Melbourne records strongest August 2014 quarterly growth: RP Data

Melbourne recorded the greatest quarterly lift in dwelling values of any Australian capital city, according to the August RP Data CoreLogic Hedonic Home Value Index.

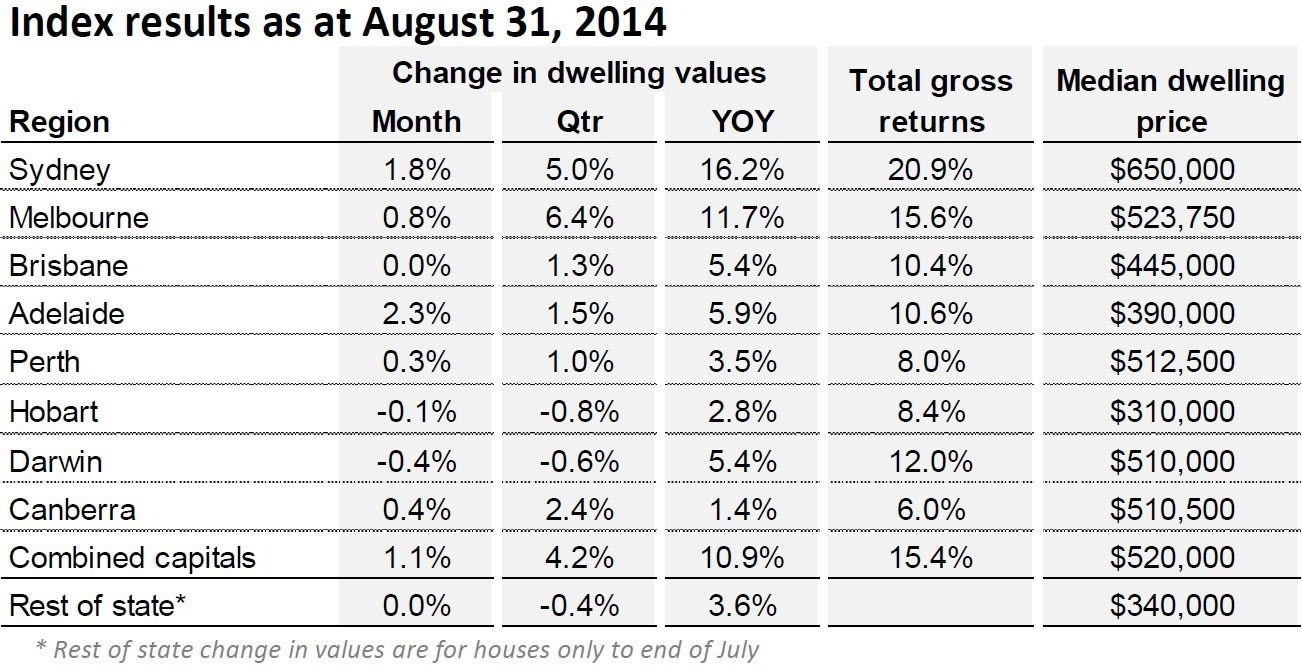

Dwelling values in Melbourne were up 6.4% for the quarter to August, ahead of the 5.0% increase recorded in Sydney. However, on a monthly basis, Sydney had the greatest dwelling value increase, with a 1.8% increase recorded last month. Melbourne saw an 0.8% increase in dwelling values over August.

According to RP Data, Melbourne's median dwelling price for August was $523,750.

Source: RP Data.

The city's dwelling values are now 6.9% above their previous peak, and 19.5% up from the most recent market trough. Over the past 12 months, Melbourne's homes have increased in value by 11.7%.

The median price of a house in Melbourne now sits at $570,000, while the median unit price is $460,000. House prices increased by 6.6% in the three months to August, with a 12.4% increase recorded by RP Data over the past year.

Unit price growth has been slightly more modest, with a 5.2% quarterly increase in unit values and a 6.2% rise on an annual basis.

Despite a 10.9% increase in dwelling values across the capitals on a yearly basis, only Melbourne and Sydney the only two capital cities to record double digit price growth. According to RP Data Research director Tim Lawless, Melbourne and Sydney's housing markets are responsible for the "two tier" market conditions.

"Over the latest growth cycle we have seen Sydney dwelling values increase by 27% and Melbourne values up by 19.5%," noted Lawless.

"Sydney and Melbourne were also the strongest performing cities during the 2009/10 growth cycle. Since the beginning of 2009, we have seen values rise by a cumulative 50.1% and 46.1% respectively in Sydney and Melbourne.

"Looking at the remaining state capitals over the same time frame, the next best performer was Perth where values are now 15% higher, followed by Adelaide at 9.9%, Brisbane with 5.3% and Hobart where dwelling values are actually 1.5% lower."

He predicts that home prices are likely to continue to increase in the next quarter.

“Considering the ongoing high rate of auction clearance rates, a generally rapid rate of sale and the ongoing low interest rate environment, it’s likely that dwelling values rise even further over the next three months," said Lawless.

Rental yields are lower in Melbourne than in any other capital city, with houses offering 3.2% yields and units offering 4.2%.

Lawless notes that Sydney's gross rental yields have fallen to 3.6%.

"In Melbourne, where rental yields are even lower, we have seen gross yields fall by 32 basis points over the year to reach 3.2% gross," he said.

"With yields so low in the cities where values are seeing the largest capital gains, it is clear that investors remain very much focussed on value growth rather than yield.”