Investor loans soar, inflation makes a comeback: CommSec's Savanth Sebastian

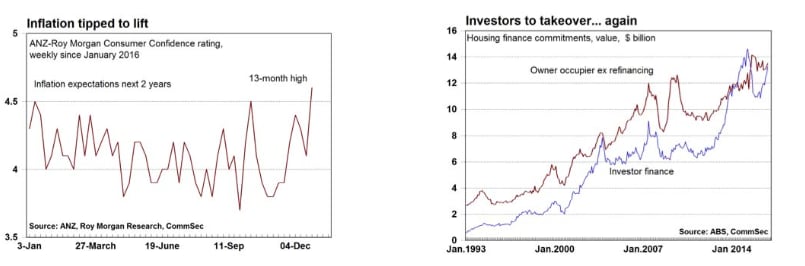

The ANZ/Roy Morgan consumer confidence rating eased from four-month highs, falling by 0.7 per cent to 119.3 in the week to January 15. Confidence is up 4.6 per cent over the year and well above the average of 113.1 since 2014.

The inflation expectation 2 years ahead was at 4.6 per cent, a 13-month high. Inflation expectations has now held above 4 per cent for the past 5 months.

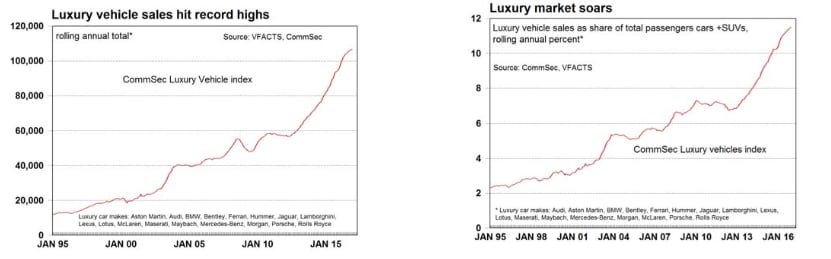

The Bureau of Statistics (ABS) reported that new vehicle sales rose by 0.3 per cent in December. The CommSec Luxury Vehicle index hit record highs in 2016 with sales of 17 luxury marques up 12.1 percent on a year ago.

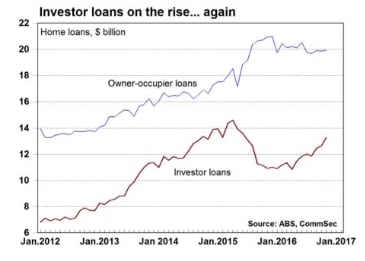

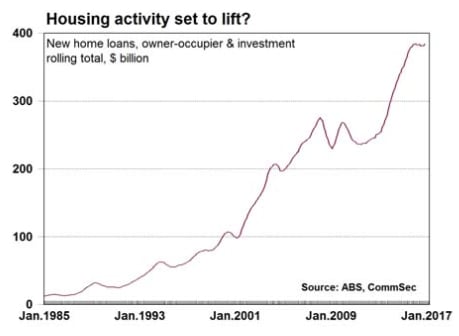

On its own, the lift in home loans doesn’t look overly concerning – especially given it was only the second rise in the past five months. But couple it with the lift in home prices in the latter part of last year and it suggests that the housing landscape may continue to cause policymakers a little bit of angst over 2017. Even more so when you delve a bit deeper into the data and realise that the lift in the value of loans was largely driven by investors.

The value of loans by investors surged by 4.9 per cent in November to be up 21.4 over the year – the strongest annual growth in 19 months.

If home prices continue to lift, with growth largely driven by investor loans, regulators may look at further restrictions to curb lending.

Household confidence remains just shy of recent four month highs. And more importantly confidence is holding well above longer-term averages. In particular, the measure of whether it was a good time to buy a major household item lifted to the highest levels in five months. No doubt the discounts offered by retailers post-Christmas are enticing households to spend a little bit more freely.

Interestingly the inflation expectation 2 years ahead was at 4.6 per cent in the past week - a 13-month high. Inflation expectations have now held above 4 per cent for the past 5 months. There is no doubt that inflationary pressures have bottomed out and are likely to start lifting.

Annual new vehicle sales are just shy of recent record highs, suggestive of underlying strength in business and consumer sentiment and finances. But the trends aren’t uniform with sales of sports utility vehicles consistently setting new highs while passenger car sales have now fallen to 20- year lows in rolling annual terms.

- The number of new home loans was down by 2.6 per cent on a year ago.

- Loans by owner-occupiers for the construction of homes rose by 2.3 per cent in November.

- Loans to buy newly-erected dwellings rose by 3.3 per cent.

- Loans for the purchase of established dwellings (excluding refinancing) rose by 2.0 per cent.

- The number of refinancing transactions fell by 1.2 per cent.

