Chinese still coming but Melbourne and Brisbane inner city at risk of over supply: RBA monetary statement

The outlook for China’s growth is a significant uncertainty for the outlook for the Australian economy, according to the latest RBA statement on monetary policy issued this morning.

But in the period ahead, Australian dwelling investment seems likely to be supported by continued strong demand from foreign buyers, the central bank concludes.

Information from the bank’s liaison suggests that foreign buyers tend to have long-term motivations for investment and may be relatively unconcerned about temporary fluctuations in housing price growth.

The statement then adds population growth, employment prospects and expectations for future housing price growth are likely to be the most important considerations for domestic buyers.

"Some geographic areas appear to be at risk of reaching a point of oversupply, particularly the inner-city areas of Melbourne and Brisbane."

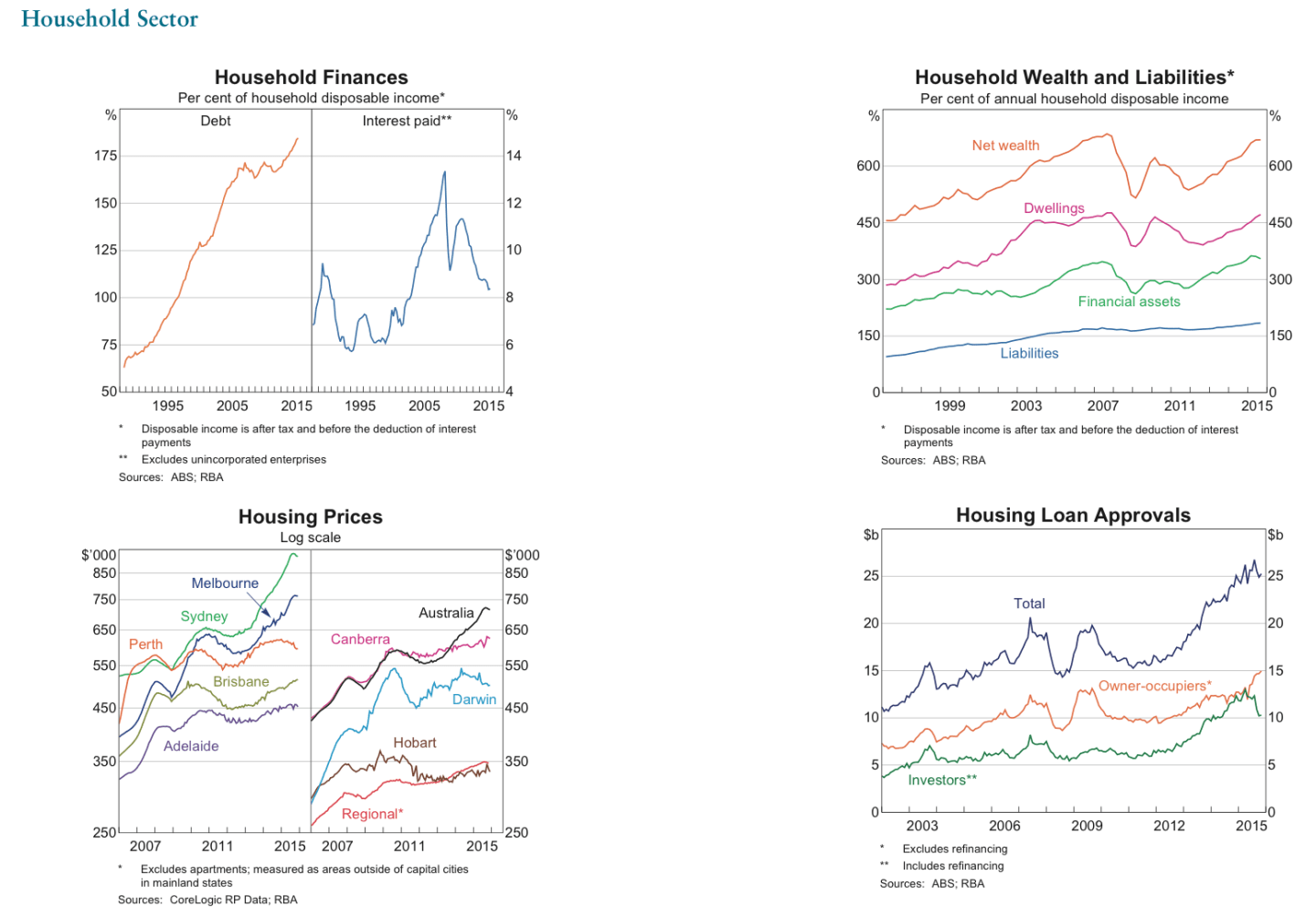

It also noted conditions in the established housing market have eased in recent months.

