Is March the biggest month in Australian property history?

whether or not there is any, erm, value, in the concept of daily property values, RP Data's Daily Home Value Index undeniably creates a great deal of opportunity for nerds to play around with charts, and I, for one, am grateful for that.

Until just a couple of days ago the RP Data index was showing national property price gains for March of a staggering 2.3% which, if it were to be sustained, would represent the greatest monthly gain on record for RP Data in Australian capital cities, representing further validation that monetary policy works on dwelling prices.

Over the past year, the home values by city, have increased by 10.51%.

Brisbane and Adelaide are now showing some gains in 2014 but, perhaps unsurprisingly, it is Sydney and Melbourne that are really driving values higher.

From what I've heard from Queenslanders who are in the market it appears likely that Brisbane will begin to show some decent gains in the near future.

For 2014 year to date, Sydney prices are up by 3.74% and up by 2.13% in March so far alone.

Meanwhile Melbourne's chart finally seems to have moderated a little, but even so, prices are up by an outlandish 5.67% in 2014 and are still up by some 2.54% in the month of March so far.

Viewpoint?

Is this all important?

Well, I'm not a huge believer in the idea of daily home values due to the obvious limitations on capturing and processing data, but these figures are certainly important in one sense.

If nothing else, the headlines that record or near-record monthly price gains will doubtless generate and which will be reported next week can themselves fuel a herd mentality.

Moreover, history has shown that where asset markets get away from central banks they can take on something of a life of their own.

The Reserve Bank will be watching all this with great care, of course.

Indeed, the RBA talked a lot about housing today, it's confidence instrumental in sending the dollar all the way up to a four month high of 92 cents.

Article continues on next page. Please click below.

I've made the point a few times that when it comes to monetary policy and other regulatory actions it matters rather less what people say on chat forums and rather more what the Reserve Bank of Australia (RBA) and APRA say, since ultimately they are the bodies tasked with making the key decisions.

While plenty of people disagree with the RBA, a couple of hours spent reading yesterday's Financial Stability review should tell you how comprehensively the central bank assesses risk.

Fortunately, I spent the two hours so you don't have to.

The four points you're probably most interested in:

1- Banking sector

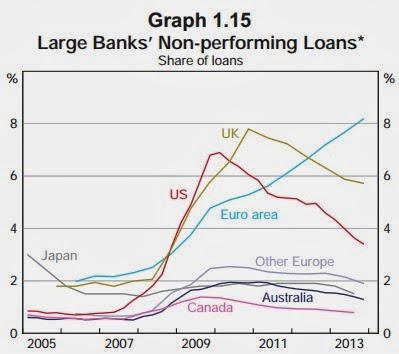

The Australian banking industry emerged from the financial crisis relatively unscathed, but events elsewhere showed that if ever there was a time to bolster capital requirements and shore up risk, it is surely now.

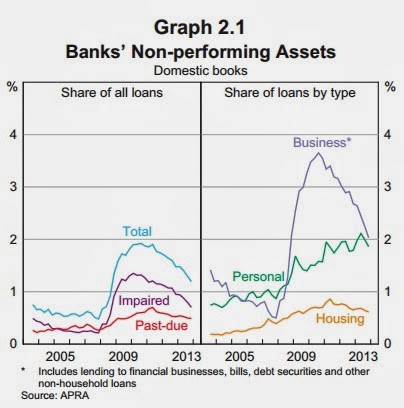

The RBA reported that the banking sector got stronger in 2013 - asset performance is improving and bad and doubtful debt charges declined.

Having increased from essentially nil in 2003, bank's non-performing loans are now declining as households enjoy very low interest rates.

Businesses too, are finding the terrain a little easier than they were during the financial crisis, and bank loan books look much healthier for that.