Lending across states/territories in November: NSW (+1.5 per cent); Victoria (+0.8 per cent); Queensland (+2.4 per cent); South Australia (-1.3 per cent), Western Australia (-0.7 per cent); Tasmania (-1.0 per cent); Northern Territory (+2.7 per cent); ACT (+0.2 per cent).

Housing finance - value

The value of new housing commitments (owner occupier and investment) rose by 2.2 per cent in November after rising by 0.5 per cent in October. Owner-occupier loans rose by 0.4 per cent but investment loans rose by 4.9 per cent.The value of loans by owner-occupiers and investors to build new homes rose by 14.2 per cent in November after falling by 1.7 per cent in October. The value of loans to build new homes rose to an 8-month high of $3.07 billion in November.

Housing finance – other statistics

The proportion of first-time buyers in the home loan market rose from 13.7 per cent to 13.8 per cent in November (long-term average 19.4 per cent).

The proportion of fixed rate loans eased from 12.8 per cent to 12.5 per cent in November. And the average home loan across Australia stood at $376,600 in November, up 3.6 per cent in the month but down 1.6 per cent on a year ago.

Consumer confidence

The ANZ/Roy Morgan consumer confidence rating eased from four-month highs, falling by 0.7 per cent to 119.3 in the week to January 15. Confidence is up 4.6 per cent over the year and well above the average of 113.1 since 2014. Two of the five components of the index rose in the latest week:

- The estimate of family finances compared with a year ago was down from +13 to +8;

- The estimate of family finances over the next year was down from +33 to +32;

- Economic conditions over the next 12 months was unchanged at +2;

- Economic conditions over the next 5 years was up from +11 to +12;

- The measure of whether it was a good time to buy a major household item was up from +41 to +43 – the strongest reading in 5 months.

In addition the inflation expectation 2 years ahead was at 4.6 per cent, a 13-month high. Inflation expectations has now held above 4 per cent for the past 5 months.

New car sales:

According to the Australian Bureau of Statistics (ABS) new vehicle sales rose by 0.3 per cent in December after falling by 0.7 per cent in November. Passenger car sales rose by 3.6 per cent, while sales of sports utility vehicles fell by 3.3 per cent and sales of “other” vehicles (includes utilities, panel vans, cab chassis, goods carrying vans, rigid trucks, prime movers, non-freight carrying trucks, and buses) rose by 0.7 per cent.New vehicles sales were up by 0.2 per cent over the year. Passenger car sales in December were down by 4.2 per cent over the year, while SUVs sales were unchanged and “other vehicles” were up by 10 per cent.

In rolling annual terms, 1,178,133 new vehicles were sold over the 2016 calendar year. Sales of SUVs (441,023) eased from record highs in annual terms, while annual sales of “other” vehicles stood at a record high of 250,853. Sales of passenger vehicles fell to a 20-year low of 486,257 in the year to December.

CommSec Luxury Vehicle index

The CommSec Luxury vehicle index hit record highs in 2016. Sales of 17 luxury marques totalled a record 106,658 units in 2016, up 12.1 per cent on a year ago. Luxury vehicles now account for 9.17 per cent of total vehicle sales and a record 11.50 per cent of passenger cars and SUVs alone.The CommSec Luxury vehicle index includes Audi, Aston Martin, BMW, Bentley, Ferrari, Hummer, Jaguar, Lamborghini, Lexus, Lotus, Maserati, Maybach, Mercedes-Benz, Mclaren, Porsche and Rolls Royce.

In 2016 record sales were recorded by Audi, BMW, Ferrari, Jaguar, Lamborghini and McLaren.

Luxury auto sales have been running at a double-digit annual rate for almost four years.

What is the importance of the economic data?

Housing Finance data is produced monthly by the Bureau of Statistics and shows commitments by lenders, such as banks, to provide finance for housing purposes. The lending figures relate to those looking to buy or build homes to live in as well as those seeking to buy or build homes for investment purposes. Generally people get their finance organised first, so the figures are regarded as a leading indicator on the housing market.

The ANZ/Roy Morgan weekly survey of consumer confidence closely tracks the monthly Westpac/Melbourne Institute consumer sentiment index but the former measure is a timelier assessment of consumer attitudes and is now closely tracked by the Reserve Bank.

The Australian Bureau of Statistics provides seasonally adjusted and trend estimates of industry data. The Federal Chamber of Automotive Industries releases estimates of car sales on the third business day of the month. The figures highlight the strength of consumer spending as well as conditions facing auto & components companies.

What are the implications for interest rates and investors?

Looking forward, policymakers will keep a close eye on how the rebalancing of the domestic economy (away from mining investment) is keeping pace. Inflation and housing activity are likely to be closely watched over 2017.

Savanth Sebastian is an economist for CommSec