Melbourne property market very resilient and may return to heady heights of 2009 in some sectors: Mark Armstrong

The Melbourne property market had everything thrown at it at 2012 with low clearance rates, international reports that stated it is overvalued and a barrage of negative reports in the media suggesting the market was going to experience a US-style crash.

But the latest figures from the REIV show not only did the property market hold its ground, but it actually began to pick itself up from the canvas and showed significant growth in the last quarter of the year.

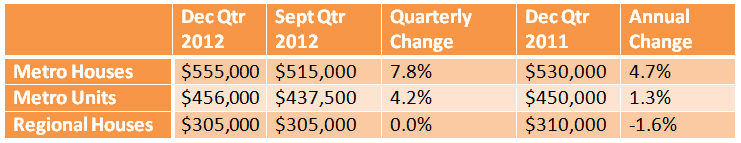

While the 2012 year started on shaking ground as property values continued to slide, the December quarter showed a massive 7.8% jump in median value for houses.

This growth is in line with what I was seeing in the market as reported in my September Property Observer article A new breed of upgrading ‘home investors’ injects buoyancy into the subdued suburban property market.

The research showed strong demand coming from home buyers who were looking to upgrade the family home and take advantage of a soft property market.

This jump in last quarter median values turned the corner for the housing market and resulted in a 4.7% growth for the year. Melbourne apartments also performed well. with 4.2% growth in the last quarter pushing it into positive territory by years end.

The wash-up is the market has proved to be very resilient and as we look forward into the 2013 there are some clear signs the property market will continue this trend and some sectors may even return to the heady heights of in explosive growth seen in 2009. The catalyst will be a growth in confidence driven by interest rates once again.

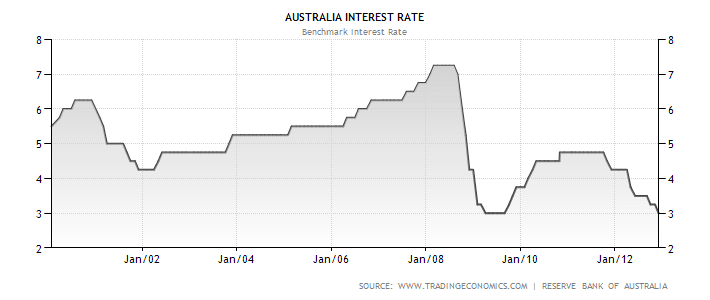

While history is no guarantee of what will happen in the future it does provide some useful insights. In September 2008 the cash rate was at 7%, seven months later it had plummeted to 3% and property investors exploded back onto the scene forcing the property market in Melbourne to surge by more than 20% in 2009.

This time around the RBA has been a bit more tentative with the trigger. It has been careful not to cause a frenzy and has slowly lowered rates to entice investment back.

The last upward interest rate movement was way back in November 2010, and the RBA has met to discuss the economies outlook 23 times since. On 17 of those occasions it has decided to leave the rates on hold. In the remaining meetings the board have voted to lower rates. Rates have now fallen by 1.75% at sit at the 2009 level of 3%.

This slow decline in rates has meant property investors have sat on the sidelines and watched. This will not last forever.

I don’t think the return of property investors will be as bullish as we experienced in 2009, and this is a good thing. Any market that experiences euphoric highs is destined to fall on the other side. I predict the market will learn from its recent experience and move into a more sustainable growth pattern.

Interest rates are not the only factor weighing on investors' minds. Their confidence is being enhanced by the fact many Australians have money burning a hole in their pockets. According to the RBA household savings rates are at the highest levels since the mid ’80s. They have been trending up since the mid-2000s and now hover around 10% of disposable income.

In addition, many borrowers have been making substantial excess principal repayments in recent years, and this will increase their equity and cashflow positions.

Mark Armstrong is a director of iProperty Plan, which provides independent analysis and tailored advice to investors and home buyers.