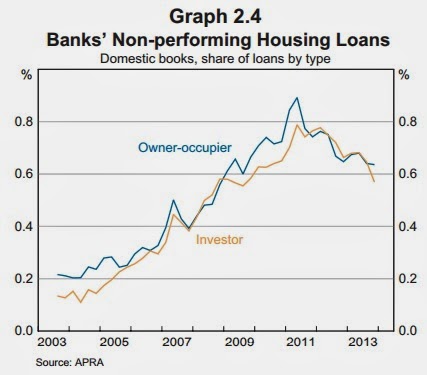

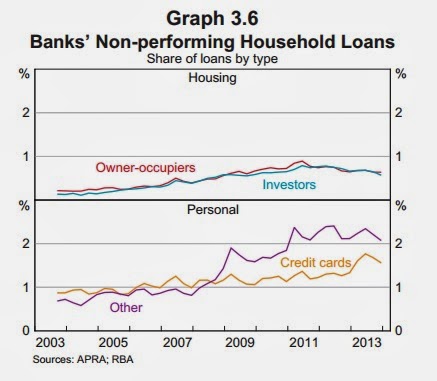

The non-performing share of banks’ domestic housing loan portfolios fell over the six months to December 2013, to 0.6% down from a peak of 0.9% in mid 2011, helped by low interest rates and tighter mortgage lending since 2008.

The ratio of impaired housing loans has fallen recent quarters with rising dwelling prices helping banks to deal with their troubled assets and being able to report a reduction in mortgages-in-possession.

Those are the bare numbers, but a bit of context here might be helpful:

We have just been through the greatest financial crisis since the Great Depression, so non-performing loans of 0.6% is a very sound result.

2 - Lending standards and bank balance sheets

Low-doc lending continues to represent less than 1% of loan approvals, while the share of loan approvals with loan-to-valuation ratios (LVRs) greater than or equal to 90% has been fairly steady since 2011 at around 13%.

The share of banks’ funding sourced from domestic deposits has increased from about 40% in 2008 to around 57% currently.

That's a good thing.

Australia's major banks (classified by APRA as "D-SIBS) have bolstered their capital and funding structures since the financial crisis and are in fact already well-placed to meet APRA's more stringent Basel III capital requirements which will kick in in 2016.

A key point here:

Banks are generating imperiously strong, comfortably double-digit returns on equity (ROE) and colossal net profits after tax (e.g. even after tax Commbank cleared a net profit of $7.8 billion in their 2013 financial year - before tax the figure was closer to $11 billion).

Surely then, herein lies a golden opportunity to enforce the strengthening of capital ratios further through earnings retention, reducing dividend payments or scaling back share market purchases in order to offer dividend reinvestment plans (DRPs).

Of course, bank execs will want to continue chasing the golden egg of 15% ROEs through reinvestment and greater expansion of their loan books, but if our major lenders are to receive an implicit government guarantee then, stuff it, make them shore up their capital ratios, I say.

It would be better for everyone over the long-term.

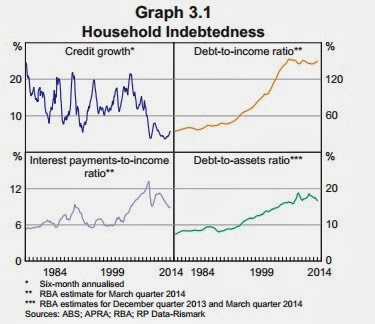

The overall financial position of the household sector was little changed in 2013 and indicators of financial stress remain low, reported the RBA.

Households continued to manage their finances with greater prudence than a decade ago, household wealth continued to increase, the saving ratio was within its range of recent years and, importantly, households continued to pay down mortgages much more quickly than required.

The household saving ratio remained within its range of recent years, at about 10%.

The proportion of disposable income required to meet interest payments on household debt has now stabilised over the past six months, having previously declined in line with the fall in mortgage interest rates in recent years.

4 - Housing market

As for the housing market, the RBA noted that lending to self-managed super funds (SMSFs) is now being tightened up and remains only a small part of the market, as do purchases by non-residents.

The RBA noted that "the pick-up in investor activity in the housing market does not appear to pose near-term risks to financial stability" but "developments will continue to be monitored closely for signs of excessive speculation and riskier lending practices".

The Reserve Bank is very keen to ensure that lending standards in Australia remain high.

Summary

There is much more besides which you can read here, but that is the flavour of the report.

Lending standards will be monitored but on the face of it the RBA appears to be more focused on aggregate loan impairments and indicators of financial stress than dwelling prices.