Wacky or realistic? Wagga Wagga property tipped to outperform Sydney and Melbourne from 2016: Simon Pressley

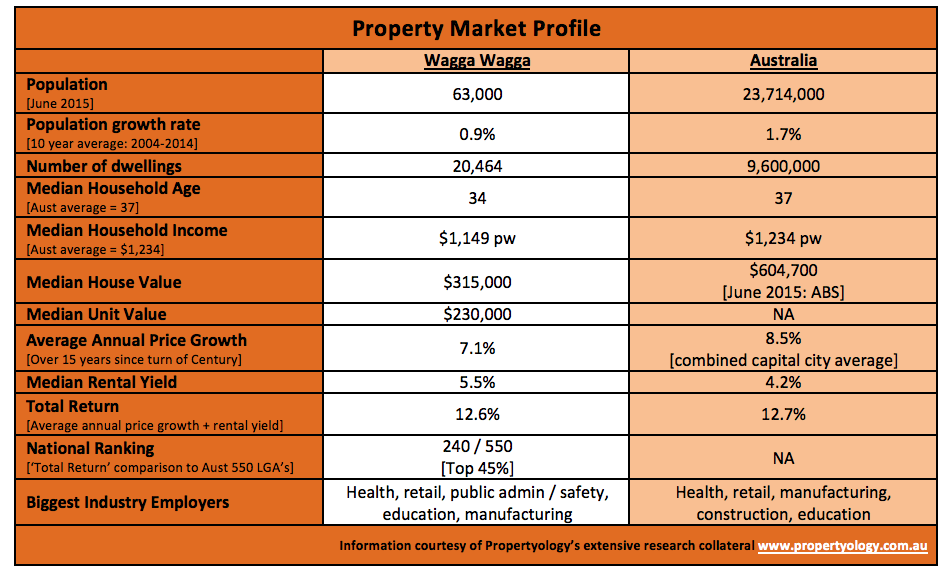

A median property value of $315,000 and rental yields superior to those offered by capital cities makes it worth considering Australia’s twenty-ninth biggest city as a viable option to add to a property portfolio.

With a population of 63,000, Wagga Wagga is New South Wale’s largest inland city. It has essential health infrastructure, tertiary education offerings through Charles Sturt University, and a quality commerce and retail hub. Wagga Wagga services a broader Riverina regional population of 200,000 people.

Located along Australia’s national (Hume) highway, transport and warehousing are important industries, with Toll Holdings a major employer. Heinz (processed food), Teys (abattoirs), Cargill (grain), and Riverina Oils & Bio Energy are also employers which manufacture agricultural products from the region.

The Kapooka army recruitment base and the Forest Hill RAAF logistics and training base are staples to the economy.

The Murray Darling Basin supports the agriculture industry. Heavy clay soils have been the subject of much conjecture over the years. Parts of Wagga Wagga do suffer localised flooding, mostly in pockets to the north, the historical part of the city. The suburbs to the south of the city are newer and on higher land.

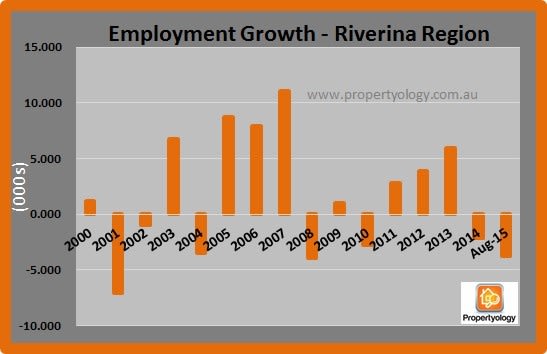

During 2015, there were approximately 77,000 jobs spread across the Riverina region.

For the two year period ending August 2015, the region’s growth in jobs had been neutral compared to the 3 percent national increase. Propertyology believes that the outlook for jobs in the region is a healthy one largely due to the significant extra demand for quality agricultural products from Asia’s fast rising middle class.

Free Trade Agreements recently signed with South Korea, Japan, and China (India is also expected to follow) paves the way for a huge opportunity for Australian agriculture. The region is Australia’s biggest producer of wine grapes, rice, and chicken, while beef and grain are also very prominent.

