Latest construction data sets alarm bells ringing

The ABS released its Construction Work Done figures for the September quarter which underscored two key systemic risks for Australia's economy and housing markets, with the following alarm bells now sounding loud and clear:

- The long anticipated "mining construction cliff" is now well underway, with engineering construction spend registering a significant 12% decline over the past year to be 15% off from the peak; and

- A forthcoming glut of new build residential properties, particularly of attached dwellings: units and apartments.

Let's take quick 'shufty' in four short parts.

Part 1 - Total Construction Slides

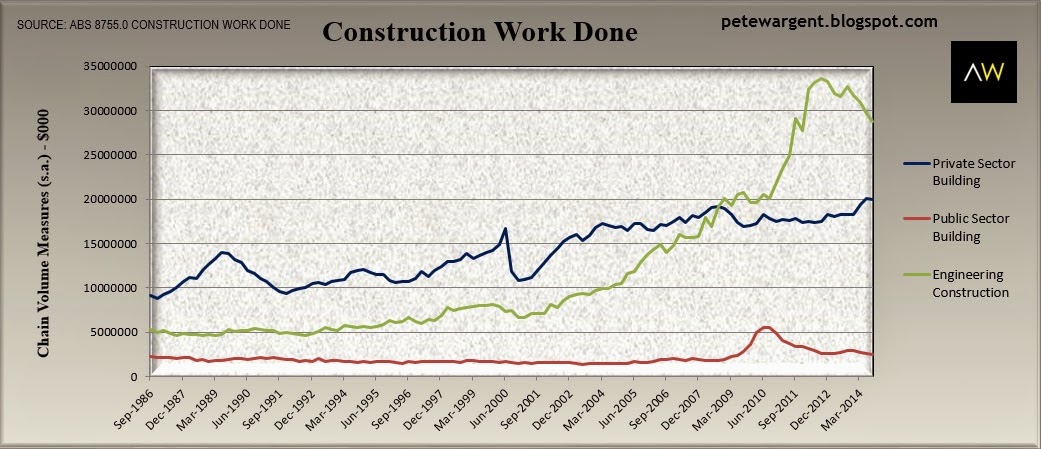

Total construction work done remains elevated in historical terms at a seasonally adjusted $51,146 million in the September quarter.

From a macro-economic perspective, of course, it is the trend which is of importance, and total construction has now passed its peak, declining further by a seasonally adjusted 2.2% in Q3 to be 5.1% lower over the year in chain volume measures terms.

This was a slightly undercooked result versus expectations, and hardly the most auspicious of starts for the inputs into the Q3 National Accounts.

Of significantly greater concern is what will eventuate for mining and engineering construction prospectively, with total spend already being some 12.1% lower in chain volume measures terms than only one year ago.

With commodity prices tanking it will be increasingly difficult for marginal projects, such as some of those in the coal sector, to pass through feasibility studies to the construction stage, thus reinforcing the entrenched downtrend.

Moreover, the sheer scale of the mining construction boom on the way up (even today engineering comprises more than 56% of construction expenditure reported here at a punchy $28,710 million in Q3) means that there must eventually be an equivalent drag on the way back down - a drag which will be nigh on impossible for work done in the other building and construction sectors to offset.

Low interest are thus clearly set to be with us for some time to come, which must in turn impact investment decisions and other construction trends, as the financing component of new developments remains historically speaking very cheap.

Part 2 - The Mining Cliff Cometh

The engineering construction data by state unsurprisingly revealed that total spend in Queensland and Western Australia is now receding sharply.

Other states which benefited less dramatically from the boom years are also now in decline, albeit to a less significant extent, as the resources boom continues to transition into the export phase from the construction phase.

The ABS provided few details concerning what caused the tremendous spike in Q3 engineering construction in the Northern Territory, although cost blowouts at the Ichthys LNG project have been reported elsewhere related to the struggling UGL, while Inpex continues to report project progress in its regular updates.

From a national perspective, we must now expect further declines ahead, and therefore tomorrow's capex data release takes on an additional level of interest!

Article continues on the next page. Please click below.

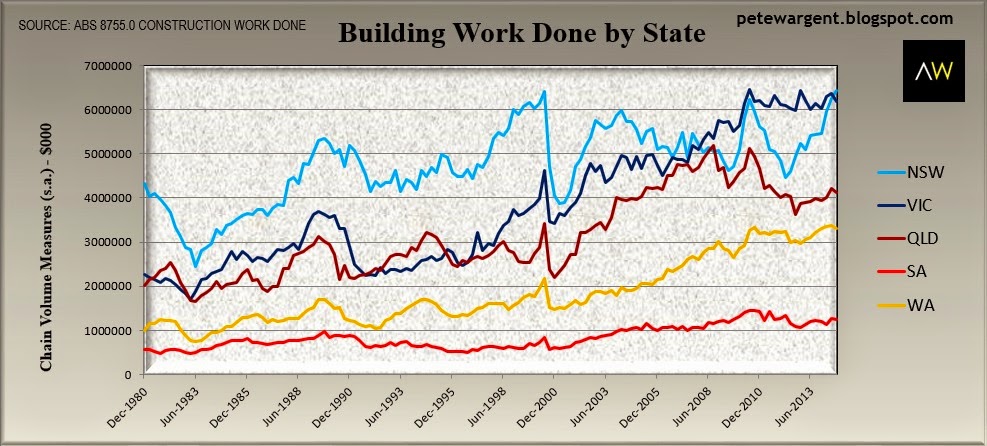

Part 3 - NSW Now Leads Building Work Done

With a massive 54% seasonally adjusted increase in non-residential building in New South Wales since Q1 2012 (mainly related to Sydney projects) in concert with a solid pipeline of residential building, NSW now leads the nation in terms of building work done, which is promising news for the state economy.

