Modest gain for housing key to holding down core inflation: Westpac's Justin Smirk

GUEST OBSERVER

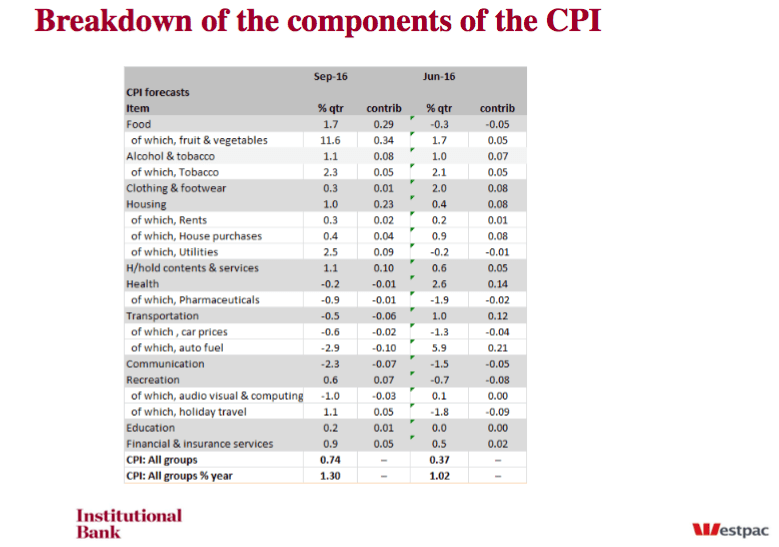

The Q3 CPI printed 0.7 percent compared to Westpac’s forecast for 0.9 percent. The market median was 0.5 percent. The annual rate is now 1.3 percent/yr compared to 1.0 percent/yr in Q2 and 1.3 percent/yr in Q1. The June quarter was the lowest rate of annual inflation since June 1999.

The core measures, which are seasonally adjusted and exclude extreme moves, rose 0.3 percent compared to the market’s expectation of 0.4 percent rise. Westpac’s forecast was also 0.4 percent. In the quarter, the trimmed mean gained 0.35 percent while the weighted median lifted 0.28 percent. The annual pace of the average of the core inflation measures is now 1.5 percent/yr from 1.6 percent/yr in Q2 (originally reported as 1.5 percent/yr) and Q1 (Q1 has been revised from an original estimate of 1.4 percent/yr).

The six month annualised pace of core inflation came in 1.7 percent/yr pace, a lift from 1.5 percent/yr in Q2 and the fifth quarter in a row it has been below the bottom of the target band; lowest six month annualised pace since the 1.3 percent/y print in March (a seventeen year low).

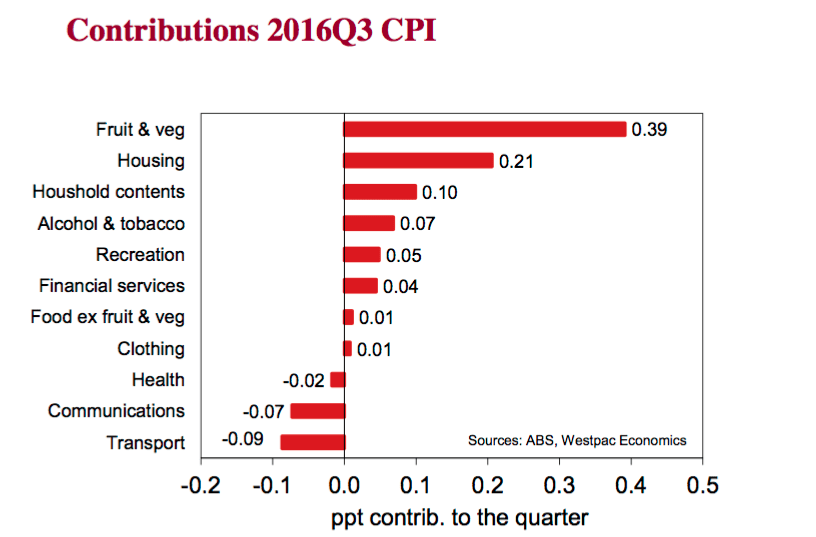

Our top of the market forecast was based on large contribution from fresh fruit & vegetables boosting a solid contribution from electricity bills. Fresh & fruit & vegetables rose as expected (11.6 percent) but total food was slightly softer at 1.7 percent (our forecast was 2.1 percent) due to softer prices elsewhere in this grouping. We suspect the ongoing competition from new entrants is keeping disinflationary pressure in this sector.

