Property investor lending running at 12.4% annual growth: APRA

As at 31 March 2015, the total of residential term loans to households held by all authorised lenders was $1.30 trillion, according to the latex March quarter 2015 APRA figures.

This is an increase of $23.9 billion (1.9%) on 31 December 2014 and an increase of $107.1 billion (9%) on 31 March 2014.

Owner-occupied loans accounted for 65.4% of residential term loans to households.

Owner- occupied loans were $852 billion, an increase of $12.7 billion (1.5% on 31 December 2014) and $57.3 billion (7.2% on 31 March 2014).

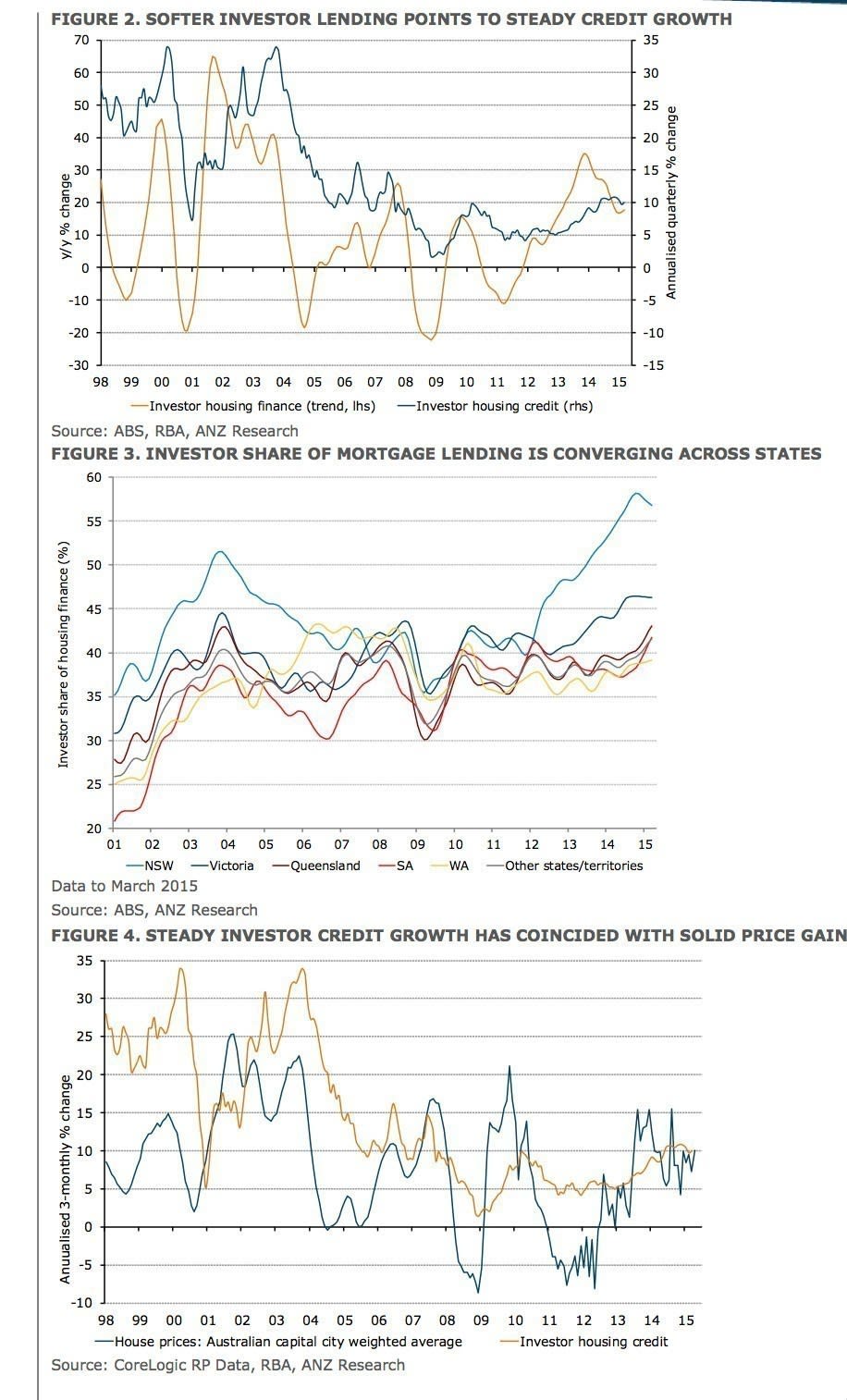

Investment loans accounted for 34.6% of residential term loans. Investment loans were $450.2 billion, an increase of $11.2 billion (2.6%) on 31 December 2014 and $49.8 billion (12.4%) on 31 March 2014.

