If something looks too good to be true, challenge it: Pete Wargent

“As if…”

As someone previously employed in the mining sector, I’ve spent far too much of the past 13 years writing annual reports and ASX stock market releases for listed companies, and if there’s one thing you learn very quickly as a Group FC it’s that you're often the only person who understands the company financials (and often you're one of very few people who appears to even care).

This is one of the many reasons people invest in stocks so badly, for if you don’t fully understand the detailed financials, how on earth can you know what a company is worth?

Opaquely, some companies report “normalised earnings” almost every year, which sceptics now refer to as “as if earnings” as in: “Here are our earnings as if we didn’t have our loss-making operations…”

From writing stock exchange releases I also know only too well that if you manipulate statistics (especially from small sample sizes) hard enough and often enough, you can prove just about anything by "torturing the figures until they confess".

Nowhere are statistics manipulated harder or tortured more often than in residential real estate. Always challenge what you are told, and remember this key rule of investment…

“If something looks too good to be true, it probably is”

A fine case in point was the February Labour Force data released last week which showed that the Australian economy seemingly added an unbelievable 71,500 jobs in a month.

That statistic is definitely too good to be true, but it nevertheless raised the ire of Hotspotting’s Terry Ryder:

“They [economists] told us the jobless rate would rise, with only 10,000 new jobs created. The outcome was 70,000 new jobs created and the jobless rate steady at 5.4%. Do we get our money back? Or an apology at least?”

If you understand how the samples are collated, rotated and extrapolated, you would know that forecasting jobs growth accurately month-on-month is impossible.

The February numbers were too good to be true and next month’s figures will be correspondingly weaker.

Real estate myths

It’s been a busy week for Ryder with him again taking aim at investors in capital city properties:

“The fossils of real estate are creatures known as Mythosaurus. They’re the relics who cling to ancient folklore such as “the inner-city suburbs provide the best growth” and “Sydney’s good suburbs are the strongest in the nation”. The factor that all myths have in common is that they are unsupported by research evidence. But Mythosaurus does not concern him or herself with inconveniences like statistics.”

Instead, Ryder tips Bowen in Queensland in spite of its 17-18% vacancy rate, puts Cairns back on the watchlist after its desperately miserable run and went on to highlight that: “Port Augusta has a median house price of $175,000, despite annual growth averaging 12% over the past 10 years.“

Naturally enough Ryder has picked out a town with outstanding growth, but...whoa! "Growth" of 12% per annum and houses still only cost $175,000? 12%!

Mr Mythosaurus may not like to concern himself with the inconvenience of statistics, but he may wish to look a little more closely at that.

Why don’t we all invest in small towns like Port Augusta? Firstly, because of gearing into an illiquid asset in these times of elevated household leverage as property owners across Europe and the US have discovered to their cost.

And secondly, because quoting median suburb “growth” figures over a carefully selected timeframe is a commonly employed spruik, for as experienced investors well know "growth" can be distorted by a range of factors.

How to calculate ACTUAL capital growth

Go back a reasonable period of time of, say, 20 years to 1993, a time horizon which incorporates the greatest boom in the history of Australian household debt and property values, and see what houses in Port Augusta were selling for in that year, which was typically between $40,000 and $80,000 (with an outlying few selling for significantly more).

With your dusted-off compound interest tables to hand you'll discover that the implied growth over 20 years for most houses appears to track remarkably consistently at around 6% per annum or sometimes a little below. Interestingly the cheapest properties in their growth infancy tended to fare the best, perhaps partly due to the ability of owners to add value through improvements - the premium properties which sold for as much as $150,000 or more two decades ago by and large have shown diabolical growth.

Sure there are some outliers and some properties displayed woeful growth at times, but one assumes that as an investor you would have avoided these. 6% p.a. is materially lower capital growth than an experienced investor in the closest major city market of Melbourne would have expected to achieve over a corresponding time period, and it is also lower than the returns you would have expected from an equivalently resources-focused city such as Perth.

