Indian mining group set to buy two Australian mines

Asian investment in Australian real estate is set to expand in the mining sector with Indian government-owned mining company NMDC Limited undertaking due diligence of two Australian mining properties, one in Western Australia and the other in the Northern Territory.

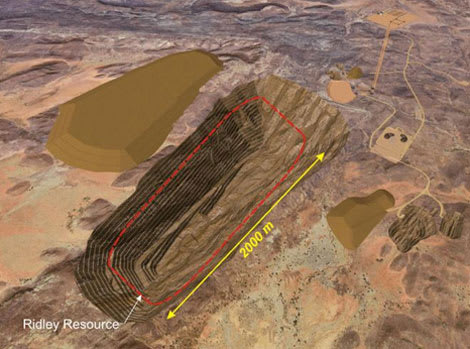

NMDC is looking to acquire Atlas Mining’s 2 billion-tonne Ridley magnetite iron ore project in the Pilbara region of Western Australia (75 kilometres east of Port Hedland) and Minemakers Ltd’s Wonarah phosphate reserve, about 260 kilometres east of Tennant Creek in the Northern Territory.

Port Hedland property prices have soared in the wake of the mining boom, with RP Data reporting a median sales price of $1.1 million and median rents of $2,200.

Tennant Creek house prices are up 34.4%, with a median sales price of $215,000. Hotspotting.com.au’s Terry Ryder picked Tennant Creek as the best-performing Northern Territory market of 2011.

The Indian mining giant is believed to be in advanced discussions for a $200 million line-of-credit loan to fund the acquisitions and other mine development programmes, reported Indian website Zeebiz.com.

It has also been reported the NMDC is seeking to invest in Queensland coal projects.

NMDC is expected complete negotiations and due diligence processes for the two mines by March.

Indian interest in Australian mines follows increasing Asian investment in Australian mines including South Korea steelmaker Posco recently expanding its holdings in the Roy Hill iron ore mine in the Pilbara from 3.75% to 15%.

In 2010 Posco acquired a 70% stake in Anglo's Sutton Forest coalmine, on the NSW south coast, for $50 million.

Thailand coal group Banpu acquired 80% of Centennial Coal in July 2010 for $2 billion.

NMDC investment in Wonarah will help fund the building of a railway link to Tennant Creek, which could cost as much as $620 million.

Wonarah is one of the largest under-developed phosphate reserves in Australia, with an estimated resource of 1.26 billion tonnes. Wonarah's phosphate rock is one of the key inputs of the global fertiliser market.

Reports that NMDC is carrying out due diligence of the Wonarah mine follows it entering into a memorandum of understanding with Minemakers in July last year to acquire a 50% interest in the project.

Last year, NMDC, which has a market capitalisation of around $20 billion, acquired a majority holding (50%) of Perth-based Australian exploration company Legacy Iron Ore for $18.9 million.

NMDC is India's largest iron ore producer and exporter, presently producing about 30 million tons of iron ore from three mines in India.

To find out more about Asian investment in Australian real estate download our free eBook: Foreign Investment in Australian Property Markets.