Commonwealth Bank reports $1.9 billion quarterly profit but with higher Bankwest home loan arrears rates

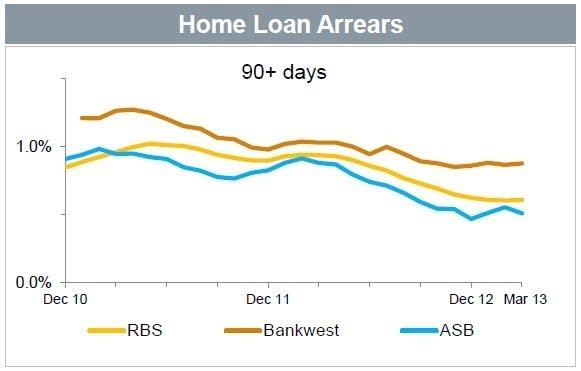

Bankwest has a distinctly higher proportion of borrowers three months or more behind on their mortgage repayments than parent company the Commonwealth Bank and fellow subsidiary, the New Zealand ASB bank, according to Commonwealth Bank's March quarter update.

The results reveal that the Commonwealth Bank reported unaudited cash earnings for the three months ended 31 March 2013 of $1.9 billion.

Statutory net profit over the period was also $1.9 billion.

The Commonwealth Bank reported that “system home loan credit growth remained modest through the March quarter, with the Group growing slightly ahead of system”.

Total impairment expense was $255 million in the quarter, or 19 basis points of total average loans, but with a higher impairment contribution from Bankwest, acquired by the Commonwealth Bank in October 2008.

The graph below shows the percentage of home loans in the three banking divisions more than three months in arrears with ‘RBS’ referring to the Commonwealth Bank’s retail banking services division.

The bank grew its household deposits above system growth with deposit margins remaining “under pressure in a competitive market”.