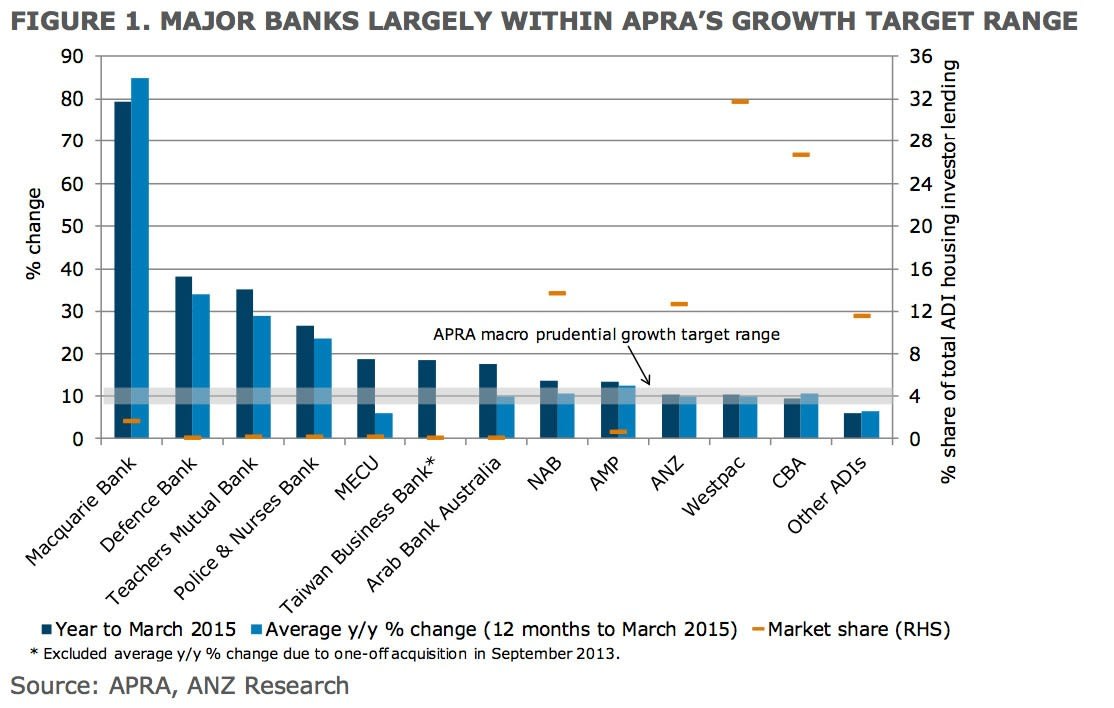

The latest lending data suggests lenders are generally meeting the 10% growth restraint sought by APRA, though some still to sufficiently rein in the pace of investor loans.

It has been suggested more than 82% of investor lending remains within APRA’s macro prudential growth target (not materially above 10%).

While a number of lenders are comfortably below this range (around 12% of market share) and have scope to increase their exposure to housing investors, some lenders are tracking well above APRA’s macro prudential target growth range.

The 10 per cent benchmark is not a hard limit, but is a key risk indicator for supervisors in the current environment.

