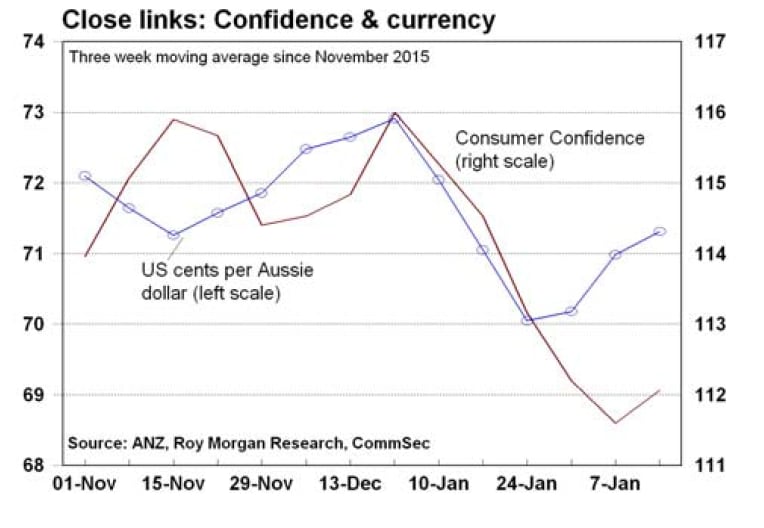

The weekly ANZ/Roy Morgan consumer confidence rating rose by 2.2 points (2.0 per cent) to 113.6 in the week to February 14. Confidence is up 3.5 per cent over the year and above the average of 111.4 since 2014. None of the five components of the index fell in the latest week.

Lending: Total new loans (personal, business, housing & lease) fell by 4.0 per cent in December from 7ó- year highs. Total lending is up by 6.9 per cent on a year ago.

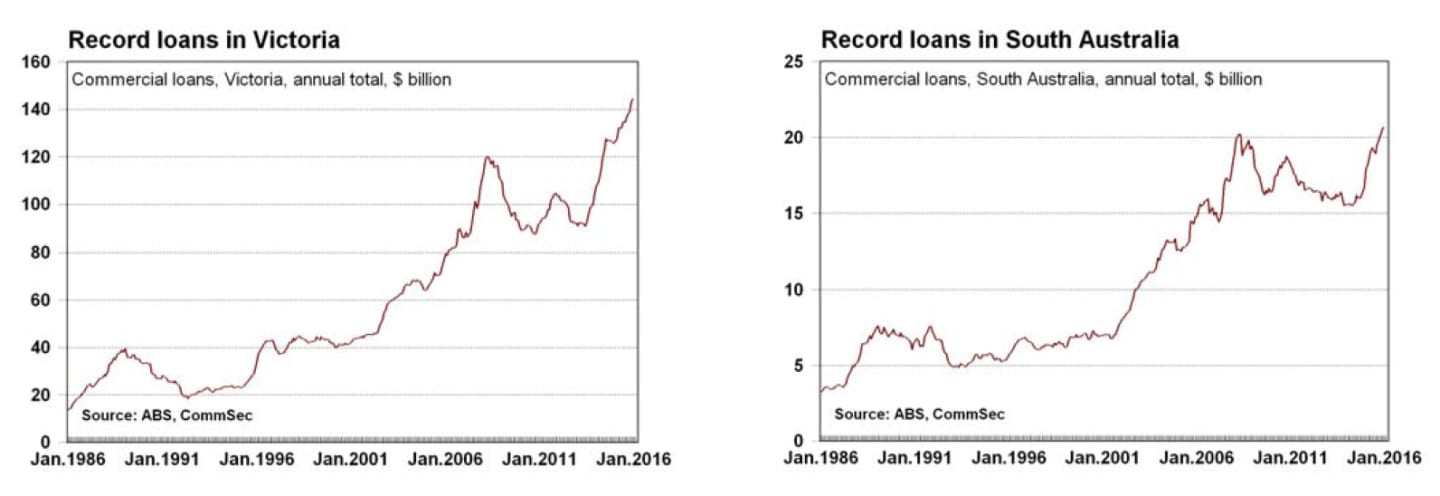

Record business lending: In 2015, new commercial loans hit record highs in both Victoria and South Australia.

