Banks earning less - just $1.2 billion in mortgage fees in 2012: RBA paper

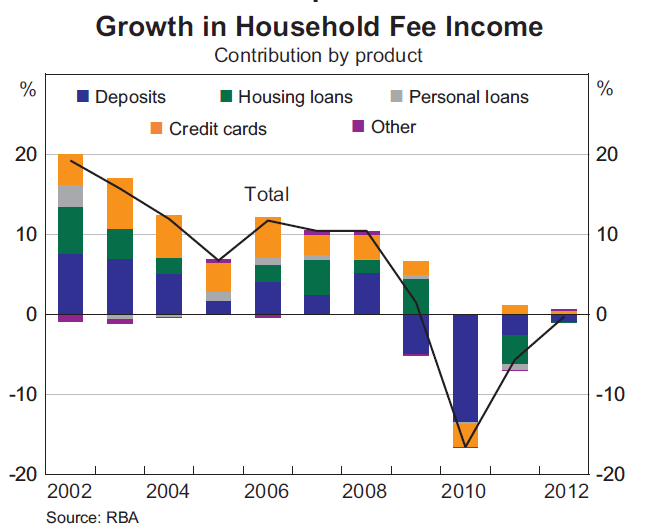

There was a small decline in mortgage fees earned by banks over 2012 compared with a rise of 6.5% from 2006 to 2011 a new RBA paper shows.

Banks earned $1.218 billion in mortgage fees in 2012 compare with $1.222 billion in 2011 and $1.377 billion in 2010, according to a paper by Jessica Pratten from the RBA’s Domestic Markets Department.

Mortgage fees were second only to credit card fees ($1.312 billion) and deposit fees ($1.105 billion) earned by banks over 2012.

Pratten notes that the slight decline in housing loan fee income occurred despite the 5% increase in mortgage lending over the year.

“This divergence partly reflected the decision by a number of banks to waive application and other fees.

“It also resulted from a continued fall in exit fee income following the Federal Government’s ban on exit fees on variable rate home loans in July 2011.

“In the lead-up to the ban there had been speculation that lenders would increase other fees to compensate for the potential loss of income.

“However, average fees (excluding exit fees) charged on variable rate mortgages discharged after three years have declined slightly for both bank and non-bank lenders since the ban was implemented," she says.