A close call but the RBA to leave interest rates on hold: Shane Oliver

GUEST OBSERVER

Japanese and Chinese shares up but US shares down slightly and Australian shares having another bad week.

Bond yields continued to back up as prospects for a December Fed rate hike continue to firm and as stronger UK growth diminished prospects for a further Bank of England easing. Commodity prices were mixed but the $US continued its ascent and the $A fell slightly.

Why the recent poor performance from Australian shares?

While global shares have been range bound over the last few months (with Eurozone and Japanese shares benefitting from falls in their currencies and the US share market down a bit) Australian shares are down 5 percent from their August high.

This relative underperformance reflects a combination of: concerns about the Fed and the US election that seem to be weighing on most share markets at present; a reversal of the huge bond rally that had helped the higher dividend paying Australian share market and sectors like real estate investment trusts up to mid-year; a soft patch in consumer spending weighing on retailers; and stock specific issues. Of these the turn up in bond yields is perhaps most significant taking a huge toll on defensive high yield sectors like REITs.

With the Fed on track to hike again in December and the RBA likely to be on hold for now a further back up in bond yields is likely into December. However, while the bond bull market is likely over as global inflation bottoms the back up in yields generally is likely to be gradual as global growth is set to remain constrained, the Fed is likely to remain gradual in raising interest rates and other major central banks including the RBA are likely on hold or skewed to easing further.

Meanwhile defensive yield sectors are getting very oversold and due for a bounce and cyclical sectors have more upside if as we expect that global and Australian economies continue to see moderate growth. Bottom line – it’s just another correction.

Spain moving out of limbo with the focus shifting to Italy.

The political impasse that has hung over Spain following inconclusive elections in December and June looks likely to be resolved with the Socialist party voting to a abstain from voting in a parliamentary confidence vote that will then see Mariano Rajoy confirmed as PM. However, political risk in Europe has shifted to Italy and Austria.

Italy will see a referendum on reducing the power of its Senate on December 4 with PM Matteo Renzi seeking to reduce its power in order to proceed with economic reform (something maybe Australia should think about!) and threatening to resign if the referendum is not passed which would then provide a boost to the mostly anti-Euro Five Star Movement.

On the same day Austria will see a re-run of its presidential election with the far right candidate being anti-Euro. So if these go the wrong way we could see another bout of Eurozone break up fears. Either way I remain of the view that the Eurozone will continue to hang together – mainland Europeans are far more attached to the EU and Eurozone than the UK ever was, much of the recent rise in populists in Europe is really a backlash against austerity than necessarily the Euro (which remains popular). What’s more European shares remain very undervalued.

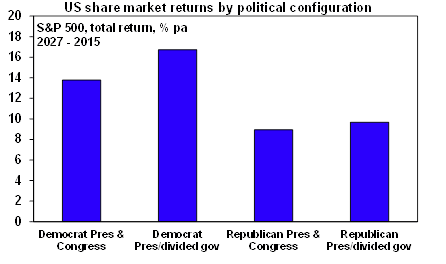

Based on history the best outcome for US shares will be a Clinton victory but with the Republicans retaining control of at least the House of Representatives. Since 1927 US total share returns have been strongest at an average 16.7 percent pa when there has been a Democrat president and Republican control of the House, the Senate or both. By contrast the return has only averaged 8.9 percent pa when the Republicans controlled the presidency and Congress.

Source: Bloomberg, AMP Capital

A Trump victory would likely trigger an initial bout of “risk off” with shares down (both in the US and globally), bonds rallying and the $US up as investors fret about his economic policies particularly his protectionist trade policies triggering a global trade war. Australian shares and the $A would be particularly vulnerable to this given our high trade exposure. But a Clinton/Democrat clean sweep of the Presidency and Congress would likely also trigger a bout of nervousness in US shares as it would be easier for Clinton to implement less business friendly tax and regulatory policies that would weigh on US health, energy and financial stocks.

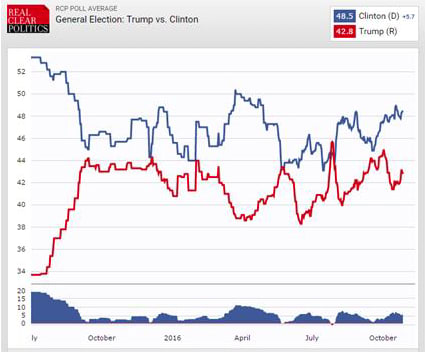

This would likely be more focussed on US shares though with less of an impact on global/Australian shares. A lot could still happen been now and election day but at this stage while Clinton looks to be ahead with a 5.7 point lead across a range of polls and leading in most battleground states (so we are sticking with a 70 percent probability of a Clinton victory), there is no sign of a wave of support going towards the Democrats that will see them win the necessary 30 seats to take the House.

Major global economic events and implication

US data was good. Manufacturing and services conditions PMIs are up solidly, home sales are strong and home prices continue to rise and unemployment claims remain low. Durable goods orders are trending sideways though and consumer confidence fell but this looks to be related to election uncertainty. All consistent with a December rate hike.

Despite a few high profile misses, the US September quarter profit reporting season is actually looking pretty good…the profit recession looks to have ended. Of the 275 S&P 500 companies to report so far, 78 percent have beat on earnings and 59% have beat on sales. Profits are now expected to be up 4 percent on the June quarter and up 15 percent from their March quarter low. A 4 percent yoy gain in revenue is a key driver.