Reserve Bank Board upbeat on economy: “Members noted that recent domestic data had, on balance, been positive and judged that there were reasonable prospects for growth to increase gradually over the forecast period”.

The lending and consumer confidence figures have implications for finance providers, retailers, and companies dependent on consumer and business spending. The RBA Board minutes provides insights on the interest rate outlook.

What does it all mean?

The Aussie dollar is holding near US71-72 cents; unemployment is at 2-year lows; interest rates are stable; and petrol prices are low. So what’s not to like? Sure the sharemarket has been volatile, but Aussie consumers seem resigned to the fact that is a “normal” situation. And they are looking through the volatility, realising that our economy is in good shape.

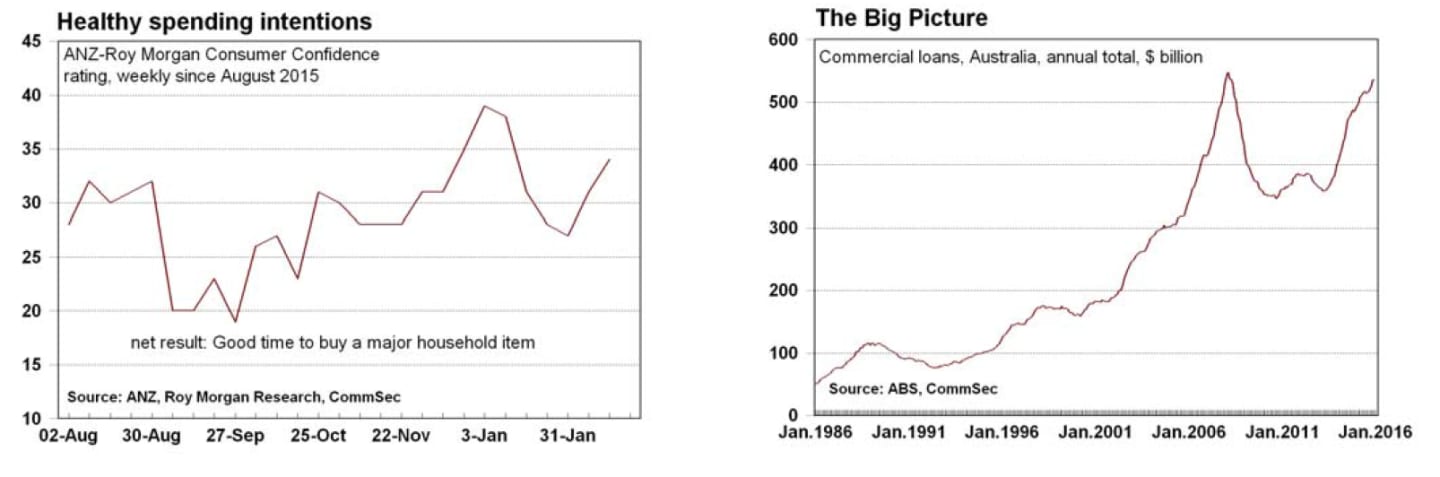

The good news for retailers is that consumers continue to believe it is a good time to buy a car, fridge, washing machine or television. Certainly retailers don’t seem to be in a rush to lift prices, so affordability is good.

Discussion about changes to negative gearing wouldn’t have influenced confidence levels for the simple reason that few would be affected by the changes – the proposals largely applying to high income earners with large property holdings.

There were no surprises in the Reserve Bank Board minutes. Of course in recent weeks there has been the interest rate decision, Statement on Monetary Policy and testimony from the Reserve Bank Governor.

The Reserve Bank is closely watching for signs of oversupply in the housing market, but it’s a case of so far, so good.

Businesses are borrowing; you just need to dig for the detail. In 2015, business lending was at record highs in South Australia and Victoria. Lending in NSW was at 7ó year highs. But lending in Western Australia was at 15-month lows.

What do the figures show?

Consumer confidence

The weekly ANZ/Roy Morgan consumer confidence rating rose by 2.2 points (2.0 per cent) to 113.6 in the week to February 14. Confidence is up 3.5 per cent over the year and above the average of 111.4 since 2014.