"National housing prices have declined slightly from their September 2015 peak, following strong growth earlier in 2015.

"Auction clearance rates, which are another timely gauge of housing market conditions, have also declined from very high levels to be around their long-run averages.

"However, some other indicators – including turnover rates, days on market and the eventual discount on vendor asking prices – have been little changed.

"The easing in housing market conditions has been most pronounced for detached houses in Sydney and Melbourne, where earlier price growth had been strongest, and in Perth, where prices have been declining since early 2015."

It noted growth of national apartment prices had been noticeably slower than that of detached housing prices, reflecting large increases in higher-density housing supply over recent years, especially in Melbourne.

"The increase in supply over recent years, partly in response to strong investor demand, has been associated with a gradual increase in the nationwide rental vacancy rate.

"Rental yields remain low by historical standards.

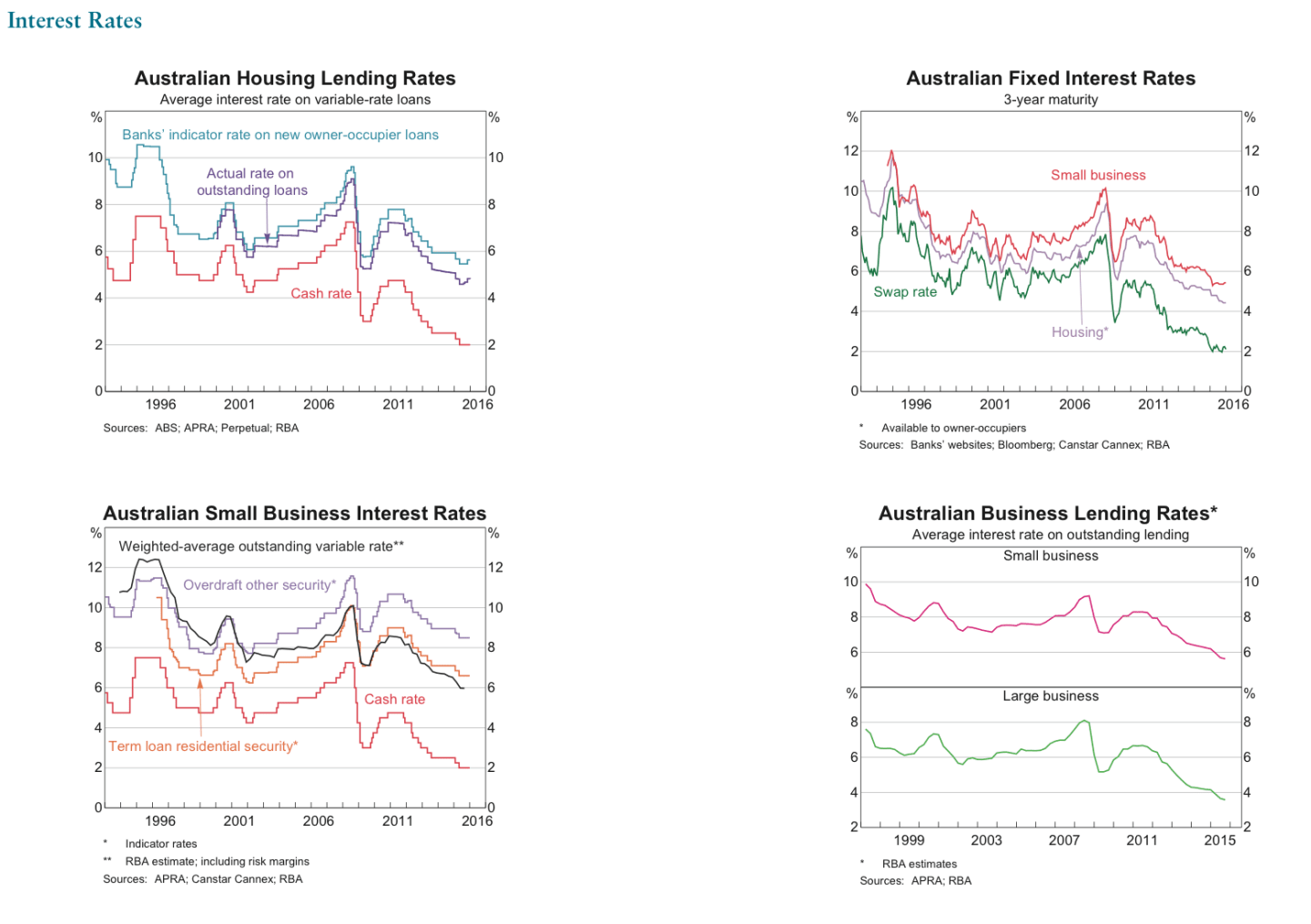

"Dwelling investment grew strongly over the year to the September quarter, supported by low interest rates and the significant increase in housing prices over the past several years."