The benchmark has been established after advice from members of the Council of Financial Regulators, taking into account a range of factors including income growth and recent market trends.

ADIs with greater than $1 billion of residential term loans held 98.4% of all residential term loans as at 31 March 2015. These ADIs reported 5.3 million loans totalling $1.28 trillion.

Of these loans: the average loan size was approximately $243,000, compared to $235,000 as at 31 March 2014; $479.1 billion (37.4%) were interest-only loans; and $30.1 billion (2.3%) were low-documentation loans.

New housing loan approvals with ADIs with greater than $1 billion of residential term loans saw approval of $82.3 billion of new loans in the quarter ending 31 March 2015. This is a decrease of $10.9 billion (11.7%) on the quarter ending 31 December 2014 and an increase of $8.5 billion (11.5% on the quarter ending 31 March 2014.

Of the new loan approvals $51.9 billion (63.0%) were for owner-occupied loans, a decrease of $6.5 billion (11.2%) from the quarter ending 31 December 2014; $30.4 billion (37.0%) were for investment loans, a decrease of $4.4 billion (12.6% from the quarter ending 31 December 2014; $34.8 billion (42.3%) were interest-only loans; $9.1 billion (11.1% had a loan-to-valuation ratio greater than or equal to 90%; and $0.6 billion (0.7%) were low-documentation loans.

It was December 9 last year when tthe Australian Prudential Regulation Authority (APRA) wrote to authorised deposit-taking institutions (ADIs) outlining further steps it plans to take to reinforce sound residential mortgage lending practices.

These steps have been developed following discussions with other members of the Council of Financial Regulators.

In the context of historically low interest rates, high levels of household debt, strong competition in the housing market and accelerating credit growth, APRA has indicated it will be further increasing the level of supervisory oversight on mortgage lending in the period ahead.

Las December APRA advised it did not propose to introduce across-the-board increases in capital requirements, or caps on particular types of loans, to address current risks in the housing sector.

However, APRA flagged to ADIs that it will be paying particular attention to specific areas of prudential concern.

These included:

- higher risk mortgage lending — for example, high loan-to-income loans, high loan-to-valuation (LVR) loans, interest-only loans to owner occupiers, and loans with very long terms;

- strong growth in lending to property investors — portfolio growth materially above a threshold of 10 per cent will be an important risk indicator for APRA supervisors in considering the need for further action;

- loan affordability tests for new borrowers — in APRA’s view, these should incorporate an interest rate buffer of at least 2 per cent above the loan product rate, and a floor lending rate of at least 7 per cent, when assessing borrowers’ ability to service their loans. Good practice would be to maintain a buffer and floor rate comfortably above these levels.

In the first quarter of 2015, APRA supervisors indicated they would be reviewing ADIs’ lending practices and, where an ADI is not maintaining a prudent approach, may institute further supervisory action.

This could include increases in the level of capital that those individual ADIs are required to hold.

APRA Chairman Wayne Byres noted that while in many cases ADIs already operate in line with these expectations, the steps announced last December would "help guard" against a relaxation of lending standards and, where relevant, prompt some ADIs to adopt a more prudent approach in the current environment.

‘This is a measured and targeted response to emerging pressures in the housing market. These steps represent a dialling up in the intensity of APRA’s supervision, proportionate to the current level of risk and targeted at specific higher risk lending practices in individual ADIs’ he said.

‘There are other steps open to APRA, should risks intensify or lending standards weaken and, in conjunction with other members of the Council of Financial Regulators, we will continue to keep these under active review.’

The steps announced today build on the enhanced monitoring and supervisory oversight of residential mortgage lending risks that APRA has put in place over the past year, which has included a major stress test of the banking industry, targeted reviews of ADIs’ residential mortgage lending and the release of detailed guidance to ADIs on sound residential mortgage lending practices.

APRA’s heightened supervisory focus on lending standards is being conducted in conjunction with the review of interest-only lending announced by the Australian Securities and Investments Commission (ASIC).