None of the five components of the index fell in the latest week:

The estimate of family finances compared with a year ago was up from +6 to +7;

The estimate of family finances over the next year was steady at +26 points;

Economic conditions over the next 12 months was up from -11 to -6;

Economic conditions over the next 5 years was up from +5 to +7;

The measure of whether it was a good time to buy a major household item was up from +31 points to +34 points.

Lending finance

Total new loans (personal, business, housing & lease) fell by 4.0 per cent in December from 7ó-year high.

Lending has followed a zig-zag course over the last five months. Total lending is up 6.9 per cent on a year ago.

Housing finance: The seasonally adjusted measure of construction and new purchases rose by 0.9 per cent in December while alterations & additions rose by 0.8 per cent. Home loans are up 21.4 per cent on a year.

Commercial finance: The seasonally adjusted series for the value of total commercial finance commitments fell by 7.3 per cent in December after rising by 0.9 per cent in November. Revolving credit commitments fell by 18.3 per cent (+20.9 per cent in November). Fixed lending commitments fell by 3.3 per cent – the third straight decline.

Business loans are up 1.7 per cent over the year.

Over the year to December, total business lending was $535.2 billion, up 9.6 per cent over the year. Lending in South Australia rose by 23.5 per cent followed by Victoria (up 14.9 per cent), Queensland (up 12.3 per cent), NSW (up 9.9 per cent) and Western Australia (down 5.0 per cent). No consistent data was available for other states and territories.

Personal finance: The seasonally adjusted series for the value of total personal finance commitments rose by 2.1 per cent in December after lifting by 1.4 per cent in November. Revolving credit commitments rose by 1.5 per cent and fixed lending commitments rose by 2.6 per cent. Personal loans are down 1.6 per cent over the year.

Within personal fixed finance commitments, loans for new cars were up 9.6 per cent on a year earlier while loans for used cars were down by 1.2 per cent. Loans for residential blocks of land were up by 5.3 per cent on a year ago – the first rise in 14 months.

Lease finance: Lending rose by 1.7 per cent in December. Lease finance rose by 36.9 per cent over the year.

The key quotes from the Board minutes:

Stronger growth expected: “Overall, members noted that recent domestic data had, on balance, been positive and judged that there were reasonable prospects for growth to increase gradually over the forecast period.”

Job market: “Employment growth over 2015 had been stronger than earlier expected and the starting point for the forecast for the unemployment rate was around ó percentage point lower.

Bank funding costs: “Funding costs for Australian banks had increased a little from their low levels recently, reflecting higher short-term wholesale funding costs both in offshore and domestic markets. The cost of new long-term wholesale funding had also increased, but remained below the cost of maturing debt. Members noted that an important issue was the extent to which higher wholesale funding costs led to a rise in deposit rates.”

Services sector: “Output growth in the services sector, particularly household services, had been strong.”

Housing: “Information from liaison contacts indicated that demand for high-density housing in Sydney, Melbourne and Brisbane had been sufficient to absorb the increase in the supply that had come onto the market, whereas demand had been somewhat weaker in Perth, which had experienced a decline in prices and rents for apartments over the past year.”

Housing: “To date, there had not been any substantive signs of financial distress from developers, but there had been an increasing number of projects put on hold, particularly in areas where there were concerns about potential oversupply.”

What is the importance of the economic data?

The ANZ/Roy Morgan weekly survey of consumer confidence closely tracks the monthly Westpac/Melbourne

Institute consumer sentiment index but the former measure is a timelier assessment of consumer attitudes and is now closely tracked by the Reserve Bank.

Lending Finance is released monthly by the Bureau of Statistics and contains figures on new housing, personal, commercial and lease finance commitments. The importance of the data lies in what it reveals about the appropriateness of interest rate settings, confidence and spending levels in the economy.

The Reserve Bank releases minutes of its monthly Board meeting a fortnight after the event. The minutes give a guide to Reserve Bank thinking on interest rate settings.

What are the implications for interest rates and investors?

Businesses are borrowing with lending in 2015 not far off the record high set in the mining construction boom era.

Businesses are quietly going about their business, thus raising questions about whether investment is higher than analysts suspect.

The Reserve Bank is showing no inclination of acting on its ‘easing bias’ any time soon.

Craig James is the chief economist at CommSec.