The lift in electricity bills was there but it was about half of what we had expected with utilities lifting 2.5 percent vs our expectation for 5.7 percent. Rents rose 0.3 percent (0.2 percent expected) while dwelling purchases lifted 0.4 v (as expected). All up housing rose 1.0 percent vs our expectation for 1.4 v (a 0.23ppt contribution vs 0.31ppt forecast).

Two areas of upside surprise were clothing and footwear (0.3 percent vs –0.1 percent expected) and household contents & services (1.1 percent vs 0.8 percent expected). While this is only a modest upside surprise it does suggest we are finally seeing some pass–through from the earlier devaluation of the AUD and higher raw input costs.

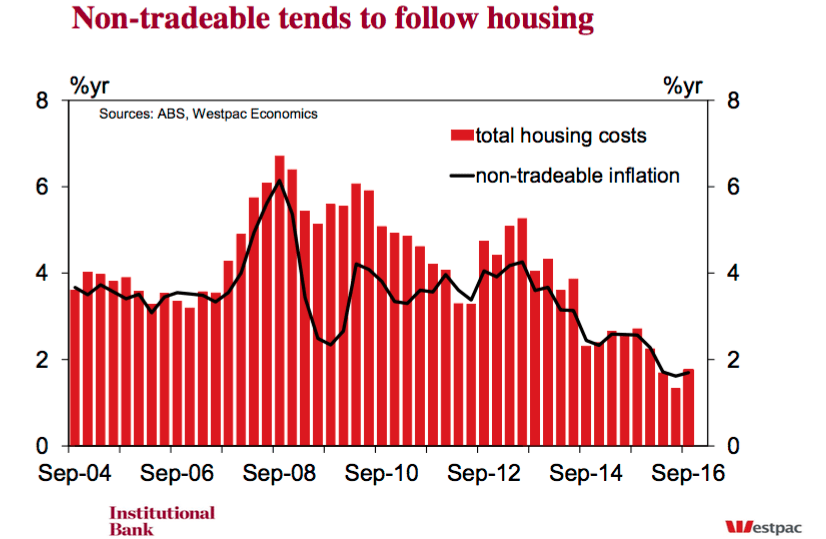

The modest gain for housing has been key to holding down core inflation. The large rise in electricity bills is trimmed out of the core measures while the subdued gains for dwellings and rents remain in. In the quarter dwelling price gains eased back in Sydney (0.5 percent from 1.5 percent in Q2 and 0.5 percent in Q1) as did Brisbane (0.4 percent from 0.9 percent in Q2 and 0.4 percent in Q1) while Melbourne has picked up the pace (0.8 percent from 0.9 percent in Q2 and 0.5 percent in Q1). Dwelling prices continue to decline in Perth falling 0.4 percent (from –0.1 percent in Q2 and –2.2 percent in Q1).

Non-traded prices rose 0.5 percent in Q3 from 0.4 percent in Q2 which has seen a modest lift in the annual pace to 1.7 percent/yr from 1.6 percent/yr. Given the lift in power bills that boosted this quarter result, and remembering that the September quarter get the usual seasonal boost from the annual repricing of administrated prices, then this is a subdued print.

Traded goods prices rose 1.0 percent/qrt following a 0.6 percent/qtr gain in Q2 and a very weak –1.4 percent in Q1. The September quarter saw something of a reversal for the auto fuel prices (–2.9 percent/qtr vs. +5.9 percent/qtr Q2 and –10% in Q1) while fresh fruit & vegetables build on the modest Q2 gains (11.6 percent compared to 1.7 percent Q2 and –4.3 percent in Q1). However, excluding fuel, food and tobacco traded goods lifted 0.6 percent which is a modest gain from run of softer numbers (–0.3 percent in Q2 and 0.1 percent in Q1). This left this ‘core’ measure of traded goods prices at a very modest 0.9 percent/yr.

So the September quarter was a mixed update with some softness continuing in the non-traded sector but signs of AUD (and rising input costs) inflationary pass-through to clothing & footwear as well as household contents & services. But offsetting this is the clear ongoing competition in the groceries space which is holding down food prices overall. So while we may argue we have seen the low point for core inflation, any acceleration from here is going to be a very mild one.

Justin Smirk is senior economist, Westpac Group and can be contacted here.