Australian banks way ahead of global rivals on property market exposure: Moody's

Don't ever expect Australian banks to ever talk down the property market.

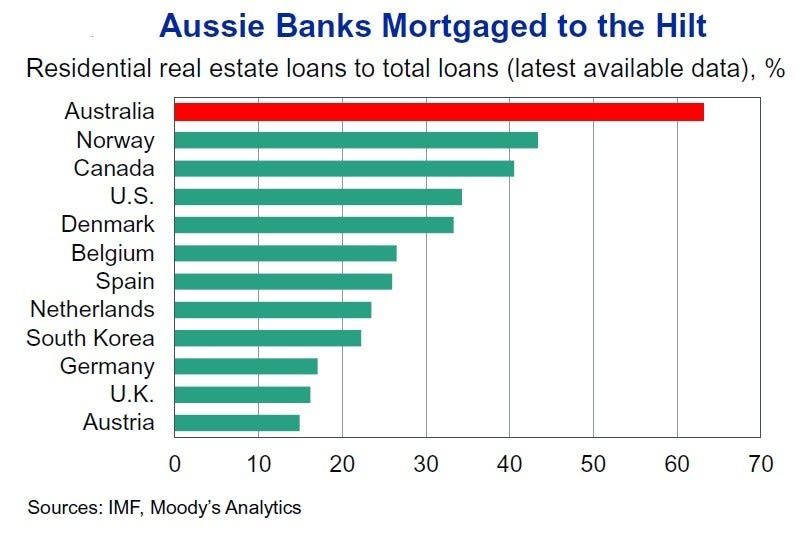

The following graph, prepared as part of a report by Tony Hughes, managing director of Moody's Analytics, shows the degree to which Australian banks are leveraged to the property market compared with other countries.

As can be clearly seen, Australian banks have almost two-thirds of their lending tied to the residential property market, compared with just over 40% in Canada, 35% in the US and less than 20% in Germany and the UK.

"The high degree of exposure to the domestic mortgage market raises many concerns," writes Hughes.

"Recent experience has shown that house prices can fall significantly and trigger serious banking meltdowns.

"But what are the chances of a similar housing collapse in Australia?

"Many international analysts think the chances of an antipodean housing bust are quite high—it would take a bold economist who has been in a decade-long coma to declare that an Australian housing correction was impossible. When trends in Australian house prices are compared globally, the signs look worrying.

"House prices have increased for longer and faster than in many of the markets where prices cratered during the Great Recession," he says.