Now you might say that 6% is solid enough capital growth, and you’d be absolutely right.Remember though, that in the preceding days of higher inflation interest rates tumbled from an eye-watering 17.50% in 1990 to just 4.75% in 1993 and the result of this structural shift was the greatest leveraging up by households in Australia’s history.

The RBA warned Australians last week that this borrowing bonanza plateaued in 2006 and its like will not be seen again. In fact, if you have owned a property in Port Augusta since 2008, you would be aware that many houses have declined in price since that time, doubtless not helped by BHP's shelving of its proposed Olympic Dam expansion.

Actual capital growth in capital cities

In recent years, prices in some capital cities have increased (Melbourne, Sydney, Canberra) but have been weak in cities such as Adelaide and Brisbane. Of course, median price growth in capital cities gets distorted too, with the average capital growth dragged down by the dross and the remote under-performers, but investors in quality properties reasonably close to the centres of the cities aim for far higher actual capital growth over the long term than is generally attained in the regions.

Can Mr Mythosaurus give you an example of actual capital growth in the closest major metropolis to Port Augusta? Well, here's just one example of many: we've just seen a villa unit in Camberwell (9km to the east of Melbourne's CBD) sell for $585,000 - it last changed hands in the same condition in July 2000 for $186,000 - a comfortably compounding growth of ~9.25% per annum over nearly 13 years since it was last sold. No data distortion there, purely a huge demand in that suburb for a quality medium-density property.

How does median price growth become so distorted?

Through 2011 and 2012 I went on the road for 15 months and travelled to virtually every significant town and city in Australia. If you stroll around Port Augusta what you find is a significant number of newer houses on titles which last changed hands between 1997 and 2003 for somewhere between $8,000 and $30,000. You don’t need me to tell you that a house bought for well under $10,000 in 2003 (which is now worth more than $220,000) wouldn't have resembled Kirribilli House when acquired, and it has not simply magically appreciated to more than 22 times its previous value.

It's exactly the same principle as empty plots of land selling in Port Augusta for just $6,000 in 2004 the titles of which are valued today at more than $220,000...that's "growth" of more than 92% per annum because they have now been built on.

Such gross distortions in suburb median prices commonly represent developers paying land value (or land value less demolition value) for an old house in order to improve the site with a new property. The result is an abnormally depressed median price in the years the old houses are bought followed by an outrageous spike in the following years when newer or greatly improved houses hit the market.

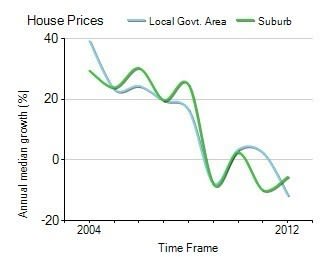

Source: APM

Suburb life cycles

This is all fairly typical of the life cycle of a small town or a fringe suburb where land values are extremely low and a building boost can massively distort median prices in the short term.

Extremely cheap properties in the infancy of growth can certainly experience a “catch-up phase”, and if population and employment growth ignite the initial flame then the median price can produce a fairly consistent growth trend in existing homes as wages increase.

However, a boost in new builds can also subsequently disguise a significant lull in median prices. As land is released to facilitate new accommodation existing homes may plateau in price and stagnate or decline as those moving in are attracted to the newer builds.

Thus consistently outperforming growth in actual house prices can only be expected if land is not released or zoning approvals are not granted to accommodate the increasing population.

Future median price growth will be lower

Although it is mentioned inappropriately rarely (or never) by promoters of real estate, leveraging up into an illiquid asset if you don’t know what you are doing is risky.

All of this is not to say that you can’t do OK by investing in a small town if you pick the right one and buy a good property, but merely to highlight two things.

Firstly, quoted suburb median price growth can be misleading and it is certainly no guarantee of future returns.

And secondly, given that the Reserve has a targeted CPI range of just 2-3%, absent an unlikely return to the days of rampant inflation median future capital growth in property must be lower than that experienced in the past.

Property prices in Australia are high and if you use debt to speculate in the wrong asset type you could experience severe financial loss.

Pete Wargent holds a range of finance and property qualifications and is the author of Get a Financial Grip – a simple plan for financial freedom.