Property 101: Expect two more 25bp cuts by the RBA in mid 2017: NAB's Alan Oster

GUEST OBSERVER

The results from this month’s survey remain broadly consistent with our prior view of the economy and the near- term outlook.

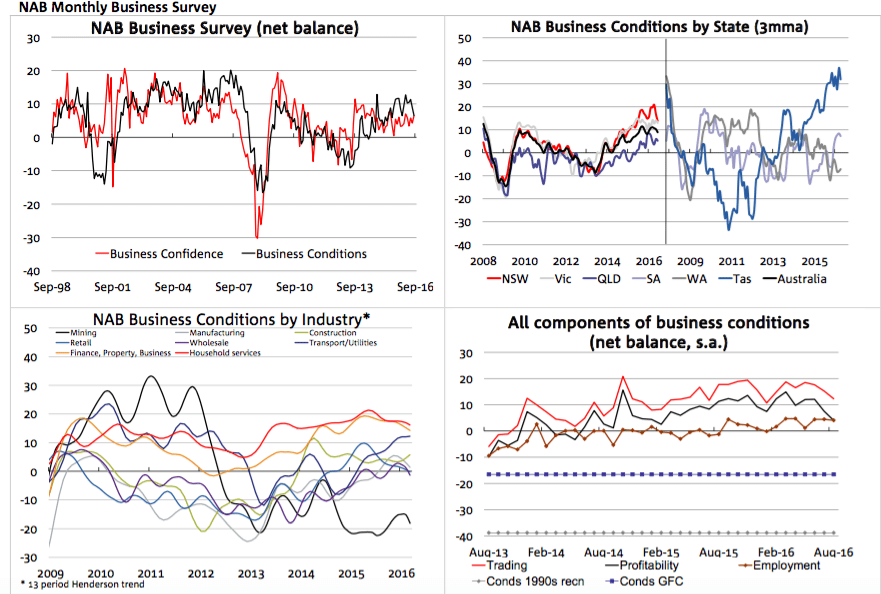

It points to a patchy, but sustained, improvement in the non-mining economy, with the major services sectors and construction leading the way.

That said, recent negative movements in retail and wholesale conditions will be a cause for concern if they continue, and we are watching to see if they represent the start of a new trend.

Beyond the near-term the outlook becomes more uncertain, as the effects of previous AUD depreciation, higher commodity exports and the housing construction cycle begin to wane.

All of these factors are expected to come to a head around 2018, and the economy will likely require additional policy support from the RBA ahead of this to firm up growth and stabilise the unemployment rate.

NAB economics currently expect two more 25bp cuts by the RBA in mid 2017.

The August NAB Monthly Business Survey is still showing solid performance in the non-mining economy, although some of the previous momentum has been lost.

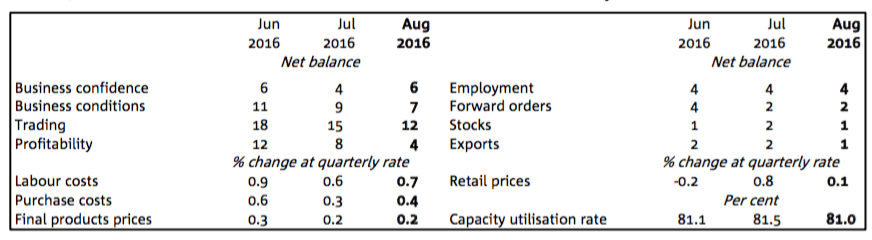

The RBA’s recent 25bp cut to the cash rate appears to have helped underpin business confidence, which remained impressively resilient to challenging headwinds. The business confidence index rose slightly to +6 index points in August (from +4), which is consistent with the long-run average for the series.

On the other hand, business conditions (an aggregation of trading conditions (sales), profitability and employment) dropped back slightly in the month, to +7 index points (from +9), but this is still well above the long run average of +5. Both trading conditions and profitability have continued to ease from their previously very high levels.

In contrast, the employment component has managed to hold onto the gains seen in recent months, although it remains the weakest of the three components.

The recent downward trend in business conditions suggests that the non-mining recovery may have lost some vigour, but headline results from the survey still suggest these segments are performing well.

The Survey still gives us confident in the near-term outlook for the economy, even though things may have cooled a bit. It is particularly encouraging to see that firms demand for labour remains quite solid, which will hopefully have some positive flow on effects to households. The employment index in the NAB Survey has continually exhibited a better trend than official labour market statistics in recent months”

There continues to be a fairly large disparity in business conditions across industries, although most are recording positive conditions in trend terms.

The strength in business conditions remains largely confined to the major services and construction industries, while relatively subdued conditions in wholesale and retail warrant close monitoring, particularly in light of disappointing consumption growth in the Q2 National Accounts. We had been hoping to see more consistent signs of a broadening economic recovery in the Survey by now, and this did appear to be the case earlier in the year but it has not been sustained.

The Survey’s leading indicators are pointing to a solid near-term outlook. Forward orders were steady and have been positive for most of the past year. NAB’s measure of capacity utilisation eased back, but remains around long-run levels, supporting the index of capital expenditure. However, the Survey is yet to reflect our growing concerns over the longer-term outlook. We expect the economy will see a material slowdown in 2017/18 as resource exports slow and residential construction begins to dry up.

For now, however, business confidence in the construction industry actually remains relatively upbeat.

Alan Oster is group chief economist, National Australia Bank, and can be contacted here.