Construction activity falls, tame building costs: Savanth Sebastian

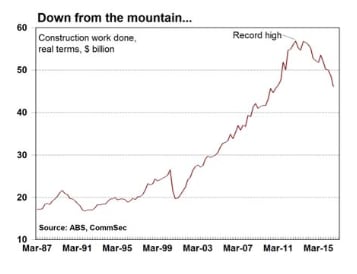

The latest construction data was certainly disappointing. Not only is construction work down over 11 percent on a year ago, but the falls were across an array of sectors.

The ‘baton pass’ from engineering to residential building was clearly the driver of activity over the last couple of years. In fact engineering work is down by 23.2 percent on a year ago – just shy of the biggest annual fall on record, as opposed to residential construction, which eased from record highs. The results are even more staggering when you consider that just over two years ago engineering work surpassed total building (residential and commercial) by more than $9 billion.

And while policymakers would not be overly concerned at present, a substantial pullback in residential activity would create a void that could cause concern. Essentially the hope would be that commercial and non-mining related business investment will lift over the coming year and provide the economy with a lift in momentum.

Construction work done fell by 4.9 percent in real (inflation-adjusted) terms in the September quarter after sliding by 3.1 percent in the June quarter. Work done is down by 11.1 percent on a year ago. Public sector construction work fell by 0.2 percent in the quarter while private sector activity fell by 6.0 percent.

Construction work fell in five of the states and territories in the September quarter. Leading the falls was Western Australia (down 13.6 percent), followed by Victoria (down 6.9 percent), South Australia (down 1.3 percent), NSW (down 2.1 percent) and Queensland (down 0.2 percent). Construction rose in the ACT (up 7.1 percent), Tasmania (up 4.7 percent), and the Northern Territory (up 0.6 percent).

Engineering work fell by 3.8 percent in the September quarter. Engineering construction is down by 23.2 percent on a year ago – just shy of the biggest annual fall on record.

Commercial (non-residential) building fell by 10.9 per cent in the September quarter to be down 7.6 percent over the year.

The measure of inflation in the construction sector (deflator) was flat in the September quarter. The annual rate of construction inflation fell from 2.6 percent to 2.0 percent. Engineering prices fell by 0.7 percent in the quarter (up 1.7 percent over the year) while building prices rose by 0.6 percent in the quarter (1.9 percent over the year).

What is the importance of the economic data?

The Bureau of Statistics releases quarterly estimates of Construction work done. The estimates are based on a survey and cover around 85 per cent of the construction work done in the period. Revised estimates will be released in coming months. The data is useful largely for historical purposes but the work yet to be done estimates provide an early warning signal of future activity. The residential work figures give a good early guide to the strength of residential investment in the national accounts.

What are the implications for interest rates and investors?

There is still plenty of work in the construction sector. But there are winners and losers across states and industry sectors. The Reserve Bank will not be overly concerned with the current trends in construction. Overall activity is correcting as expected and adjusting to the new realities.CommSec expects the cash rate to remain on hold over the foreseeable future.