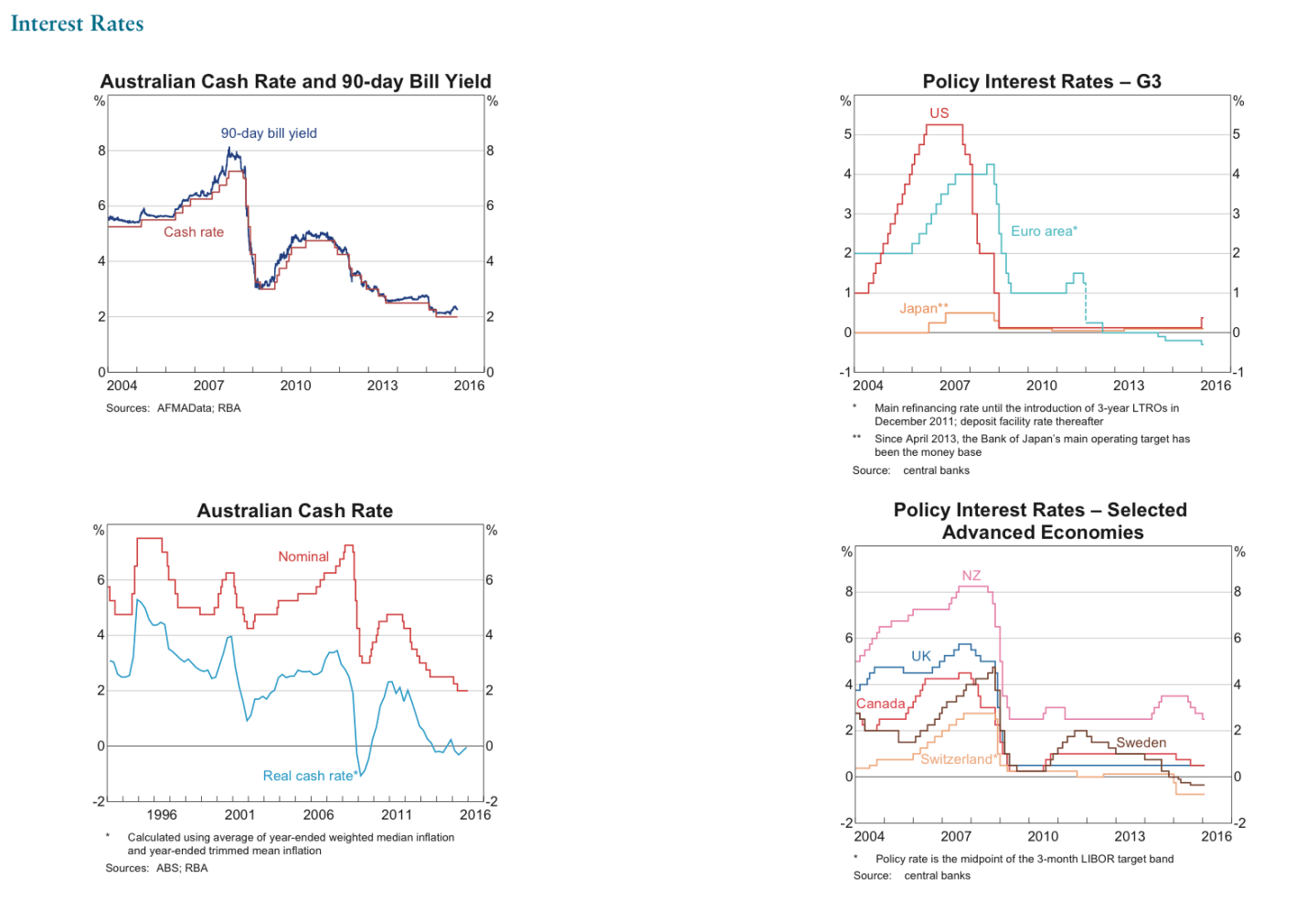

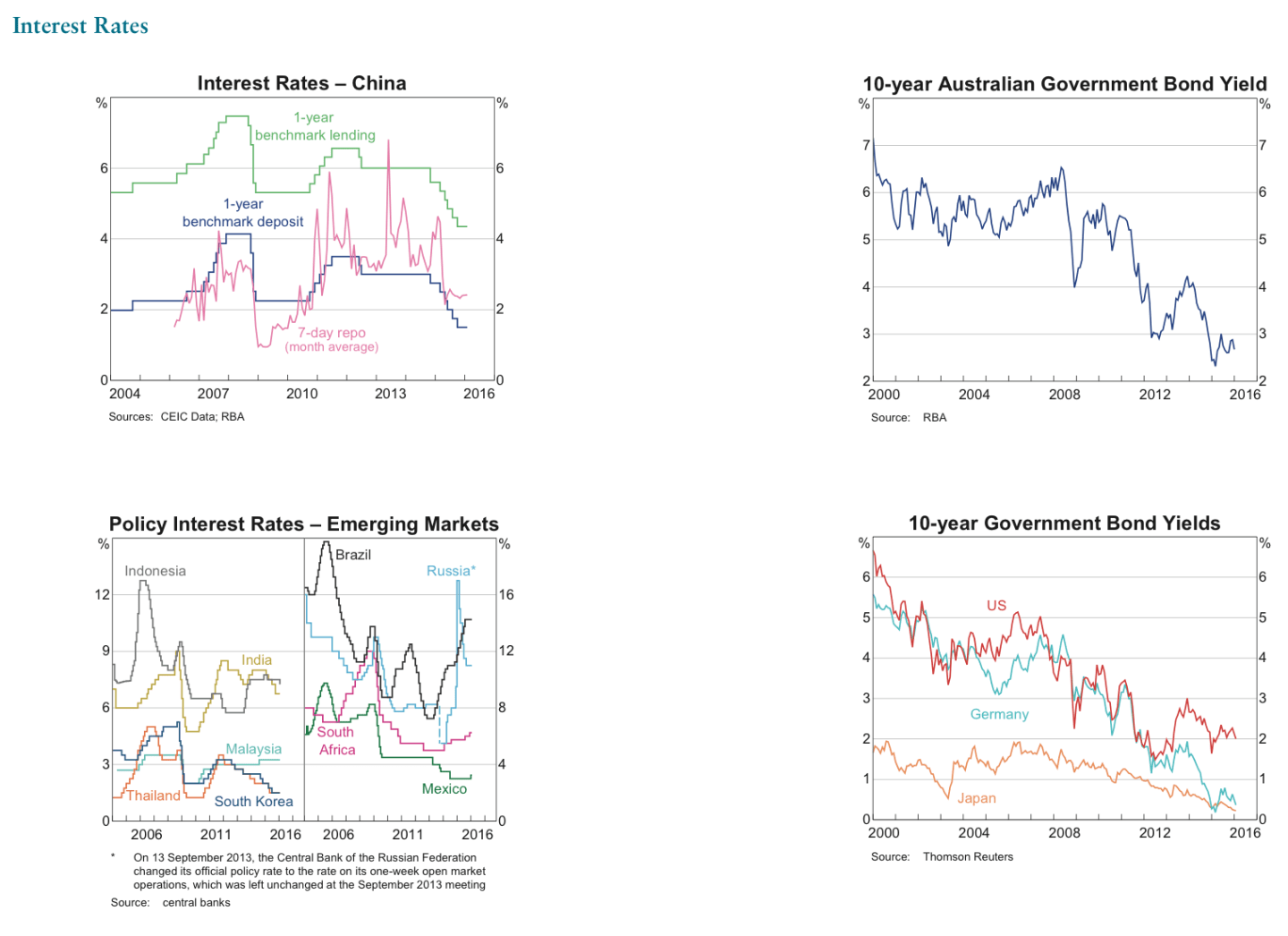

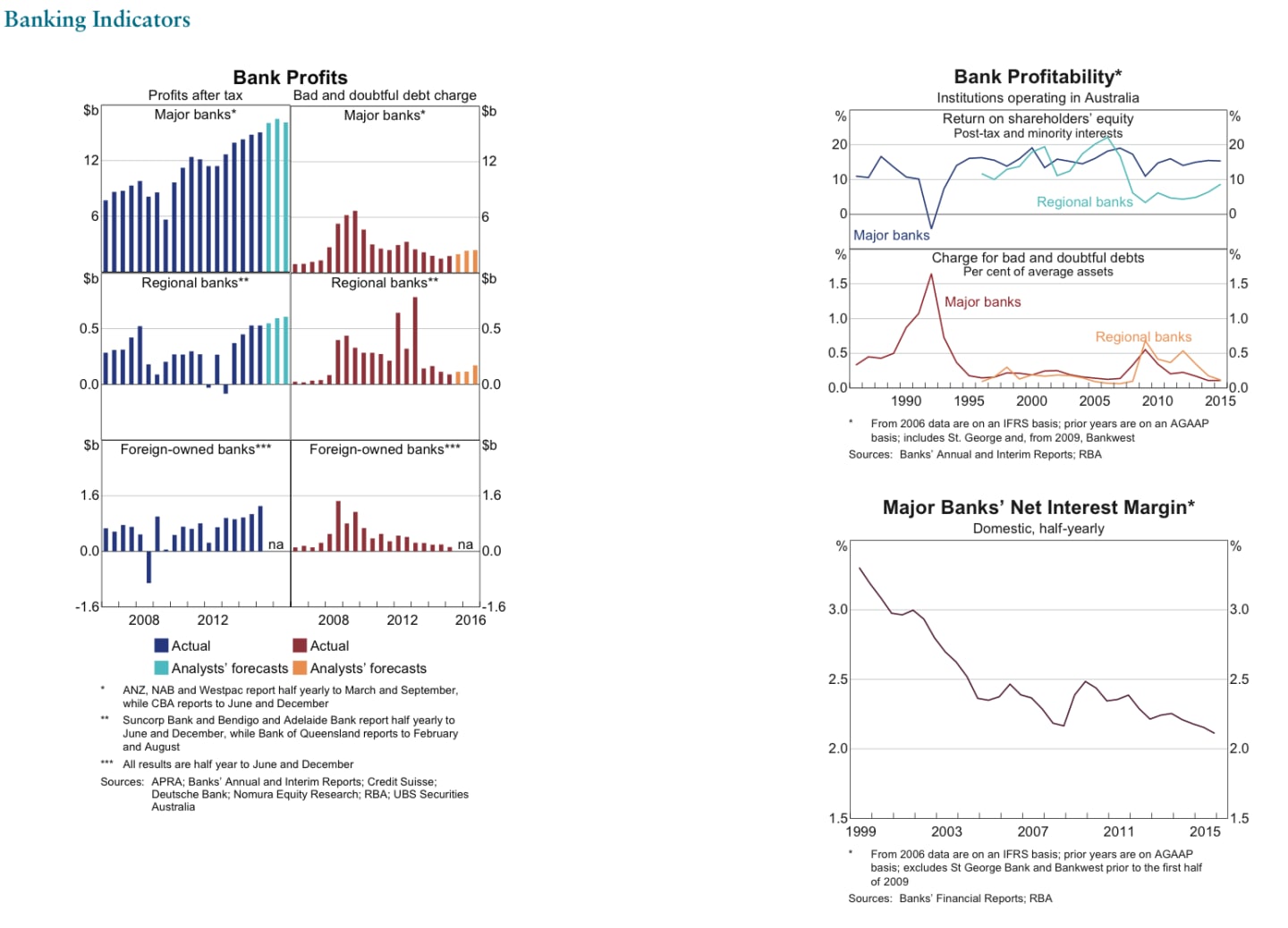

The RBA has also released its Chart Pack that summarises macroeconomic and financial market trends in Australia.

To view the RBA's Statement on Monetary Policy, February 2016, click here.