But while an inherent infrastructure and dwelling deficit are working in favour of the NSW economy, some other states are building too much of what they do not need.

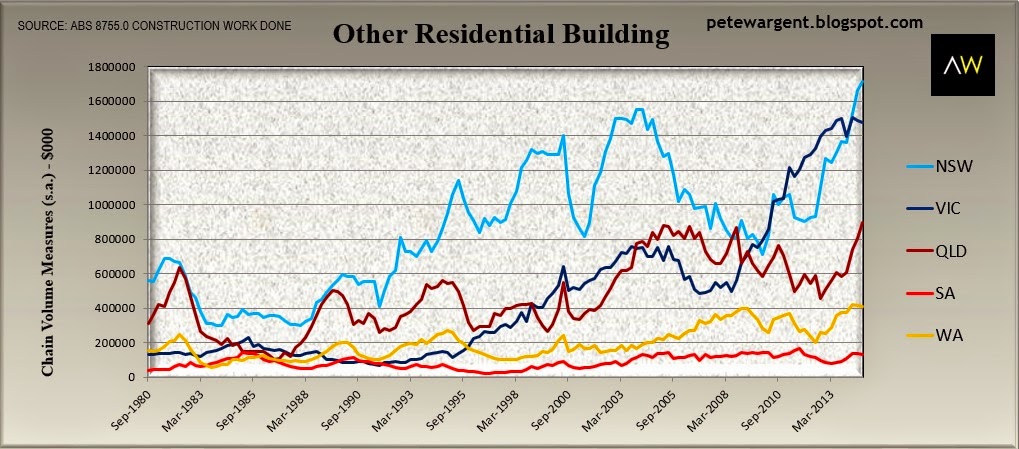

Residential building work done has increased by 9% over the past year. However, new house building has now slipped past its cyclical peak, representing adverse news for the construction sector, and note the alarming trend of the red line below for "other new residential" building.

We have known for many months of course that Australia has been approving far too many apartment buildings in certain locations, and now these building approvals are becoming a stark reality, showing up in the construction data as an unprecedented spike which is still booming.

Yikes.

New Builds Risk Flashing Red - Systemic Risk?

The next three years will see Australia break many all-time records in the residential property space.

These include the highest annualised rate of apartments constructed in Australia's history, and thus in turn record developer kickbacks and commissions paid to 'investment advisers' (i.e. developer salesmen) for the sourcing of willing interstate buyers of the detritus which developers have been unable to flog themselves (itself quite a notable achievement in the prevailing climate of cheap credit).

And the inevitable corollary will be a record number of investors losing their hard-earned cash on dud new development investment properties.

We would never recommend new build units anyway from a risk management perspective - they are too expensive and inherently lacking in scarcity value - but we cannot be any clearer on this point at this stage of the cycle. Too risky.

The Block?

Just as an infestation of cookery shows in Australia has paradoxically coincided with a record boom in the consumption of takeaway food, similarly the glut of TV renovation shows has not led to an equivalent uptick in major home renovations.

There have been many murmurings of a boom in renovation intentions but this is not to be evidenced here in the "Alterations & Additions" data, reflected by the moribund trend in the green line of the above chart.

The Housing Industry Association (HIA) forecasts a miserly 2% increase in renovations work in the year ahead following on from a 0.9% increase over the past year.

"Every little helps" from a macro-economic perspective, of course, but as the above charts clearly demonstrate these renovations numbers are merely a drop in a very large ocean of construction spend as compared to the forthcoming declines in engineering work to be completed.

Part 4 - Residential Building by State

Lastly for today, a glance at residential building by dwelling type at the state level. We already know that Victoria has been building huge numbers of new houses as compared to elsewhere, but new detached house building has now surreptitiously tiptoed past its cyclical peak.

As you can see from the chart below, it is new units and apartments which are the greatest risk area for this residential property market cycle, as developers construct unprecedented volumes of attached dwelling stock.

With apartment construction hitting record heights there will also inevitably be a glut of new stock to be sold on by commission-hungry agents. Caveat emptor!

Our previous detailed analysis of the data including here and here has shown that apartment approvals in Sydney have long since rolled over and accelerating Greater Sydney population growth reduces oversupply risk on a city-wide basis to some extent, despite some pockets of new stock over-supply (cf. CBD, inner south).

However, it must also be observed here that with unprecedented construction of attached dwelling stock set to take place through the 2-3 years ahead, particularly in Brisbane, Melbourne, Perth and Sydney, but also elsewhere, there will inevitably be some blood spilt down the track for a substantial number of today's purchasers of new and off-the-plan properties.

Scarcity Value

Always remember that, as in any asset class, buyers of and investors in residential property should look to purchase an asset with an element of scarcity value.

In this respect, with building approvals breaking record highs in 2014 - a glut of new supply being precisely the polar opposite of scarcity - and the price of new stock at sky high levels, it is therefore almost by definition the most risk-laden time to buy new property that we have yet seen.

One of the many problems with new build investments is that all too often the choice boils down to an over-priced house (as compared to established stock) in a fringe suburb where few people want to live, which is a poor investment, or an over-priced apartment in an suburb which is set to be flooded with new apartments, which is frequently an even worse prospect.

Alas there will forever be some nailed on guaranteed winners from this phase of the construction cycle, including the developers who have long land-banked their own gains from key development sites, and the so-termed 'investment advisers' plundering thumping sales commissions on new stock.

Scant consolation to be found for those at the end of the food chain who lose out, though.

You can visit AllenWargent property buyers (London, Sydney) or Pete's blog.

His latest book is 'Four Green Houses and a Red Hotel' .