Eurozone manufacturing and services conditions PMIs also rose strongly in October pointing to continued moderate growth.

Japanese data was also solid with strong manufacturing conditions, a rise in small business confidence, an improvement in household spending and solid labour market indicators. Deflation continued in September though with core inflation falling to zero.

Chinese industrial profits slowed in September to 7.7 percent yoy, but consumer confidence spiked higher in October.

Australian economic events and implications

Inflation remains very low, but maybe not low enough to trigger another RBA rate cut just yet. While September quarter CPI inflation at 0.7 percent quarter on quarter was a bit higher than expected this was mainly due to prices for fruit & vegetables, electricity, tobacco and property rates while underlying inflation at 0.3 percent qoq was a bit lower than expected with ongoing evidence that deflationary pressures are still working through the economy.

However, on balance it is probably not enough to trigger an immediate rate cut as inflation is in line with the RBA’s own expectations, economic growth looks to be reasonable and rising commodity prices are set to boost national income. The latter was reflected in the second rise in the goods terms of trade in row in the September quarter with a further rise likely in the December quarter as higher coal and iron ore prices feed through. Meanwhile new home sales rose again in September and remain strong and producer price inflation remains very low.

What to watch over the next week?

In the US, the Fed (Wednesday) is very unlikely to raise interest rates particularly with a “risky” election just six days later but the post meeting statement is likely to confirm that the Fed is on track to raise rates in mid-December (the market probability is just 17 percent for a November hike and 72% for a December hike).

Meanwhile September quarter earnings reports will continue to flow with around 100 S&P 500 companies due to report, the October ISM manufacturing conditions index (Tuesday) is likely to show a further improvement and jobs data (Friday) is expected to show continued solid jobs growth of around 170,000, a slight fall in the unemployment rate to 4.9 percent but continued modest wages growth. Meanwhile, core inflation according to the private consumption deflator (Monday) is likely to have remained unchanged at 1.7 percent yoy in September.

In the Eurozone, September quarter GDP data (Monday) is expected to show continued moderate GDP growth and expect a further rise in October CPI inflation (Monday) as the fall in oil prices from a year ago drops out but core inflation to remain around 0.8 percent yoy.

Japanese industrial production for September (Monday) is expected to show continued growth and the Bank of Japan (Tuesday) is unlikely to make any changes to monetary policy after the further easing announced a month or so ago.

Chinese manufacturing conditions PMIs for October (Tuesday) are likely to pause or slow slightly but remain consistent with a stabilisation in growth.

In Australia, it’s a close call but the RBA is expected to leave interest rates on hold at its monthly Board meeting (Tuesday). September quarter inflation was low on an underlying basis but probably not low enough to trigger another cut just yet as it is in line with the RBA’s own expectations, economic growth in Australia looks reasonable with the worst of the mining investment slump behind us and a rise in commodity prices is starting to boost national income again. As such, the RBA can afford to be patient in waiting for inflation to head back to target and thereby avoid the risk of adding to financial instability (read a further acceleration in Sydney and Melbourne home price gains) with another rate cut for now.

Overall, we think that the RBA will leave rates on hold at its Melbourne Cup Day meeting, but that with inflation remaining very low, the $A still uncomfortably high and jobs data softening lately its premature to close the door on another rate cut but that’s more likely to be a 2017 story. The Reserve Bank’s Statement on Monetary Policy (Friday) will likely see little change to the RBA’s growth and inflation forecasts.

On the data front, expect credit growth (Monday) to remain moderate, CoreLogic home price growth (Tuesday) to remain solid, building approvals (Wednesday) to fall 6 percent, the trade deficit (Thursday) to show a further decline as higher coal prices flow through and retail sales (Friday) to grow 0.2 percent in September but just 0.1 percent in the September quarter in real terms.

Outlook for markets

We remain cautious on shares in the short term as event risk is high for the months ahead including ongoing debate around the Fed and ECB, issues around Eurozone banks, the US election on November 8 and the Italian Senate referendum & Austrian presidential election re-run (both on December 4). Bond yields could also see more upside in the short term. However, after any short term weakness, we anticipate shares to trend higher over the next 6-12 months helped by okay valuations, continuing easy global monetary conditions, moderate economic growth and the shift from falling to rising profits for both the US and Australian share markets.

Still ultra-low bond yields point to a poor medium term return potential from them, but it’s hard to get too bearish on bonds in a world of fragile growth, spare capacity, low inflation and ongoing shocks.

Commercial property and infrastructure are likely to continue benefitting from the ongoing search for yield by investors.

Dwelling price gains are expected to slow, as the heat comes out of Sydney and Melbourne thanks to poor affordability, tougher lending standards and as apartment supply ramps up which is expected to drive 15-20 percent price falls for units in oversupplied areas around 2018.

Cash and bank deposits offer poor returns.

The outlook for the $A has become murky. A shift in the interest rate differential in favour of the US as the Fed remains on its path to hike rates should see the long term trend remain down and the $A normally overshoots on the downside after the bursting of commodity price booms and this remains our base case. But against this, the stabilisation and rising trend in some commodity prices and the continued gradual nature of Fed rate hikes suggest ongoing upside risks in the short term.

The danger is that the latter will threaten the rebalancing of the economy and the best defence against this is for the RBA to revert to a clear easing bias even if it never acts on it.

SHANE OLIVER is head of investment strategy and economics and chief economist at AMP Capital and is responsible for AMP Capital's diversified investment funds.