No rent spikes or market decimation under Labor's negative gearing: Louis Christopher

GUEST OBSERVER

Here's my opinion on the possible effects of the markets based on Labor’s policy proposal. We might make a further assessment once we see more details from the Libs.

Lets consider some of the fears that have been raised by various lobby groups who have argued both for and against.

Would there be a surge in rents?

In our opinion, we think no. And that is based on what happened in history as well as the fact that if Labor’s policy passed, it would keep negative gearing on new property.

Lets first consider history.

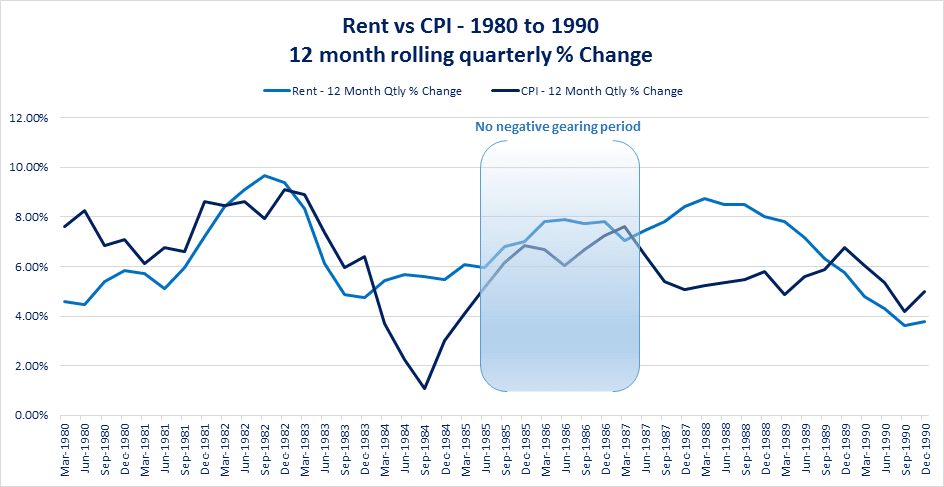

As most of you are aware, Negative gearing was briefly scrapped by Paul Keating (As Federal Treasurer), Starting July 1985. It was then restated in Mid 1987.

As the chart illustrates, while rents were rising, certainly there was no spike in rental growth rates over that time. Indeed rental growth rates were returning back to be in line with the CPI rises recorded over that period. Rental growth rates were slower than what was recorded in the early eighties.

Post the period, rents did accelerate, however so was inflation as the economy entered into an overheated period post the stock market crash of 1987. Rental growth rate completely feel away as the economy entered into recession in 1990. At no time during this period did rents fall, and that is because overall inflation in the 80s was still relatively elevated. Rents and inflation have historically been closely correlated.

For those who are interested in the city by city break up over this time, ABC Fact Check compiled an accurate story last year.

As is illustrated by ABC most of the rises this time were primarily driven from Sydney and Perth with vacancy rates in these two cities already low prior to the scrapping of Negative Gearing.

Of course, the period 1985 to 1987 was a turbulent period for the economy and major economic reform. We had the slump in the Australian dollar caused by a blow out in our current account deficit, a deregulated financial sector, a stock market boom, followed by the almighty crash of October 1987. It was indeed the roaring eighties.

In this regard, we think the evidence of a spike in rents, directly attributed to the scrapping of negative gearing is scratchy at best. And worse, it is misleading.

But just in case there is a relationship there, Labors' proposal to keep negative gearing on new properties would most likely ensure a strong supply side response to the market. We have seen such directed stimulus work on the markets before, namely in the form of various first home owner grants, so we are confident, the market is responsive to such stimulus.

A surge, followed by a slump in the market?

This would have to be one of the largest risks in Labor’s proposal. As the cross over date approaches at 1 July 2017, I believe there is a risk of a surge in investor demand for existing property to take advantage of the grandfathering provisions. Then once the date is reached, a subsequent slump could occur by the drop off in demand from investors. Once again, this is not without its precedent. This phenomena occurred during the introduction of the GST and it also happened when the first home owners grants were repealed in 2003 and 2010.

Of course, this scenario is not guaranteed, and yes, there is a chance investors would see through the ramification of such a possible slump, and then therefore hold off buying on mass. But somehow I think the animal spirits are likely to take over as they have done the past. This risk certainly cannot be completely ruled out.

A solution to this is a scaling out of concessions on existing property over a period of time. I think for example a two year phase out period would do much to reduce this risk.

New properties record a price surge. But on resale would be discounted.

We believe it is likely that a surge in demand for new properties would see an additional premium placed on such properties compared to the existing market. In our experience, off-the-plan developments, particularly for multi-story apartments come on at an average 20% premium to comparable existing units. Arguably this happens due to the ‘new’ nature of the product compared to existing properties which have older fixtures and fittings. This premium is eventually reduced to over time as ‘wear-and-tear’ develops on the property.

What may happen though is that the “20%” premium may further increase as demand surges. Remember, developers are always trying to maximise profit margin and there is no better way to do that then to lift the price! This would not be a desirable event at all as it would increase the chances of considerable investor capital losses on any resale, especially within the first five years of the life of the property. Remember, secondary purchasers will not be able to access the negative gearing benefits once the property is resold back into the market.

I also cant help myself scoff at the recent claim by Chris Bowen when he said

“Investing in a new property is not in any sense more risky than buying an existing property.”

Take it from me as someone that has assessed, analysed, owned, sold real estate of various property types over the years, new property is more risky than existing property. Lets just start with contract risk.

Has anyone read all the rescinded contracts that have taken place in Sydney last year over sunset clauses? Has anyone been reading on the appalling resale rates in areas such as Docklands over the years? Is anyone aware that quite a few builders/developers have gone belly up over the years?

Likely Scenario – An adjustment phase with some periodical distortions in the market, but no rent spikes.

We believe that should Labor’s proposal succeed there would be an adjustment period where, yes, many investors may stay away from existing property for a period of time, but only until such time that a rise in yields gives them incentive to start buying existing properties again. This would happen as investors would demand a higher yield to offset the lack of tax concessions.

But such a period would not go on forever. Once yields are higher, investors would then re-enter the market. Potentially yields could rise to the point where existing residential properties are cash-flow positive from day one, or at least, cash flow neutral. Which I believe would be a positive for the asset class over the long run.

For those advocating for a return to better value on residential property, the reduction in negative gearing concession may well trigger this process.

But this adjustment does not necessarily mean there would be an outright “decimation of the market”. We may well likely see for example a period of stagnation in property prices for existing property. Or prices rising more slowly than rents.

I suspect the outcome here would be reliant on interest rate settings and the overall health of the economy. But to ensure such a more stable outcome, we do strongly suggest to Labor that a scaling out approach is a safer strategy.

Louis Christopher is managing director, SQM Research and can be contacted here.

{mijopolls 130}