An interesting take on APRA’s directives: Jason Khoury

In an interesting take on APRA’s directives, the banks are pricing investment loans to be more expensive than ’owner-occupied’ home loans, for new and existing home loans.

There may be some contention as to what category your loan falls under. Did you borrow against your home to invest ? How about if only 50% of your loan relates to an investment property? What if your home and your investment property were cross-collateralised?

With this interest rate disparity, it’s ever more important to get your lending structure spot-on. Tailored advice is now paramount given there are ways to ensure you are getting the best rate available.

For starters, having your home loan and investment loan at the same bank is now necessary unless you want to get slugged on the carded rate.

If you took out an investment loan to buy a property, which you have since moved into as your home, your broker should have been in touch with you by now regarding the suitability of asking the bank to re-classify your loan. Should it be appropriate, I reckon do it now before the mad rush in a couple of weeks. We have done our homework in advance - each bank will deal with this request differently.

So here are the new Standard Variable Rates. There’s not much difference in movement amongst the majors (not that I’m suggesting any opportunistic collusion). Hey, at least we can all be thankful that we all own part of the banks through our superfunds...

ANZ (Owner Occd): 5.38% (CR 5.49%)*

ANZ (Investment): 5.75% (CR 5.49%)*

CBA (Owner Occd): 5.45% (CR 5.59%)*

CBA (Investment): 5.86% (CR 5.86%)*

NAB (Owner Occd): 5.43% (CR 5.52%)*

NAB (Investment): 5.72% (CR 5.63%)*

WBC (Owner Occd): 5.48% (CR 5.62%)*

WBC (Investment): 5.89% (CR 5.89%)*

* CR is the Comparison Rate. It is a notional rate which includes fees (mainly the annual package fee of around $395) into the interest rate in well-intentioned yet child-like attempt to come up with a single rate which punters can use to estimate the true cost of a loan. It is based on a $150,000 mortgage and hence does not at all relate to you unless your mortgage is exactly $150,000 and you never use your offset account or Credit Card interest free terms

The Standard Variable Rates are of course lacking meaning without applying your lifetime discount. One bank might be giving you a 1% discount off this headline rate (that discount is so 2011), whilst a broker may negotiate an unpublished cracking lifetime discount of 1.45%.

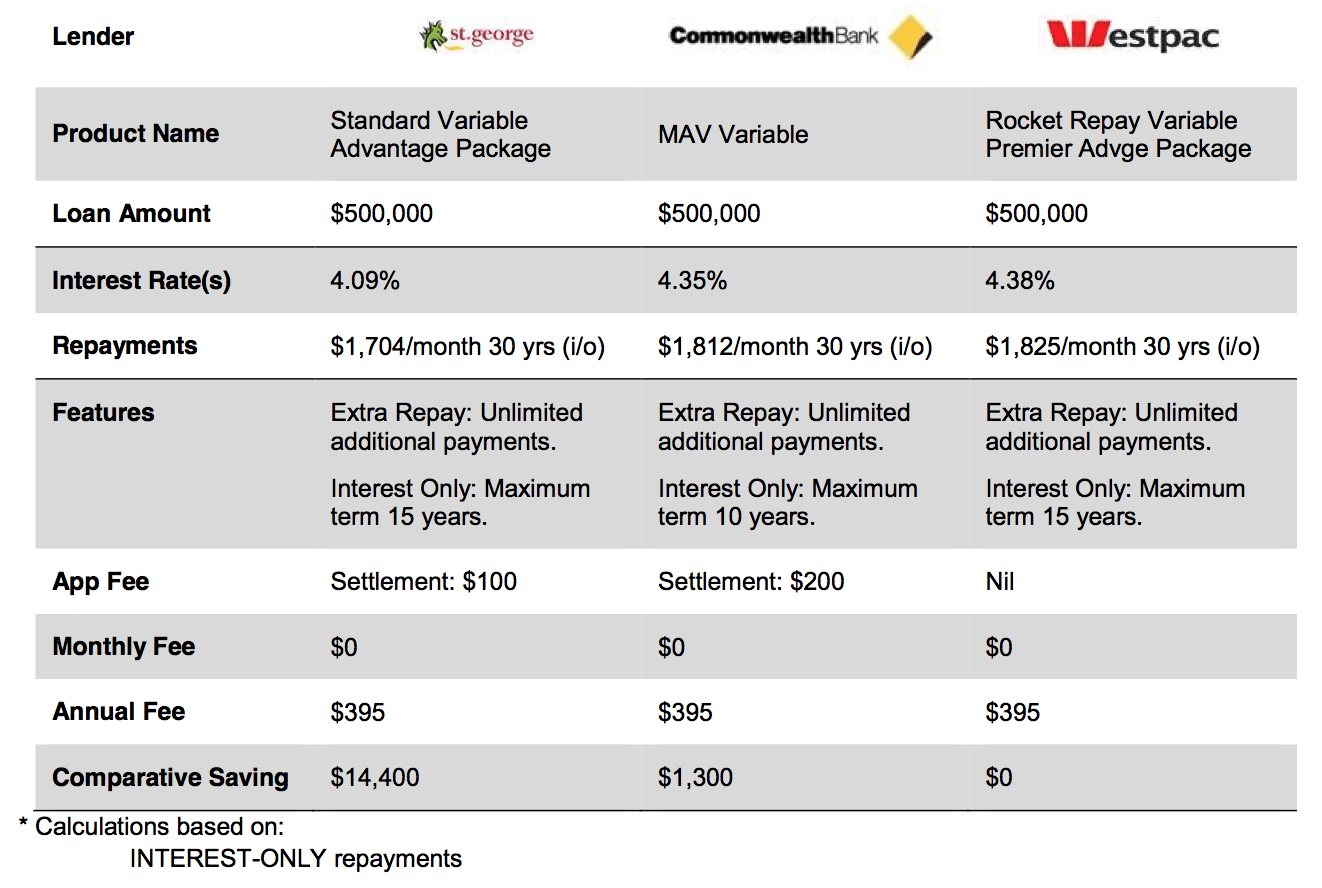

You must always consider the upfront costs, ongoing fees and the ’after discount’ interest rate; then compare the loan products over a certain time frame (please don’t compare over 30 years, perhaps this is unrealistic).

We think a 10-year projection is appropriate, that way it’s also easy to divide by 10 to see the annual $ saving.

Product Comparison – 10 Year Projection

Jason Khoury is the principal at iChoice. He can be contacted here.