Building approvals hit record high: We need to talk about Melbourne

Rumours of the imminent demise of the residential construction boom were somewhat exaggerated, it seems.

Only yesterday morning I mused in the Twittersphere that we would need to see a proverbial "king wave" of building approvals for the month of November to reinstate the data series to a record high...

...and, in the event, that's exactly what we got. Buoyed by a sizeable increase in attached dwellings over the past year, a further total of 18,245 building approvals in November took total approvals to the highest annual level on record at 199,173.

Over the past year there have been approvals for 113,734 houses (+4%) and 85,439 units and apartments (+18%) representing an excellent supply response to low interest rates and the ensuing increase in dwelling prices.

The 18,245 approvals seasonally adjusted in the month of November also smashed the previous two decade old monthly record of 17,745 set way back in August 1994, by more than 3%.

The below chart thus indicates an impressive volume of approvals in the pipeline. With population growth sliding in most states outside New South Wales this generally points towards cooling dwelling price growth in many market sectors as supply steadily comes online.

Let's take a run through the key facts and figures in three short parts, commencing with...

Part one - Australian economy

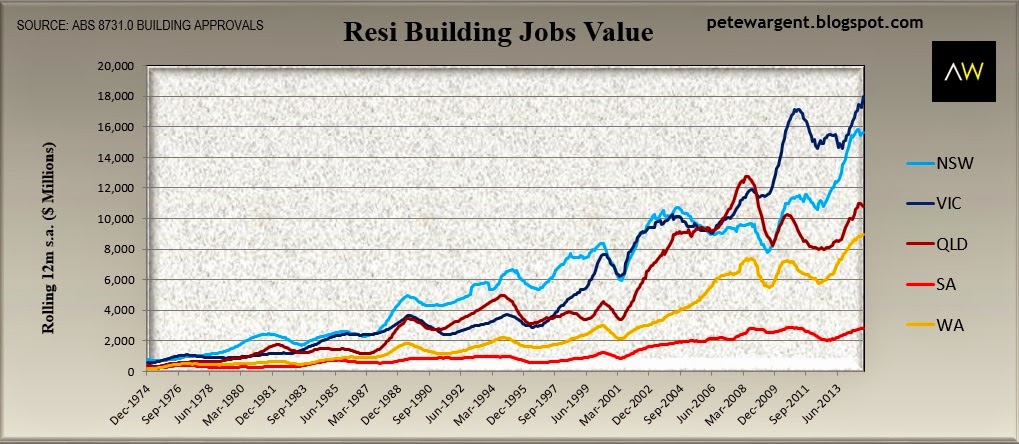

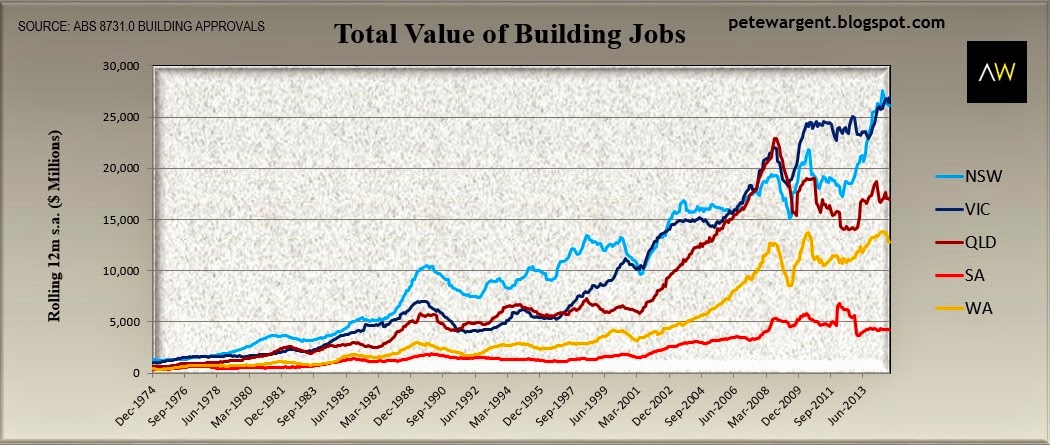

November 2014 was a monster month for the value of residential building jobs at a seasonally adjusted $5,465 million - this is by a huge margin the greatest monthly figure on record, thereby taking the total value of building jobs to new record heights on an annualised basis.

Victoria has been the kingpin of residential construction for some years now. Yet while this provides some short-term juice for the local economy, an oversupply of apartment stock is nurturing a systemic risk in that market as detailed in part three below.

