Six weekend things to consider about investment advice

1) Mentors and modelling

Who should you look to for mentoring guidance? The simplest way I know of to achieve a goal is to find someone who has achieved your targets and to find out what has worked for them.

If you want to start up a major airline, study Richard Branson's books until the ink falls off the page. If you want to build a large share portfolio through making regular contributions and a dividend reinvestment plan (DRP), find someone who has done exactly that. Ditto if your goal is create a dividend rich portfolio and live off fully franked dividends which exceed your expenses. If you want to achieve financial freedom through building a very large portfolio of properties, find someone who has done it.

Could you come to someone like me if your goal is own a factory in Mount Druitt? Well, you could, I suppose, and being a diligent kind of bloke I'd probably do an OK job, but I'd strongly suggest that you'd be better advised to find someone with 15 years of experience and expertise in Western Sydney commercial property acquisition.

Unfortunately, when it comes to personal finance and investment, too many folk take advice from people who never invest in anything ("it's too risky") or have shambolic personal finances themselves. The advice might be well-meaning enough, but ultimately it can be destructive. I'd say that there can be as much, if not significantly more risk, in inaction as in taking action.

2) Where are the customers' yachts?

Warren Buffett once said: "Wall Street is the only place that people drive to in a Rolls Royce to take advice from people who ride the subway." Like most Buffett quotes, this one is a ripper, but unfortunately it's not quite true.

In Australia, financial advice is governed under ASIC's RG 146, and advisers who wish to sell financial products must comply with the training and CPD requirements and hold an appropriate financial services licence.

Be wary, though, for licences are in no way a guarantee of good advice. Before accepting any stockbroker recommendation at face value, for example, make sure you check (a) their long-term track record from previous 'buy' recommendations, and (b) their level of independence from the recommended securities (e.g. do they underwrite capital raisings or are they otherwise involved in transactions for those companies etc.).

It's amazing some of the dross that can be shovelled your way, and this is particularly so if you qualify as a sophisticated investor for the purposes of Chapter 6D, whereby no product disclosure statement or prospectus is required.

As for real estate, although deep down we all know that property investment advice is also financial advice, properties are not treated as financial products in the same manner, and as such are not regulated in the same way.

Bizarre though it may seem, you can end up with a situation where a higher rate taxpayer seeking financial and property investment advice can take advice from someone who has never been a higher rate taxpayer, is not a financial advisor and has never invested in anything. Strange, but true.

So for once, it seems, Buffett's quote is not quite on the money.

3) Asset allocation

Portfolio asset allocation is the domain of the financial advisor and should remain as such.

If you go to a property pundit, rest assured that you will be told that property is the best and safest asset class, and that real estate is the only asset class you should turn to for building wealth. No matter that, if pressed, that property adviser would likely be unable to give you a coherent explanation of what preference shares or convertible bonds (or whatever) even are, instead falling back on bluster.

The regulatory loophole means that property advisers can continue to make outlandish claims unchecked - "nothing safer than bricks and mortar...it's a sure thing...the market is forever under-pinned...market set to boom!" - you've seen the kind of thing.

Of course, I'm not saying that hybrid instruments or even fixed interest investments are necessarily for you. I'm just saying that if is someone is financially illiterate then they aren't in a great position to advise you either way.

A good property adviser should be able to discuss what IRR might be expected from an investment, and how that might compared to the risk free rate, or returns from other asset classes.

Article continues on next page. Please click below.

4) Property, shares or both?

Personally I believe that the best portfolios have a balance of assets and some level of diversification across asset classes and countries. Others prefer to concentrate on one asset class and become a specialist.

For all the talk of which the 'better' or 'best' asset class, there really is no answer to that. Different asset classes suit people at various stages of their lives and one must take into account age, risk profile, income requirements, living arrangements, tax and estate planning and a whole host of other factors.

Notably, the level of property market commentary on this subject is poor. Here's a tip: if you ever stumble across an article comparing returns from property and share markets (an income asset) which fails to mention the word 'dividends', click on the little red cross in the top right corner of the screen (the same sometimes goes for articles written by goldbugs).

As for when property punditry veers off towards commentary on the economy and monetary policy...oh dear. Let's be generous and say that it tends to be a trifle mixed. Another of the old favourite lines is that "with property you can use 80-90% leverage, but with shares only 50%" (really? Prove it). And so on...

5) Experience counts

If I was looking to find a investment adviser I'd find one who had personally experienced investing with a substantial portfolio of assets through downturns. We've all confused bull markets for being smart, but it's when the market turns south that you find out who really has a solid investment portfolio and plan.

Why does experience matter in investing? Because successful investment is all about two things: the (1) the numbers, and (2) the psychology.

