Home lending bounces back in the lead up to spring

The value of home lending saw a jump of over five per cent in new home loans settled in July, according to new ABS data.

Owner-occupiers saw the biggest growth, with a 5.3 per cent increase in value in July.

Investors have continued their come-back into the housing market, with the value of investor loans increasing 4.7 per cent.

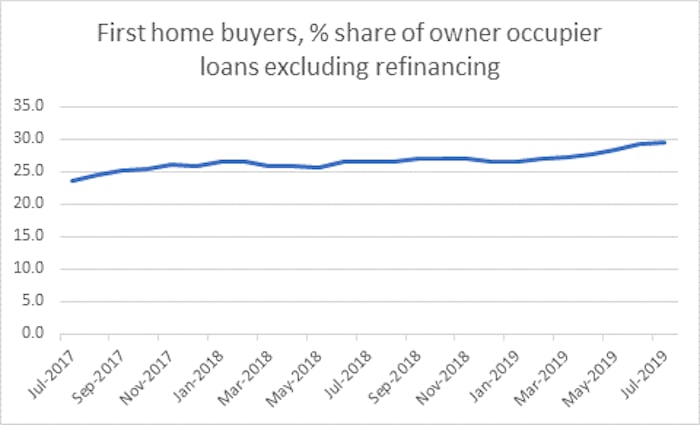

First home buyers have continued their slow but steady return to the market, increasing their share of new owner-occupier lending to 29.4 per cent in July, up from 29.3 per cent in June – the highest proportion since January 2012.

Fixed loans have continued to fall out of favour with borrowers. The proportion of owner-occupiers fixing fell to 10.4 per cent, which is the lowest level since October 2015.

Housing finance | ||

Value of new loans | % change from previous month | % change year on year |

Owner occupiers | 5.3% | -8.3% |

Investors | 4.7% | -20.4% |

All loans | 5.1% | -11.8% |

Overall lending jumped 14.7% in July, with owner-occupier lending up 16.7% and investor lending up 9.4% month-on-month.

RateCity.com.au research director Sally Tindall said the stars are starting to align for borrowers in the lead up to the spring property season, despite the gloomy economic outlook.

“Borrowers are feeling buoyed by a combination of plummeting interest rates, tax cuts, more relaxed serviceability measures and clarity around negative gearing,” she said.

“Interestingly, this is the first month that factors in APRA’s axing of its 7 per cent serviceability floor. It’s likely that part of the bounce can be attributed to this, and we expect it to continue to have a positive effect on the market.

Home loan share

Share of loans July 2019 | Share of loans | |

First home buyer share | 29.4% | 29.3% |

Fixed loan share | 10.4% | 14.1% |

Notes: Based on the share of new owner occupier loans.

“However, Australians are still on the sidelines when it comes to fixing, despite banks’ best efforts to attract new fixed borrowers onto their books”, she said.

“It’s not surprising that a lot of Australians are now opting not to fix their home loan ratein this climate when the RBA has made it clear there could be one, if not two more rate cuts to come.

“There are now dozens of lenders offering fixed rates below 3 per cent and as low as 2.74 per cent, for owner occupiers paying principal and interest, especially if they have a decent amount of equity in their home.”