With numerous wineries and picturesque landscapes, cottage tourism is popular in the region. According to Destination NSW, visitors spent more than 2.5 million nights in the Riverina in the year to March 2015 – up by 4.4 percent on 2014. Overall visitation to regional NSW increased by 4.1 percent.

Significant job creation projects in the Region’s pipeline include:

- A $75 million Intermodal Freight and Logistics hub in Wagga Wagga

- New dam infrastructure proposed at Lake Coolah and Narrandera

- A $2 million freight terminal at Leeton

- A $14 million new shopping centre in the Wagga Wagga suburb of Estella

- A large discovery of tin reserves at Adlethan

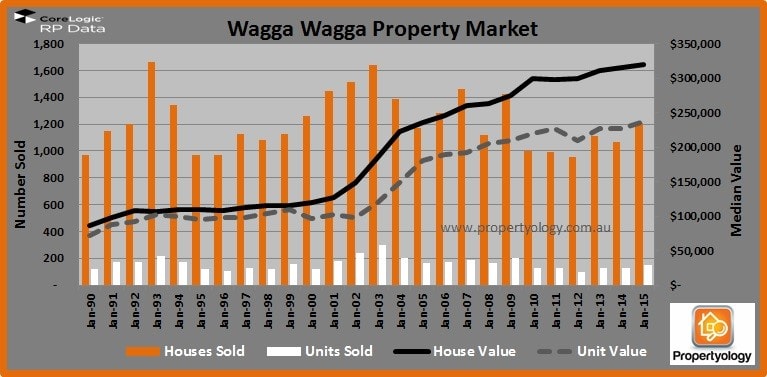

It might surprise people to know that Wagga Wagga’s 7.1 percent average annual price growth over the fifteen years since the turn of the Century was better than Greater-Sydney’s price growth of 6.3 percent over the same period. Out of 550 local governments in Australia, Wagga Wagga’s property market was ranked 240th on total return (average annual price capital growth + rental yield) over the fifteen years since 2000.

Average annual population growth over the last ten years of 0.9 percent is credible. A young demographic, a labour force with a good skills base, cost of housing almost 50% below the national average, and household incomes just below the national average add to the very solid fundamentals of the region’s property markets.

Property values increased by 2 percent to 4 percent during 2015. Of more significance, property sales volumes were the highest that Wagga Wagga has seen since 2009; this is a good indication for local confidence.

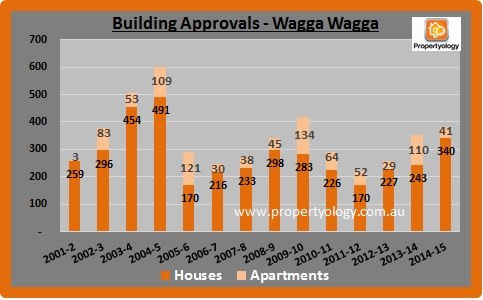

As with most of Australia, building approvals in Wagga Wagga have been increasing over the last few years. The housing supply pipeline mostly contains detached houses with a few new estates popping up. The rate of new supply appears to be more sensibly controlled than many of Australia’s bigger profile cities.

The factors likely to influence housing demand and supply, combined with Wagga Wagga’s economic profile, are such that Propertyology forecasts its property market to be a steady performer and potential for a superior return to property investors than higher profile cities such as Sydney and Melbourne over the next few years. Investors could do a lot worse than Wagga Wagga.

SIMON PRESSLEY IS MANAGING DIRECTOR OF PROPERTYOLOGY, AN REIA HALL OF FAME INDUCTEE, PROPERTY MARKET ANALYST, ACCREDITED PROPERTY INVESTMENT ADVISER, AND BUYER’S AGENT. PROPERTYOLOGY WORKS EXCLUSIVELY WITH PROPERTY INVESTORS TO PURCHASE PROPERTIES IN STRATEGICALLY CHOSEN LOCATIONS ALL OVER AUSTRALIA.

{mijopolls 124}