As analysed here previously residential construction alone doesn't stand a snowball's chance of successfully offseting the forthcoming declines in mining construction, particularly as "alterations and additions" (major renovations activity) has contributed so little to GDP over the past year, though commercial and infrastructure construction will assist.

The other state which has really embraced a building boom has been New South Wales - but contrary to popular belief the surge in the number of cranes on the Sydney skyline is not leading to an oversupply of residential property.

In fact the enormous boom in building jobs values and construction has to a significant extent been driven by infrastructure and commercial projects.

These include some of those initiated by LendLease (ASX: LLC) such as the gargantuan $6 billion Barangaroo project, of which the enormous office towers "T1, T2 and T3" have been progressing apace since the middle of 2014 (see some of my site photos here among various places on this blog for an idea of the scale).

Article continues on the next page. Please click below.

Part two- Capital cities

Rather than imbue readers with a chronic case of "chart fatigue" we will omit the state level data today other than to note that Victoria is approving huge volumes of supply, but approvals in New South Wales are now sliding.

Let's skip directly to what is happening at the more interesting capital city level where Greater Melbourne is being joined by Greater Perth in approving the largest number of houses.

However it is the supply of inner city apartment stock that holds most intrigue for us in this data series.

The trend data for Sydney apartment approvals peaked way back in September 2013 and continues to slide on a rolling annual basis - now down to a level at around 24,000 which can be easily absorbed by the growing market demand (population growth in the city could tip in at up to around 90,000 this year).

Notably some commentators have called an oversupply of residential building in Greater Sydney. I can see why you would think that given the construction that is visibly taking place.

But much of this is commerical in natue and the numbers tell another story - with the exception of a few small pockets in inner south and inner city suburbs, the market remains tight.

In reality much of desirable inner suburban Sydney has precisely the opposite problem with planning permissions generally difficult to come by and vacancy rates contracting to their lowest level in more than 22 months - since February 2013 - at just 1.5%.

Not only is the new construction not causing an oversupply, in most locations it has barely even begun to address the inherent undersupply.

Greater Brisbane continues to approve a higher number of units and apartments than has been historically typical.

Therefore although we feel that Brisbane is likely to be Australia's best performing property market over the next few years, we would suggest avoiding those inner suburbs where there is a raft of new projects coming online as detailed here previously.

The problem child is Greater Melbourne. The month of November saw an extraordinary pre-election surge of 3,931 attached dwelling approvals (to add to more than 22,000 detached house approvals in the last 12 months).

Despite there already being a glut of apartment stock on the market and elevated vacancy rates, this takes rolling annual attached dwelling approvals to an unprecedented level for Melbourne at more than 25,000, and trending rapidly towards a figure with a "3 handle".

Article continues on the next page. Please click below.

Part three - Melbourne going highrise bonkers

The value of approvals in Victoria as charted below - while promising an attractive short-term sugar hit to the local construction economy - also hints at an underlying muddle.

The number of high rise units continues to break new record levels, largely thanks to the prevailing trend towards constructing towering apartment structures to be exported to offshore investors.

In localities such as Docklands a high percentage of units are thought to stand vacant as well highlighted at the suburb level in a recent Prosper report entitled Speculative Vacancies in Melbourne 2014.

Drilling into the number of apartments approved by number of storeys below highlights the crux of the issue. More than 3,000 units of four or more storeys were approved in November alone (!) taking the rolling annual total close to 15,000. This is well over double the figures being notched as recently as 2009.

Put another way, across the last five years Victoria has approved an extraordinary 62,837 "high rise" (four plus storey) units - well over triple the 18,705 approvals in the preceding five years (New South Wales has been doing something similar in recent years but Sydney is playing catch-up after six years of woeful undersupply).

In short there is clear oversupply of highrise apartments set to land squarely in the city of Melbourne.

Of course, over the long-term this will easily be absorbed as the city population grows and the largest Australian cities adopt a more Asian city feel and style of high-density living.

Over the short-term, however, this presents a systemic risk and may result in a painful correction in that sector of the market.

The wrap

From a macroeconomic perspective this was a big result in November both in terms of the number and value of building approvals, which bodes well for this residential construction cycle pushing through until 2017.

At the capital city level apartment approvals have continued to ease back in Greater Sydney meaning that those waiting to see a harbour city oversupply are likely to be disappointed.

Melbourne, on the other hand, is continuing to wave through high rise approvals at a maniacal rate. This may mask malignant adverse consequences.

Pete Wargent is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His new book 'Four Green Houses and a Red Hotel' is out now.