Property advisers frequently throw out a few platitudes about "tax benefits" but try to pin them down about how an investment might impact your marginal tax rate or how negative gearing and depreciation works in practice. You often find that, unless they are experienced investors themselves, their grasp of the figures is tenuous at best. If you want a really good chuckle, ask them to step you through how franking credits flow through to your tax schedule and the basics of the dividend imputation system. Hmm.

If you're looking for a mentoring program, find one where the mentor has decades of experience. Investing is not like our school days where people who make errors are put on report or on detention. Mistakes are how investors learn.

When it comes to personal finance and investing, if you've ever burned through $50,000 messing around with the 'penny dreadfuls', or lent pain-inducing sums of money to unscrupulous mates who never paid you back, or diverted funds towards a shonky business venture...you'll know how to avoid making those mistakes in the future. Trust me, as someone who has done all three of those things (twice in the case of lending money to mates), experience changes your outlook.

6) There is some risk in every course of action

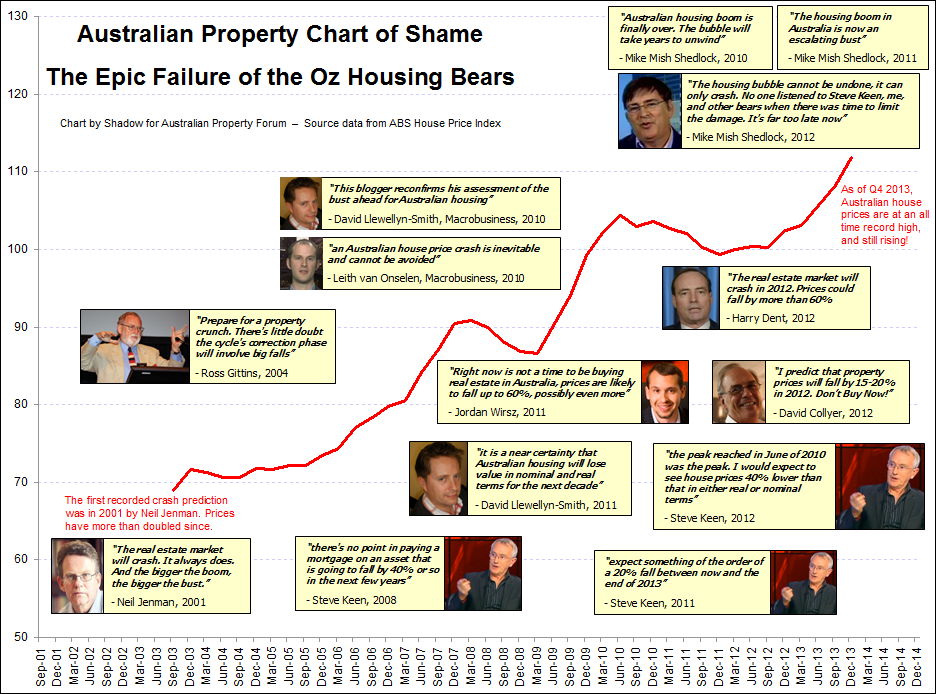

We should all understand that there is some risk in every course of action - and that includes the inaction of doing nothing. Poor old Steven Keen has copped a lot of flak over the years for advising people that their homes in Sydney would fall by 40% in a few years...when the median price was around 40% lower than where it is today. Yet, if I'd taken his advice, I guess I'd be pretty annoyed too. He's hardly been Robinson Crusoe on that front, though.

As the internet chat forums forever take great delight in reminding us, there are property crash predictions in Australia every year. One day, Australia will get a sharper correction that we've had to date, but a belief in an ability to time the market accurately appears to be something of a fallacy.

Source: Australian Property Forum

I know this isn't what a lot of people want to hear, but as the chart above shows, with a few ups and downs, Australia's house price index has broadly tracked household income growth for a decade now, which is not typically bubble behaviour. Household incomes will continue to grow over the next decade too, and through the decades after that.

Of course, it's not quite as simple as that, as certain popular suburbs will continue to outperform incomes while others will lag and likely become more affordable cheaper in real terms. That's how markets work. My strategy has been simple enough over the years, and has seen my UK and Aussie portfolios invested through a couple of colossal property booms (UK 1990s-2008, Sydney 2008-2014) and another London/UK property boom is in the post right now.

In today's crowded modern capital cities, people are increasingly realising that the commuting rat race sucks, so I just keep acquiring properties that are no more than 10-15 minutes from the city employment hubs in mature and growing property markets like Sydney and London.

It's simple geography, really, for there is almost no more inner city land upon which to build, while the city population is exploding - as compared to far weaker demand and acres of space on the outer - so aim to own well-located properties with a reasonably high land value content and your longer term outcome should be a good one.

Pete Wargent is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.His new book 'Four Green Houses and a Red Hotel' was released on 1 September 2013.