Baby boom; Healthcare leads hiring: CommSec's Savanth Sebastian

GUEST OBSERVER

Population growth is bouncing of the slowest annual pace in almost 10 years.

If population is growing near 1.3 percent, we will need productivity growth near 1.7 percent to maintain the “speed limit” of the economy at 3 per cent. As the Reserve Bank has intimated, the speed limit of the economy has probably come down to a rate closer to 2.75 per cent.

Victoria is still the population leader. You have to go back to 1888 to find a time when Victoria held the position of the state with the fastest population growth. In fact population in Victoria is growing at the fastest pace in six years. In comparison Western Australia and South Australia have the weakest annual population growth rates in 12 and 11 years respectively. A result that resonates with the slowdown and weakness in the driven mining states. Only NSW and Victoria now have an annual population growth rate above long-term averages – important in absorbing the record amount of homes being built.

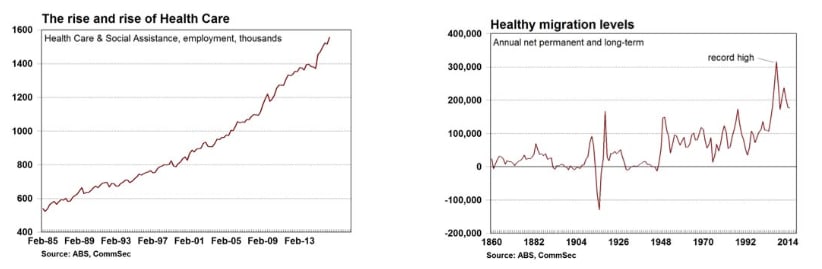

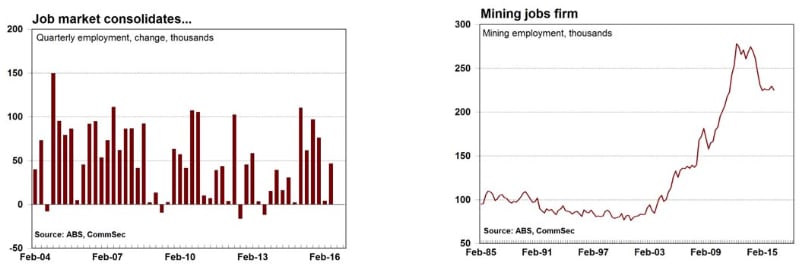

It is clear the labour market was the stellar performer over 2015. But there have been a number of signs that employment growth is now in the midst of a consolidation. Job advertisements have shown signs of consolidating in the past couple of months while the monthly employment statistics suggest employment growth has softened. Interestingly the data by industry provides a telling breakdown about where the jobs are being created. Over the three months to May employment grew by almost 47,000. Overall 10 of the 19 industry sectors recorded job gains in the past three months, with the hiring dominated by Healthcare & social assistance, Wholesale trade and Accommodation & food services.

Overall the labour market remains relatively upbeat. The lift in consumer confidence and business conditions should boost spending, investment and employment once the election is out of the way – a result that should see the jobless rate trend lower to 5.5 per cent by the end of this year.

Healthcare remains the biggest employer and was also the biggest job creator over the past year. Interestingly Finance & insurance, Construction and Retail were amongst the major employers over the past year – a result that resonates with the lift in activity across the economy.

What does the data show?

Industry employment:

Employment rose by 46,700 over the three months to May after a gain of 4,000 in the previous three months.

Over the past year employment lifted by 224,000 well above the decade average of 190,600.

Employment rose in 10 of the 19 industry sectors. Employment rose most in Health Care and Social Assistance (up 40,700), followed by Accommodation and Food Services (up 20,100) and Wholesale trade (up 17,500).

In the quarter, the number of jobs fell the most in Professional, Scientific and Technical Services (down 34,800), followed by Retail Trade (down 21,900), and Administrative and Support Services (down 18,800).

Healthcare remains the biggest employer with 1.6 million employees (13 per cent of the total) followed by Retail Trade (1.3 million jobs or 10.5 per cent) and Construction (1.08 million or 9.1 per cent).

Population Statistics:

Australia’s population expanded by 326,100 people over the year to December 2015 to 23,940,300 people.

Overall, Australia’s population growth rate rose from a 10-year low of 1.36 per cent to 1.38 per cent.

Australia’s population grew by just 71,300 people over the December quarter – the weakest quarterly result in 41⁄2-years.

A total of 177,000 people migrated to Australia over year to December, well down on the 315,700 peak migrants in the year to December 2008.

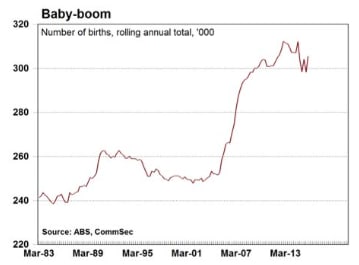

There were 305,300 babies born in the past year, just shy of the record 312,200 births in the year to December 2012.

Over the past year population growth was the strongest in Victoria (1.87 per cent – the fastest growth in 6 years), followed by NSW (1.40 per cent), the ACT (1.36 per cent), Queensland (1.26 per cent), Western Australia (1.20 per cent – weakest in almost 13 years), South Australia (0.66 per cent –weakest in 11 years), Tasmania (0.41 per cent) and the Northern Territory (0.35 per cent).

Population growth is above decade averages in NSW (7 per cent) and Victoria (5.6 per cent).

What is the importance of the report?

Demographic Statistics are issued by the Bureau of Statistics each quarter. The figures include estimates of births, deaths, in-bound and out-bound migration movements and estimates of population change by State.

The Australian Bureau of Statistics (ABS) provides detailed labour market figures one week after releasing ‘top level’ statistics of employment & unemployment levels across states and territories. The detailed data is useful in identifying broader underlying trends and instructive about the health of the economy.

What are the implications for interest rates and investors?

The latest data has few implications for interest rate settings. But if population growth remains soft, the Reserve Bank may need to make further adjustments to economic growth assumptions.

CommSec expects the Reserve Bank to cut interest rates again in August.

Savanth Sebastian is an economist for CommSec.